Do you have a favorite sauce? One of mine is a sweet chili sauce that I use on salmon, cucumber salad, and other recipes. Most everyone has a favorite sauce or a dip, with a few hundred varieties to choose from. You may like a particular marinara, tzatziki, or tahini. You may fancy a chutney, wasabi, soy, or sriracha. Whether you like béchamel, béarnaise, or barbecue, there’s undoubtedly some kind of sauce that you periodically just crave.

The strange thing about sauces, though, is that they are food, but they aren’t a meal. They aren’t soup. They aren’t appealing on their own. They are simply meant to be “food support.” They complement and enhance. Sauces aren’t the thing. They get added to the thing to make it better. Everything tastes a little better with the right kind of sauce.

It is the same with data. Data isn’t the thing. It is crucial and can make or break your insurance operation. But data is a key supporting player, an integral part of the products, services, and experiences it enhances.

Data is the lifeblood of insurance and the key to unlocking the power and potential in much of what insurers do. Data is the key to underwriting established products properly. It’s the key to developing new products based on new markets and newly available data sources. It’s the key to winning the profit game. It’s the key to identify fraud. There is almost nowhere in insurance that won’t improve if you know how to apply data in the right manner. In insurance, everything goes better with data.

The problem is that many insurers are having trouble getting the sauce out of the kitchen. They have some of the right ingredients. They have some inspiration. They have a few recipes in their box. But, they are stymied on how to make something magnificent out of the bits and pieces that seem like they might go well together.

It used to be, with data, the time it took to figure it out didn’t matter so much. Insurers could take their time, create their models, and run some numbers. Insurers could spend years and years turning data into development, but that’s not possible today. Property insurers, especially, are in a spot where they MUST get their data and analytics working for them quickly, or it won’t be working at all.

The real answer in the data game is to figure out where the data may be applied, where it will have the most impact, and do the best. Majesco, in fact, has already done this analysis many times over and is using these insights in our solutions for the industry. We have found, time and time again, that the opportunities for insurers are found in the gaps between what is expected by customers and what is currently in vogue for insurers. When insurers catch up to customers, they fill the gaps, and in this case, that means that insurers will be using data and analytics in a way in that will positively impact both their customers and their internal operations. If you’d like to understand these gaps in greater detail, you should read Majesco’s recent survey report, Bridging the Customer Expectation Gap: Property Insurance.

Why rush the data and analytics recipe?

The state of the property insurance business is increasingly challenging. It needs a change of operations and technology that uses data intelligently to remain viable and profitable. 2022’s natural disasters had a huge impact on the industry. But 2023 is worse. According to the most recent NOAA report, the US experienced 23 separate billion-dollar weather and climate disasters in the first 8 months of 2023 – the largest number since records began and already surpassing the previous record of 22 events in 2020. And this was before the most recent hurricanes and with 4 months to go in 2023.

The rising number of extreme weather events and natural disasters has had a substantial effect on people and businesses. With rising property prices, materials, and repair costs, many insureds lack sufficient insurance coverage, resulting in a gap and increased financial risk.

The impact of this is that property catastrophe reinsurance rates are rising. The January 2023 renewals reflected 20-year highs, continuing a trajectory that began in catastrophe-exposed property versus non-catastrophe exposed property, leading to wide price differences. Demand for coverage has grown as natural disasters continue to impact customers and insurers alike. But other factors such as inflation, supply chain challenges, dramatic property price increases, and financial market losses are driving the industry further into a hard market. This trend is solidified by the American Property and Casualty Insurance Association noting in a 2023 report, that the combination of historic high inflation and the growing frequency of natural catastrophes has created the hardest market in a generation for property insurance.[1] We can likely expect high rates again for 2024 renewals given what has happened this year.

What is the solution?

Insurance losses are resulting in higher premiums for customers, higher premiums for reinsurance for insurers, and a refocus on the underwriting discipline, new products, and value-added services that focus on risk resiliency with prevention and mitigation.[2]

So, where can any insurer find opportunity in the light of an environment that begs for adaptation and innovation?

Well, there’s data. Commercial property buildings, for example, are increasingly becoming “smart” and delivering vast amounts of data through real-time connected devices integrated with Building Management Systems (BMS) that can be used to monitor, predict, and prevent loss. In addition to protecting the building environment from risks such as water leaks, fire, or machinery wear, sensors can assess external risks such as weather, to provide a 360-degree view of risk in real-time.

