Table of Contents

In today’s financial landscape, the acronyms IPO and ICO frequently arise, sparking curiosity among potential investors. Both terms represent pathways for companies to raise funds, but their inner workings, benefits, and potential risks differ significantly. This article presents an in-depth exploration of IPO vs ICO, highlighting the key distinctions to guide your investment decisions.

IPO vs ICO: Definitions

Initial Public Offering (IPO): An IPO signifies the first sale of a company’s shares to the public, marking its transition from a private entity to a publicly traded company. This traditional route allows businesses to generate funds for expansion, reduce debt, or facilitate owners’ exit strategies. IPOs offer investors an opportunity to partake in the company’s growth journey and potentially profit from it.

Initial Coin Offering (ICO): An ICO, on the other hand, is a digital-age fundraising method rooted in blockchain technology. Startups or projects can sell their unique cryptocurrency tokens to early backers, often exchanging these for well-established cryptocurrencies like Bitcoin or Ethereum. ICOs can be high-risk, high-reward ventures due to their generally unregulated nature and the volatility of cryptocurrency markets. In their absolute essence, ICOs are like IPOs, but on the blockchain. The token generation and distribution happen on a decentralized and distributed ledger, also known as the blockchain. As opposed to receiving equity in a company like in traditional IPOs, investors participating in ICOs receive digital tokens.

How IPOs vs ICOs Work

The process of conducting an IPO involves numerous stages: the company must prepare a detailed prospectus, liaise with underwriters and regulatory bodies, conduct a roadshow to attract investors, and finally, launch on a stock exchange. It’s a process governed by stringent regulations and high transparency levels, ensuring investor protection.

Contrarily, an ICO operates primarily online, issuing a ‘white paper’ detailing the project and how the funds will be used. Investors purchase tokens using other cryptocurrencies, hoping that the project’s success will lead to their tokens appreciating. While ICOs are more accessible and straightforward than IPOs, the lack of regulatory oversight can increase the risk of scams or failures.

Launching an ICO is by no means a walk in the park, but we’ve put together the ultimate playbook to launch ICO that guides you on your journey.

Make sure that you go through these questions to know if an ICO is right for you:

- Does blockchain solve your business problem?

- Does your business need a token?

- Can you provide an ongoing value for this token within your dedicated business use case?

- Which jurisdiction should you launch your ICO in?

- Can your token be considered a security?

- Which parts of the ICO will you outsource, and which will you do in-house?

- Which tokenization platform will you use to create and launch your ICO?

