After years of catering to institutional clients, Kaiko proudly stands as home to the most accurate live and historical data providing systems.

When it comes to gaining an edge on digital markets, professional investment powerhouses rely on the information provided by this French company. Find out how you too can benefit from this comprehensive range of tools from our Kaiko review.

| General information | |

| Name | Kaiko |

| Type of the company | AI Trading Tool |

| Regulation status | No regulation expected |

| Warnings from Financial Regulators | No official warnings |

| Website link | kaiko.com |

| Active since | 2014 |

| Registered in | France |

| Contact info | marketing@kaiko.com |

| Trading platforms | N/A |

| Majority of clients are from | United States, Indonesia, India, France |

| Customer support | Contact form |

| Compensation fund | No |

Who Owns Kaiko Brand?

Kaiko blockchain data and market news provider for enterprises has offices in several locations around the world. Now, the name of the owning company isn’t disclosed, but the website implies that they’re headquartered in New York, US. Looking through the Division of Corporations, we didn’t find a company that matches the address given on the website.

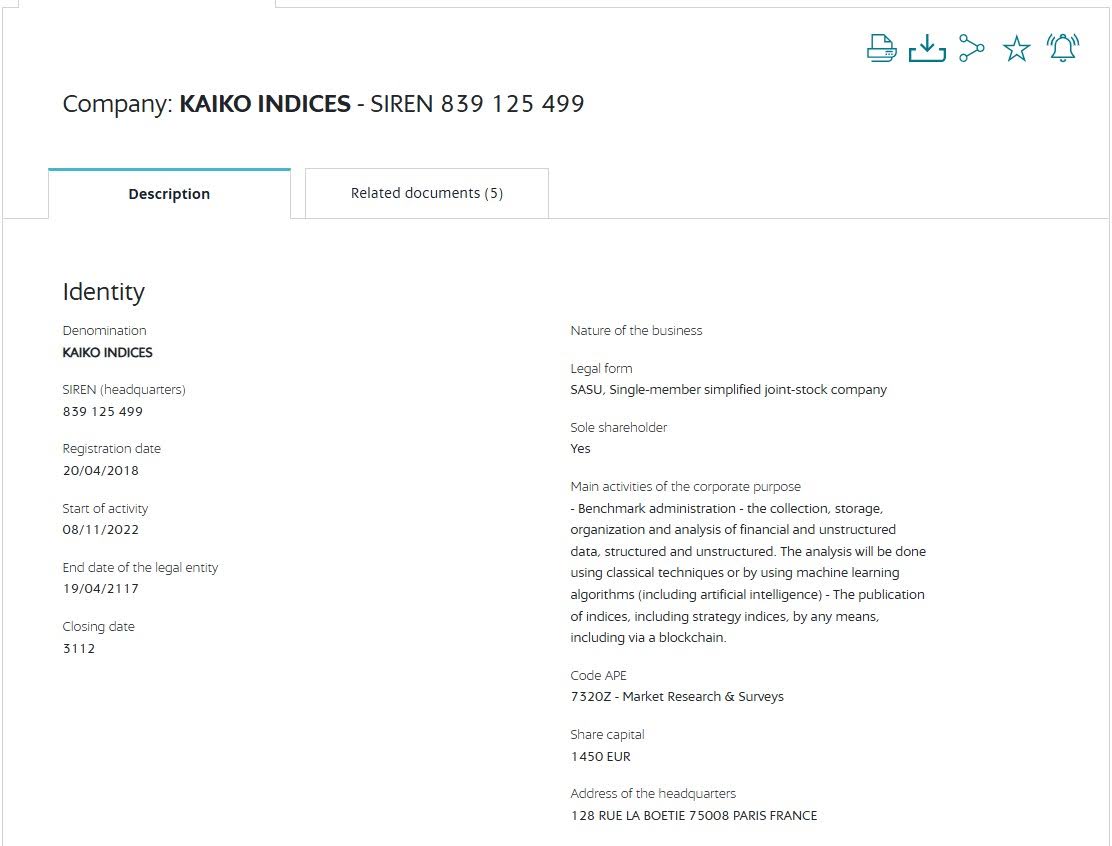

However, the company’s profile on social networks, such as LinkedIn and X, reveals that the company is actually established in France. Kaiko Indices does appear in the INPI database:

The current company CEO is Ambre Soubiran who has been in this position since 2016. Karamvir Singh, as the CPO, Elodie de Marchi-Chouard,in the position of the COO, and several other key people currently lead this company.

In terms of ownership, the company shows honesty and transparency, unlike common cons like Immediate Fortune who conceal all important information about their leadership.

While it took a while to find proof of registration, it isn’t hard to tell that the company representatives and leaders are all well-educated individuals with years of experience in the area.

