Jubilant Ingrevia Ltd continues to see rising utilization of its newly established plants and is progressing well with its capex plans, investing in high-potential product categories. This is all in line with their ambitious Pinnacle 345 vision: to triple revenue and quadruple EBITDA in 5 years. Let’s dive deeper into the company.

- About the company

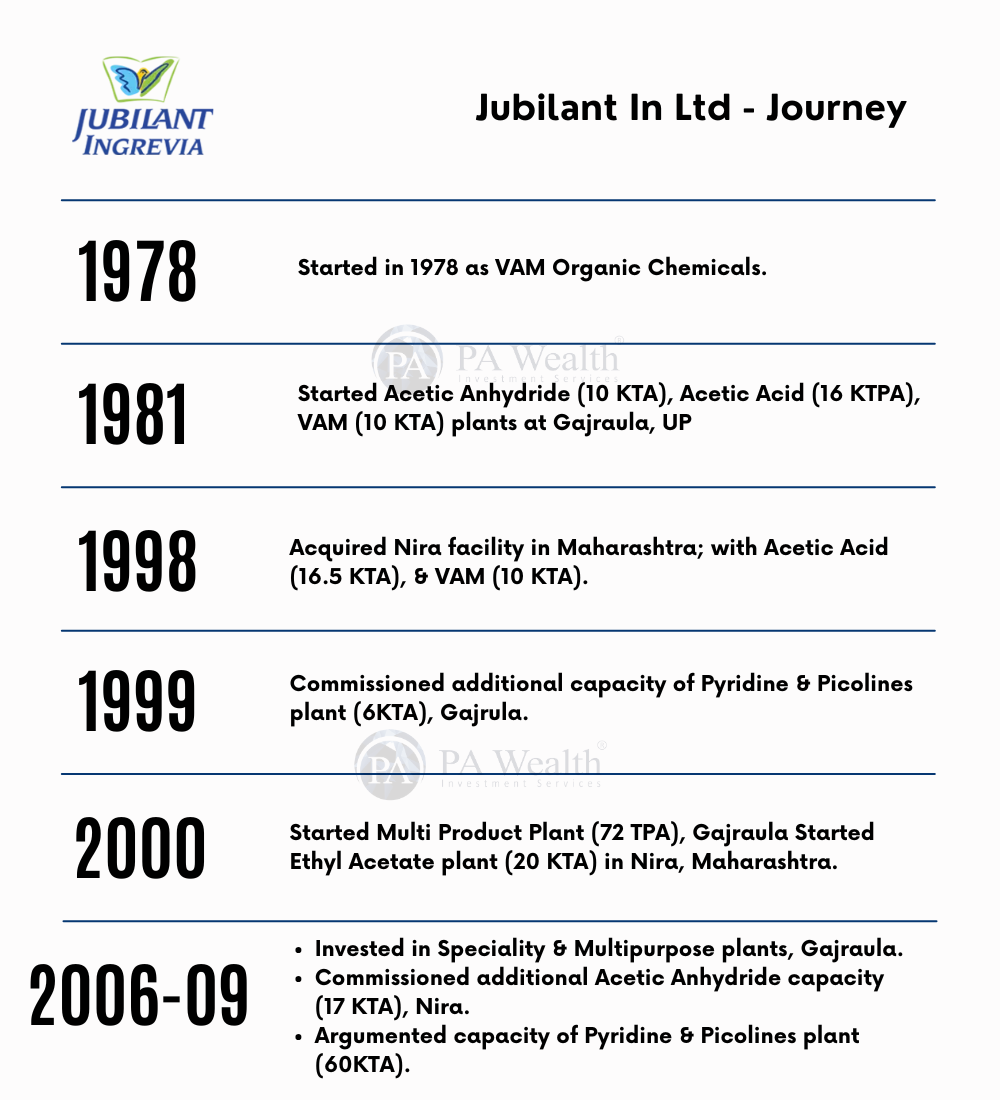

- Journey Since Inception

- Board Members