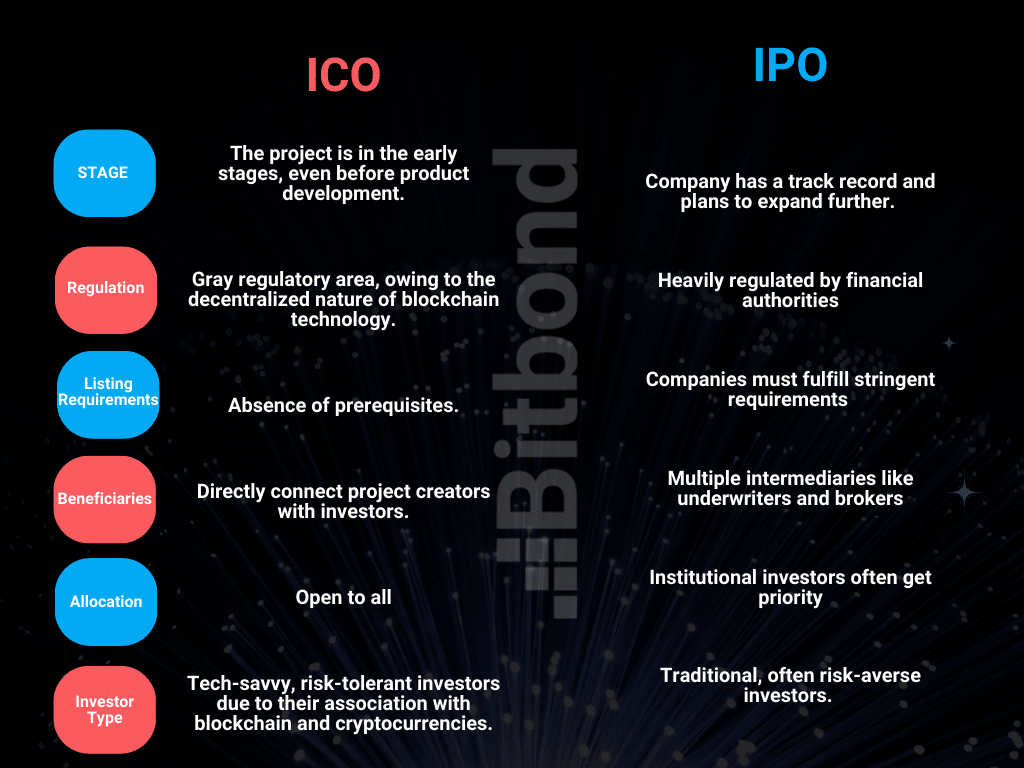

Key Differences Between IPO vs ICO

While both IPOs vs ICOs are means of fundraising, they diverge in several aspects:

- Stage: IPOs typically occur when a company has a track record and plans to expand further. ICOs, conversely, usually occur in a project’s early stages, even before product development.

- Regulation: IPOs are heavily regulated by financial authorities, while ICOs often operate in a gray regulatory area, owing to the decentralized nature of blockchain technology.

- Listing Requirements: Companies must fulfill stringent requirements to qualify for an IPO, including a minimum earnings threshold and underwriting. ICOs, however, have no such prerequisites.

- Beneficiaries (Middle Men): IPOs involve multiple intermediaries, like underwriters and brokers, while ICOs often directly connect project creators with investors.

- Allocation: In an IPO, institutional investors often get priority, while ICOs are usually open to all, although some might conduct private sales to selected investors.

- Investor Type: IPOs attract traditional, often risk-averse investors. ICOs tend to appeal to tech-savvy, risk-tolerant investors due to their association with blockchain and cryptocurrencies.

Inner Workings of an ICO & an IPO

While we’ve briefly covered how IPOs and ICOs operate, it’s essential to delve into their inner workings to comprehend their intricacies.

In an IPO, once the company finalizes the offering price and size, it lists on a stock exchange, allowing investors to buy and sell shares. The funds raised go directly to the company, and any future profit is usually shared among shareholders as dividends.

In contrast, an ICO’s mechanics rest on the underlying blockchain technology. When investors buy tokens, their ownership is recorded on the blockchain, offering a transparent and immutable record. Unlike an IPO, an ICO doesn’t confer ownership rights or claim on profits.

However, this doesn’t trivialize the token sale route since it comes with its set of risks and challenges.

Risks and Challenges of Token Sales

While token sales offer many benefits for businesses and investors, there are also several risks and challenges associated with them.

- Regulatory Concerns: One of the biggest risks associated with token sales is regulatory uncertainty. The legal status of tokens can vary depending on the jurisdiction, and regulations surrounding token sales are still evolving. This can make it difficult for businesses and investors to navigate the legal landscape and ensure compliance with all relevant regulations.

- Market Volatility: Another risk associated with token sales is market volatility. Tokens can be highly speculative, and their value can fluctuate widely based on market conditions. This can make it difficult for businesses and investors to accurately predict the future value of tokens and make informed investment decisions.

- Fraudulent Activity: Another challenge associated with token sales is the risk of fraudulent activity. Due to the decentralized and unregulated nature of the cryptocurrency market, there have been cases of fraudulent token sales, where businesses have raised funds without delivering on their promises.

- Lack of Liquidity: Another challenge associated with token sales is the lack of liquidity. Tokens can be difficult to sell, especially if they are not listed on major exchanges. This can make it difficult for investors to exit their positions and realize their returns.

- Technical Challenges: Finally, participating in token sales can also pose technical challenges for businesses and investors. The process of creating and managing tokens can be complex, and businesses must ensure that their tokens are secure and accessible to investors.

Overall, while token sales offer many benefits, they also come with risks and challenges that must be carefully considered by businesses and investors

What the Future Holds for IPO vs ICO

IPOs, with their regulatory protection and proven track record, will continue to play a vital role in the financial world. However, with the rise of decentralized finance and increasing interest in cryptocurrencies, ICOs are carving their niche.

The future of ICOs largely hinges on regulatory evolution. While the lack of oversight has led to high-profile scams, legitimate projects have also flourished, proving the potential of this fundraising method. As regulations around cryptocurrencies mature, ICOs could become a more mainstream, trusted investment avenue.

The decision between investing in an IPO vs ICO ultimately boils down to one’s risk tolerance, investment goals, and belief in the project or company in question.