And there is loss control – either with adjusters or using digital capabilities like video and self-surveys to capture pictures, data, and other information about properties – both commercial and personal and then assess that data for risk.

Both of these are an opportunity, and because of the proliferation of sensor and smart technologies, digital loss control capabilities like Majesco Loss Control, not to mention the new technologies such as ChatGPT and actionable AI, there are many more opportunities just like it.

The adage of “control what you can control” is now front and center for insurers as they look at new risk management strategies as a crucial component of their customer strategy and their property lines of business. Insurers must increasingly focus their time and resources on how they can better assess risk for a broader set of properties and prevent losses to improve underwriting profitability and customer experiences. The solution will involve data, advanced analytics, and other tools that harness data’s power, but the solution will only be viable for insurers who are willing to catch up, right now. Data will stretch insurers and their capabilities, but it will stretch them in the right direction, preparing them for a much more efficient and profitable future.

Data & Analytics for Property Pricing and Underwriting

P&C underwriting is at the heart of the insurance business. From evaluating individual risks and the exposures in an entire portfolio to assessing the risk, risk appetite, and ultimately profitability, underwriting is increasingly crucial in the face of rapidly changing risk factors. At the core of underwriting is data.

Insurance has always been a data-driven business, but access to new data sources for properties and the use of AI/ML is redefining and revolutionizing the industry. Risk management, underwriting, and loss control all involve gathering and using data needed for AI/ML models to accurately assess and identify risk, and manage and reduce risks.

Majesco has the industry’s most extensive repository of property loss control survey data, encompassing over 2 billion observational data points from 16+ million meticulously completed property surveys conducted by trained risk engineers in the field. These surveys, rigorously quality-assured, encompass a staggering 200+ million tagged photos, providing the ideal foundation for harnessing the potential of AI/ML. We have used this data to develop our Property Intelligence AI/ML model to help assess specific property data using this repository of data. Using this data and our model, insurers can personalize the pricing and underwriting for the customer’s specific risk.

Commercial Property SMB – Insurer Gaps in Data Use and Interest

Remember when insurance’s excuse for not using data was that customers didn’t want to give up their key bits of relevant data, even if it meant that it would save them money? Who might have guessed that the issue has flipped and that now it may be that insurers could lose business because customers are willing to share the data and insurers aren’t ready to make a customer’s data work for them.

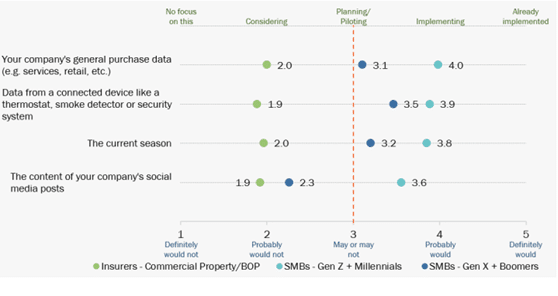

According to Majesco surveys, the old excuse evaporated in the commercial market. Overwhelmingly, SMBs are willing to share data with insurers to price and underwrite their commercial property insurance at nearly double the rate that insurers are currently using this data, as reflected in Figure 1. Interestingly, both generational groups agree, except for social media content, where the older generation aligns with insurers.

Figure 1: Customer-Insurer gaps in new data sources and technologies for commercial property insurance pricing and underwriting

The growth of IoT devices and sensors throughout homes and businesses is accelerating. In addition to sensors (temperature, water, infrared, sound, etc.), we are witnessing tremendous growth in video surveillance (with mobile capabilities), particularly given the rise in crime due to societal risk.

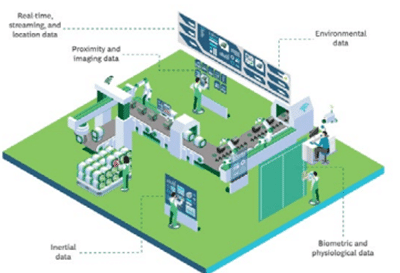

According to a BCG article, in 2020 there were 30 billion connected devices in the world, which is expected to increase by over 30%, to 41 billion devices by 2024.[3] Today’s IoT devices embedded in equipment and infrastructure for commercial businesses produce over 14 zettabytes of data, with numerical or visual information on people, things, and environmental factors, as reflected in Figure 2. The breadth of this data offers the opportunity to use it in real-time, rather than rely on historical data for risk assessment and underwriting, while also providing new data that gives more insight into the risk.