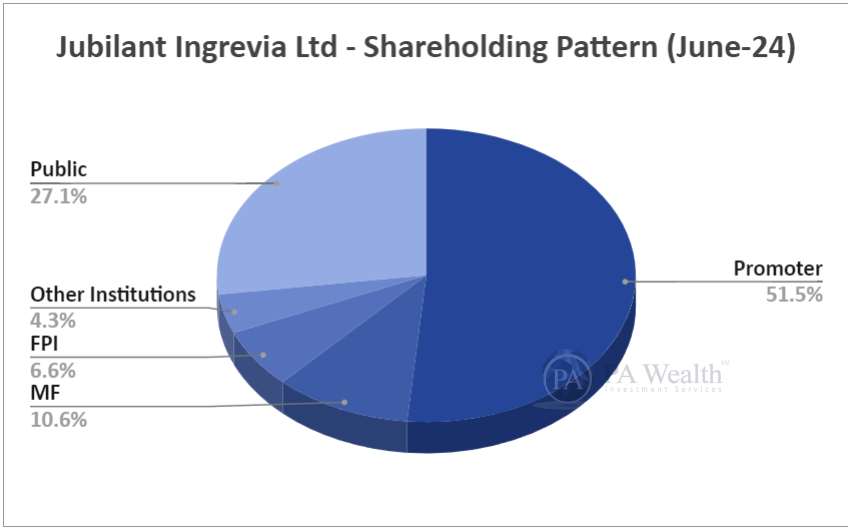

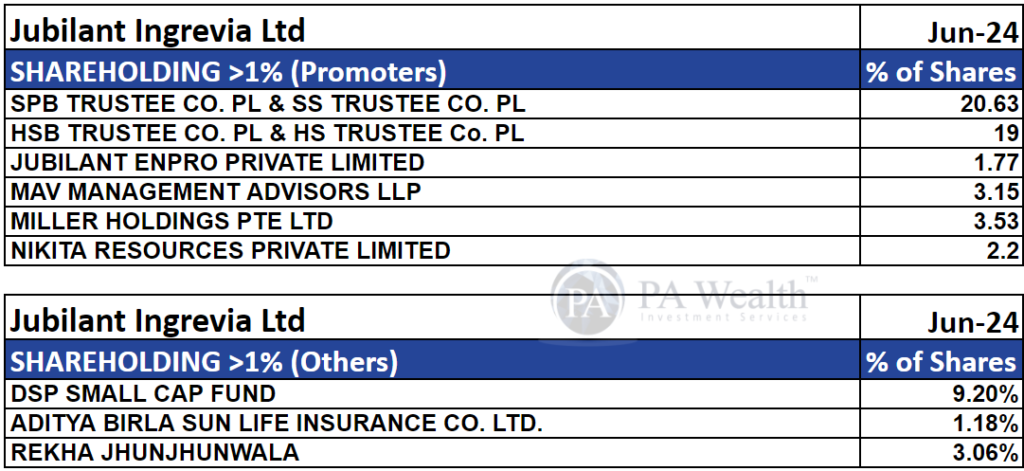

- Shareholding Pattern

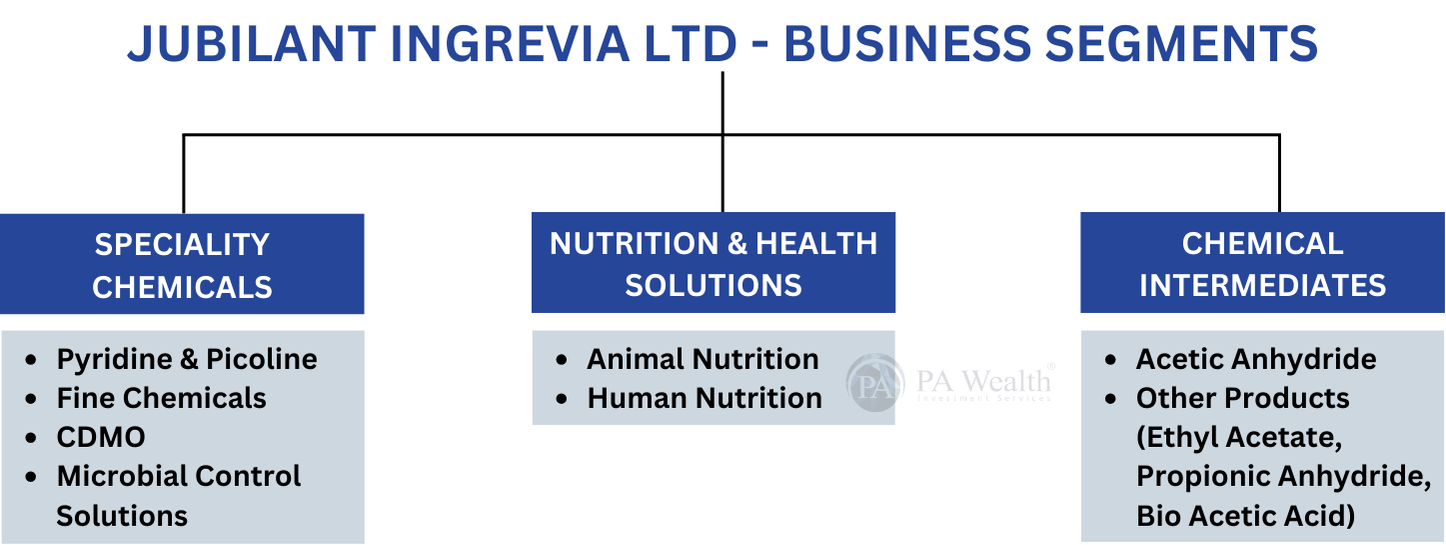

- Business Segments

- Revenue Break up

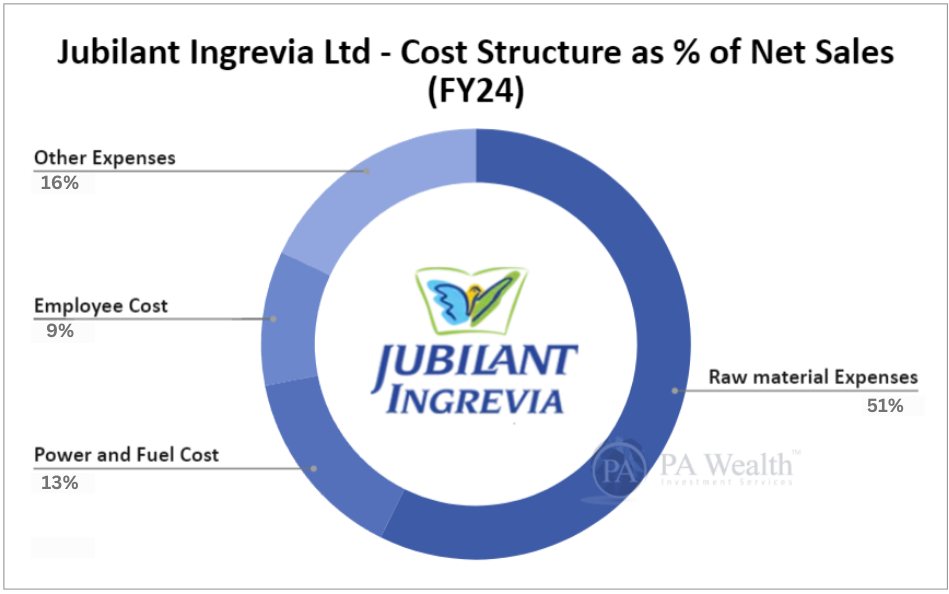

- Cost Structure

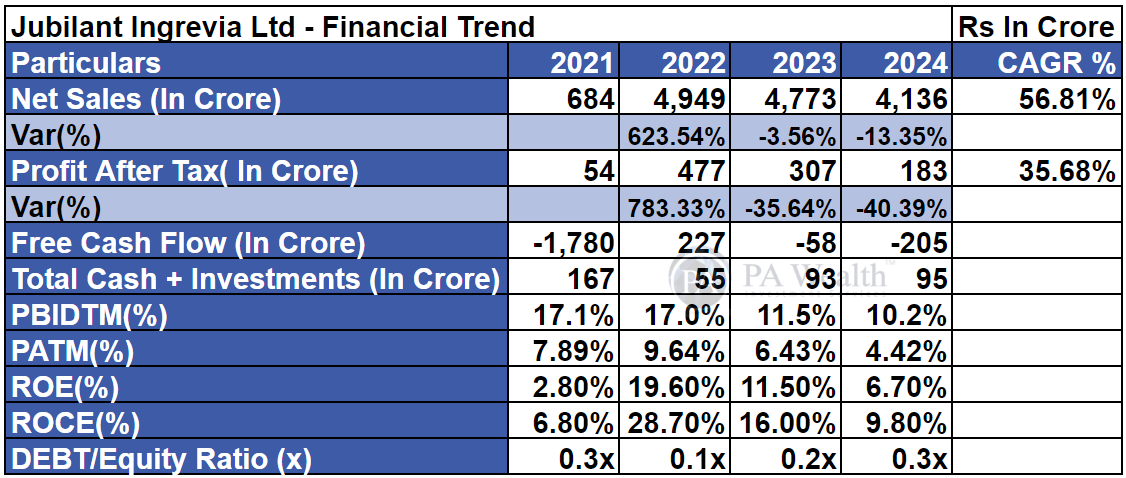

- Financial Parameters

- Management Key Highlights

- Strengths & Weaknesses

(A) About

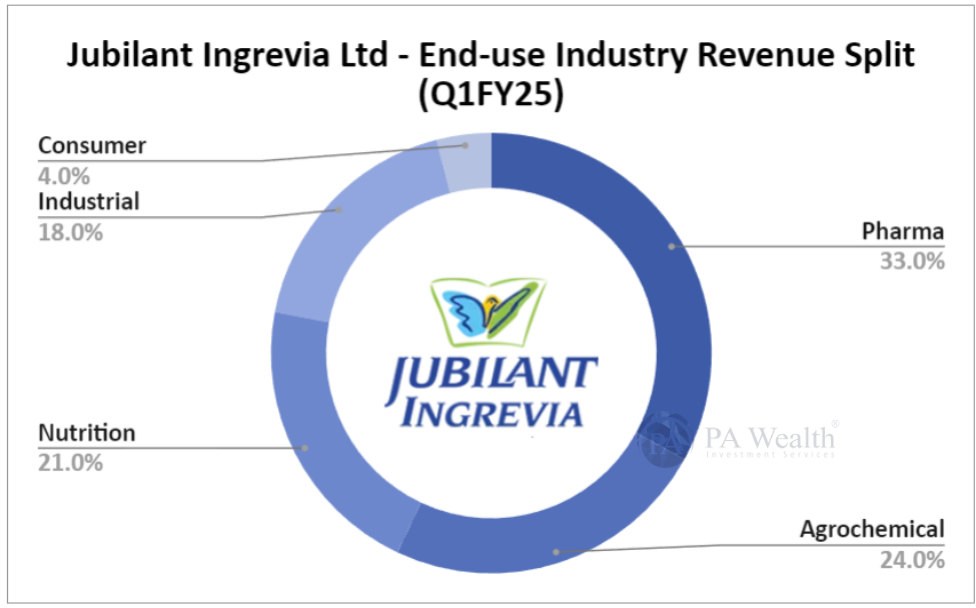

Jubilant Ingrevia, a global integrated Life Science products and Innovative Solutions provider serving, Pharmaceutical, Nutrition, Agrochemical, Consumer and Industrial customers with its customized products and solutions that are innovative, cost-effective and conforming to excellent quality standards.

The company also provides custom research and manufacturing for pharmaceutical and agrochemical customers on an exclusive basis. It has 40+ years of legacy in the Chemicals space, started in 1978.

- Global player in Pyridine + Beta, Vitamin B3 and Acetic Anhydride.

- Serves 15 of the top 20 Global Pharma & 7 of the top 10 Global Agrochemical companies.

- Leading low cost provider.

(B) Journey

(C) Board of Director

(D) Shareholding Pattern

(E) Business Segment

Specialty Chemicals

(i) CDMO

- In Pharmaceuticals company’s CDMO team develops customized solutions for the pharmaceutical and agrochemical industries for cGMP and non-GMP products.