Pros & Cons

When there aren’t any Kaiko reviews posted by individual clients and retail traders, it is difficult to estimate the quality of the service. However, that isn’t surprising either, because the services are primarily aimed at institutional users and organizations.

Kaiko data aggregator collects market insights from over 100 exchanges. Furthermore, financial professionals can utilize risk metrics and portfolio tools.

On the other hand, Kaiko DeFi and blockchain data provided covers most liquid DeFi protocols. Therefore, clients ranging from financial institutions to crypto-native enterprises can find something they may want to use.

| Pros | Cons |

| Institutional-grade market data | Kaiko app not available |

| Robust Kaiko API for live and historical data | Professional clientele only |

| Comprehensive risk tools | Low transparency around owning company |

| Mints, burns and transactions from leading DEXs | Prices/subscription plans not revealed |

| Insight into liquidity | |

| Trial subscription supported |

Kaiko Accounts and Costs:

When it comes to Kaiko crypto markets data, you can expect a wide variety of information provided concerning:

Standardized across all DEXs, aggregated data offers deep insights. Moreover, that also includes a detailed report on every single blockchain wallet’s tokens for an exact period. The coverage includes Ethereum and Blockchain. Take a look at the sample for several user addresses:

Cryptocurrency price feeds available cover thousands of assets. Data aggregated includes both asset and exchange level, provided by reliable Kaiko liquidity ranking tools. Lastly, with the advanced portfolio system, risk management is upgraded to a professional degree.

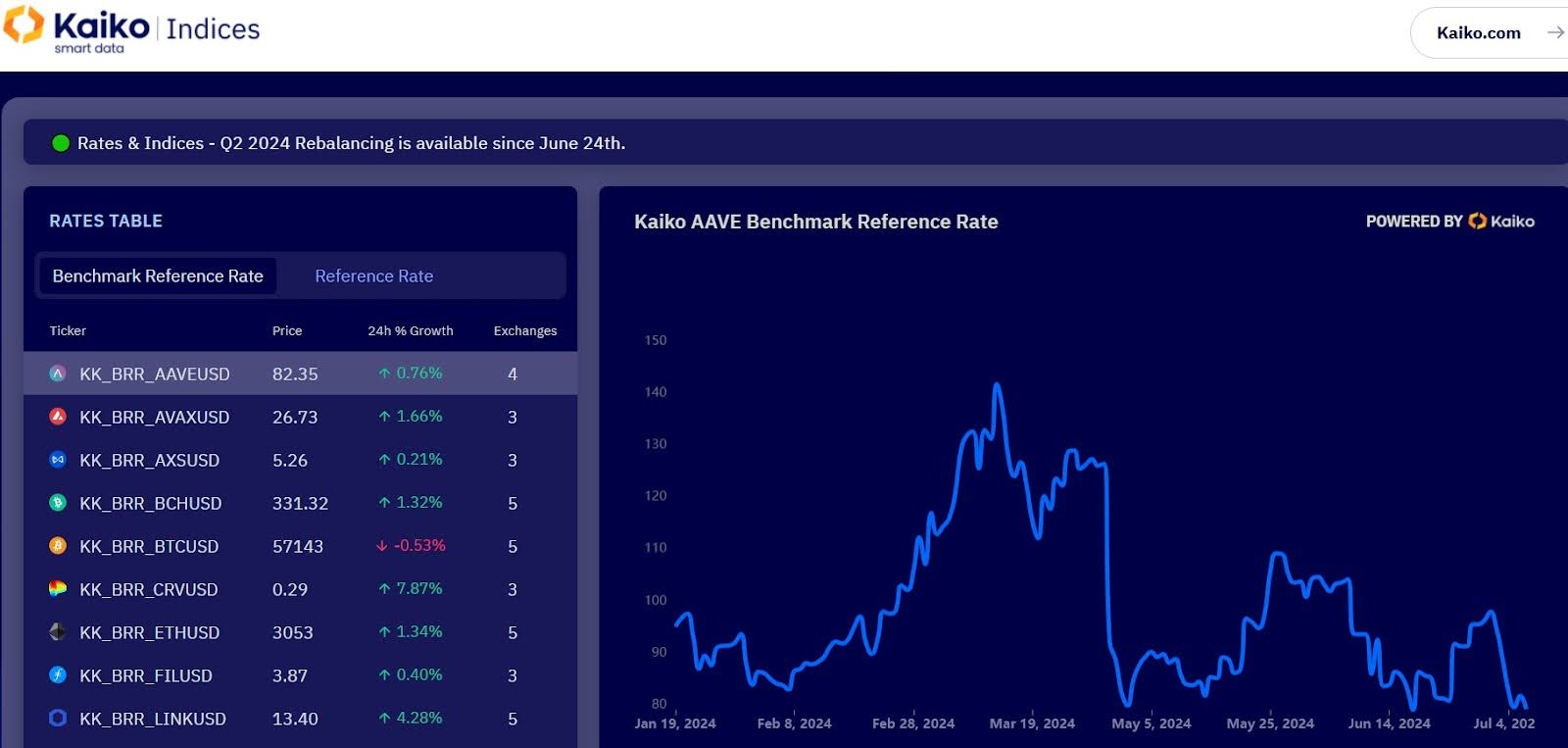

Financial experts, and products issuers especially, can rely on verified benchmarks and indices:

Lastly, another major purpose of the data collected is to produce accurate and exact analysis. Kaiko research use case includes the chance for analysts and blockchain professionals to gain even more precise and in-depth understanding on the crypto markets.

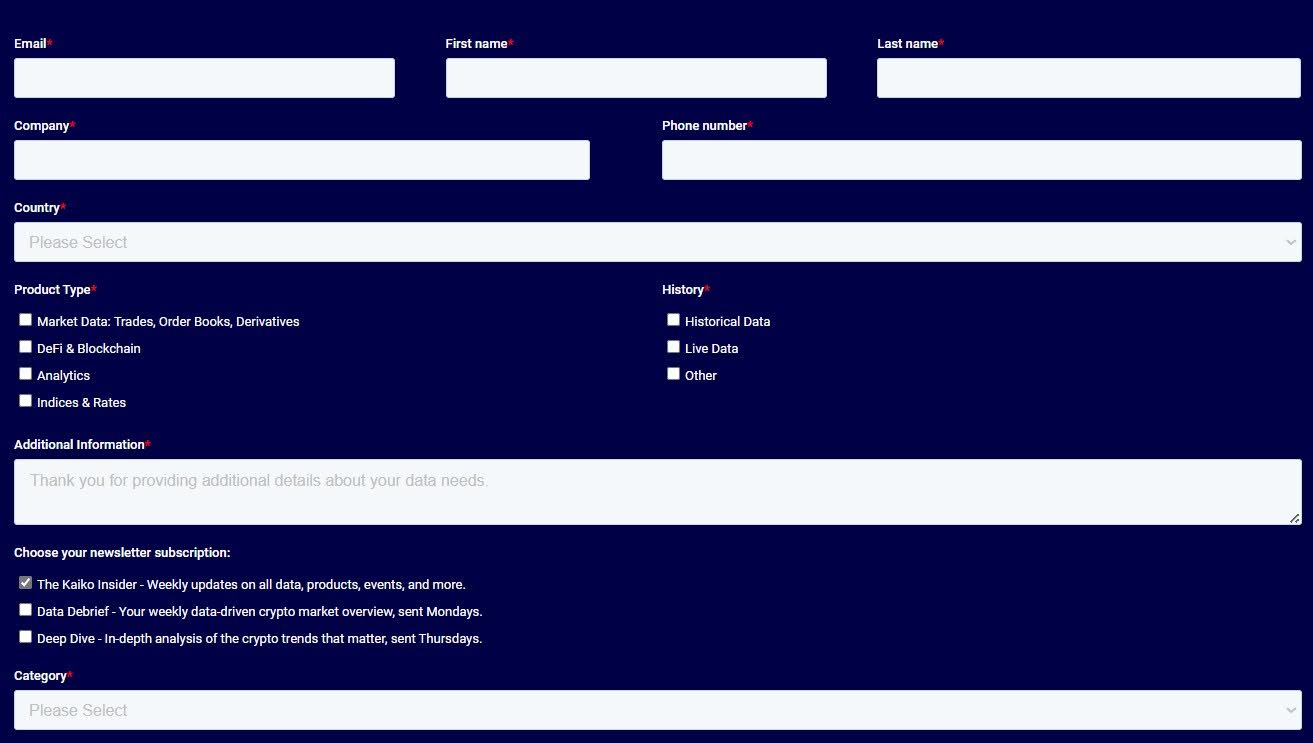

Unfortunately, a major drawback is the fact that there’s no clarification on how much these tools cost. Institutional clients interested in subscribing can gather more information by contacting the company through the following form which can also be used to request a trial:

Keep in mind that all of the mentioned tools can potentially provide an edge on the world’s markets, but only if you choose a regulated trading environment, which Ortega Capital definitely doesn’t provide.

FAQ

What is Kaiko?

Kaiko is a major market data collector and information aggregator that caters institutional clients.

Is Kaiko Real or Fake?

While the company isn’t overly transparent about their conduct, the leadership team is known and they’re all experienced people with the necessary knowledge in the field.

What Does Kaiko Do?

The website offers advanced tools for collecting market data, liquidity information, crypto tokens and exchanges insights and other similar details.

The post Kaiko Review: Premier Portal for Accessing Market Data appeared first on Fundevity.