- It is one of the global leader in manufacturing and selling of value added agro intermediates.

(ii) Fine Chemicals

- Its sub segment includes a variety of value added products based on Pyridine, Picoline and Diketene.

- These are primarily used in pharmaceuticals, agrochemicals and personal care.

(iii) Microbial Control Solutions

- It offers a range of safe and highly efficacious anti microbial products for application in paints, coatings, industrial, cosmetic and personal care industries.

(iv) Bio-Pyridine and Bio-Picolines

- It is the world’s largest and only non – Chinese scaled player in the Pyridine sector and hold a dominant position in the global market for Pyridine and Picoline.

Nutrition & Health Solutions

Company has a strong presence in animal feed and health solutions spaces. Its Segment is divided into 2 products:

(i) Human Nutrition & Health Solutions

- It offers diverse food ingredients and premix solutions for the human nutraceutical industries, personal care & cosmetics, bakery, beverages, confectionery.

(ii) Animal Nutrition and Health Solutions

- Offers more than 24 high quality feed additives used by the poultry, dairy, aqua and pet food industries.

Chemical Intermediates

- Company is the global leader in the Acetyls product range.

- Currently this business has been increasing its market share of Acetic Anhydride globally by placing higher volumes in the global market.

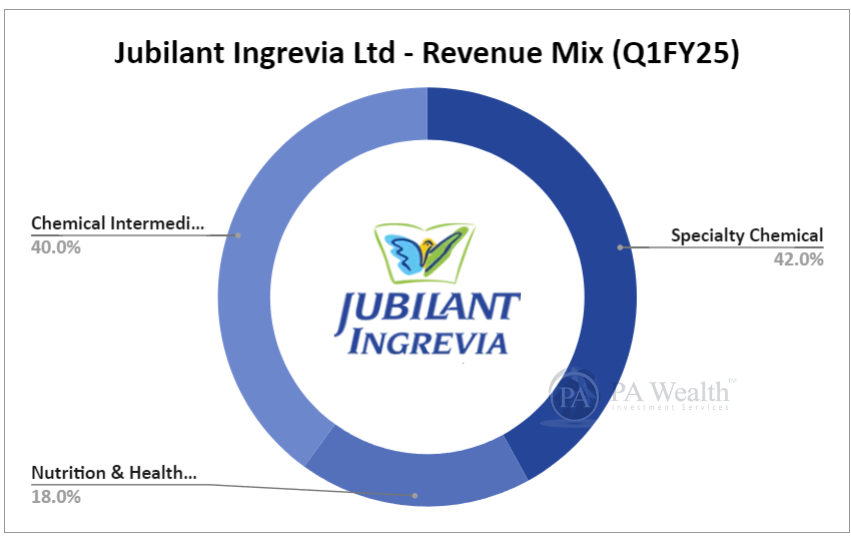

(F) Segment Revenue

(G) Cost Structure of Jubilant Ingrevia Ltd

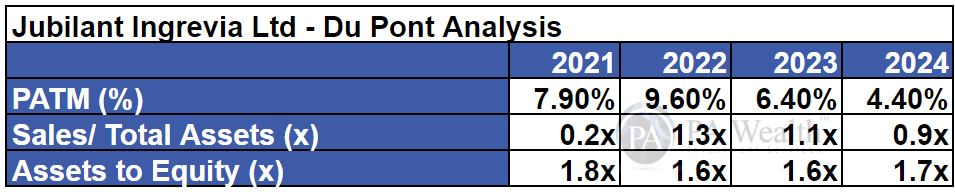

(H) Financials

The company’s net sales have increased from Rs 684 Cr. in FY21 to Rs 4136 Cr. in FY24 over the past 4 years at a CAGR of 56.81%. The company’s PAT has grown from Rs 54 Cr. in FY21 to Rs 183 Cr at a CAGR of 35.68%.

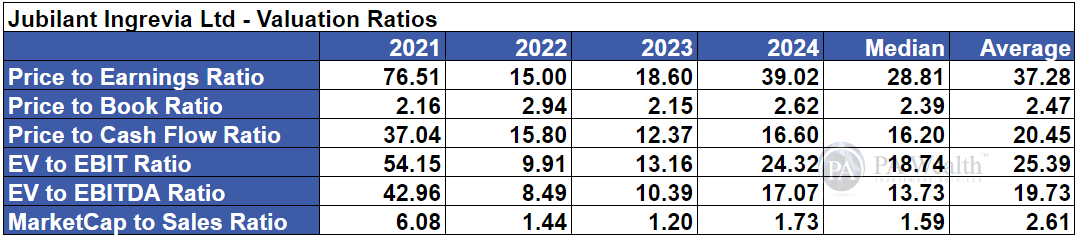

Valuations Ratios

(I) Management Discussion & Concall

Industry Outlook

- Indian Chemical sector is thriving due to the heightened demand and supportive government policies. India’s chemical sector ranked the 6th largest globally by output. Contribute 7% to India’s GDP.

- The nutrition sector also witnessed price pressure due to excess supplies from China.

- Agrochemical sector in India is projected to grow at 8-10% in 2025.

- Indian Animal health market is estimated to grow at a CAGR of 9.52% between 2022-27.

Business Highlights

- The agrochemical sector was hurt the worst due to overstocking in the distribution channel and oversupply in China.

- The volume of Niacinamide grew due to increasing market demand. This volume expansion has allowed the company to expand its global market share.

- The Specialty Chemical & Nutrition segment contributes ~ 60% of revenue and ~75% of EBITDA.

- Furthermore, new product lines such as Diketene and food-grade Choline Tartrate are gaining strong traction.

- North America’s revenue doubled year on year, while Europe and Japan enjoyed consistent growth.

- The company is presently the world’s leading producer of pyridine and picolines, as well as the only scale non-Chinese player.

- In Niacinamide, the company maintained its leadership position, ranking second in the feed grade, with consistent quarter-on-quarter volume growth.

Future Outlook

- Expects to witness improvement in all 3 business segment in FY25 over FY24.

- The company will continue to see increasing utilisation of its newly created plants and remain on track with its capex plans towards investing in high-potential product categories to deliver on its bold vision of Pinnacle 345 i.e. 3 times Revenue, 4 times EBITDA, in 5 years.

- Expects revenue to grow from Rs 4500 Cr to Rs 12000 to Rs 13000 Cr+ and 20%+ EBITDA margin. In which Specialty Chemical business can do 23% to 25%, Nutrition business at 12-13% and specialty products to 17-18%+ and for acetyl business, the long term should be 10-12%.

(J) Strength & Weakness

Strengths

(i) Healthy business risk profile, driven by leading market position across most products and vertically integrated operations

Jubilant Ingrevia Ltd benefits from vertically integrated operations across the value chain, leading to cost competitiveness. About 40% of the CI segment volume is consumed by the SC segment and about 40-45% of the pyridine and picolines output of the SC segment is used in the NHS segment.

(ii) Diversified revenue profile

Revenue profile is diversified, with 38% derived from the high-margin SC segment in fiscal 2024, 16% from the NHS segment and the balance 46% from the relatively low-contribution CI segment. Jubilant Ingrevia is targeting to increase the share of revenue from higher-margin SC and NHS segments over the medium term as the share from SC and NHS improved to 60% during the first quarter of fiscal 2025. Revenue diversity is further augmented by presence in the international markets, which accounted for 41% share of the total revenue in fiscal 2024.

Weaknesses

(i) Working capital-intensive operations

Operations are moderately working capital intensive, indicated by gross current assets (GCAs) of 160 days for fiscal 2024, having increased from 137 days last year, driven by high inventory levels, as the company maintains about two months of raw material and one month of finished goods stock given its wide product portfolio and presence across multiple geographies.

(ii) Exposure to fluctuations in input prices and government policies

Fluctuations in the prices of acetic acid (key raw material for the CI segment) has led to volatility in operating margin. While input price is a pass-through, in case of any sharp increase or decrease in price, there could be some impact on the margin. While its operations are exposed to government policies given the widespread international presence.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore

The post Jubilant Ingrevia Ltd – Focused on Tripling its Revenue appeared first on PA Wealth.