Figure 2: Types of data generated by commercial IoT devices

In fact, businesses are taking advantage of IoT-based technologies to streamline processes, increase efficiency and safety, and provide security. It is estimated that nearly 34% of North American and European businesses use IoT devices, with another 12% planning to integrate IoT within the next year.[4]

Insurers’ ability to create customer value from the IoT will depend on their willingness to dive in and start experimenting with IoT technology and data today. Leaders are doing this and will outpace those who follow, putting them at risk of keeping their customers. Insurers that wish to remain viable, must catch up in their use of data in the commercial market.

Personal Property Consumer – Insurer Gaps in Data Use and Interest

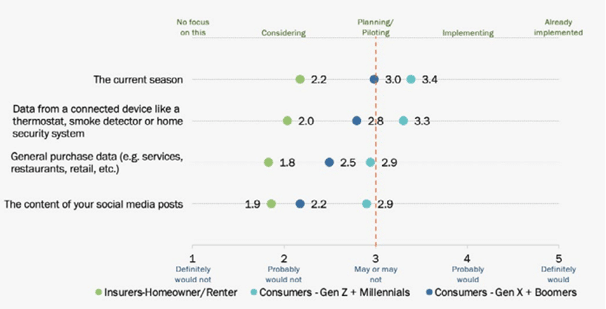

Similar to SMBs, consumers are overwhelmingly interested in using their data for pricing and underwriting of their property insurance as reflected in Figure 3. In fact, they are up to 2 times more interested than insurers, reflecting a large customer expectation gap.

Figure 3: Customer-Insurer gaps in new data sources and technologies for personal property insurance pricing and underwriting

According to CoreLogic’s Residential Cost Handbook, nearly 64% of homeowners don’t have enough insurance coverage and are underinsured by an average of 27%.[5]

This is not surprising, given the rise in property values. In November 2021, it was reported that the median price of single-family existing homes rose in 99% of the 183 markets tracked by the National Association of Realtors in the third quarter, with double-digit price increases seen in 78% of the markets.[6]Over the last couple of years, prices have risen from 15% to over 30% on average, with some markets even higher. Imagine doing a digital loss control survey via self-survey or video on your entire book of business to better assess each property risk, but also to better assess reinsurance needs. Majesco has customers who are doing just that with great success.

Adding fuel to the change, it is anticipated that smart home devices will continue to be a major area for IoT, with over 800 million smart home devices shipped in 2020 and predicted to exceed 1.4 billion by 2025. It is estimated that 41.9% of US households owned a smart home device in 2021, which will rise to nearly 50% by 2025. The result is the number of smart home devices purchased will exceed 1.94 billion by 2023.[7]

This growth in adoption offers insurers a significant opportunity to meet customer expectations by capturing and using the data for personalized risk assessments and underwriting. With the increased valuations and the growth of the adoption of smart home devices, customers are increasingly interested in personalized pricing and underwriting based on their own location and property details. Insurers must begin to address this need and expectation to acquire and retain customers. Customer loyalty is in jeopardy once personalized pricing takes over the market. Only insurers that are meeting expectations can expect to hang on to and expand their business and portfolio of customers.

But more than that, only insurers who truly understand their business, using data as their guide, will know which business they want and which they don’t want. The data-smart insurer will benefit from the data-vetted portfolio.

Majesco is, right now, helping insurers to transition their operations to catch up in the data game. These companies are preparing to take advantage of market-leading data and analytic technologies for P&C insurance. They are making better decisions using data and analytics and are proving how everything in the insurance operation goes better with data. Majesco’s Intelligent Core for P&C, Loss Control, and Property Intelligence is at the leading edge of what leading insurance operations need now, and in the very near future.

“The need for rapid product innovation, efficient operations, and robust digital capabilities is driving the need for core systems rich with APIs and accessible data. Majesco offers a P&C Policy solution with an open architecture and self-service configuration tools that enable insurance carriers to deploy the capabilities needed to succeed in this new era of insurance. Majesco’s sizable customer base and continued momentum in the market qualifies them as a Dominant Provider in the P&C core systems space.” — Martina Conlon, Head of Property and Casualty Insurance at Datos Insights.

Do you understand what it means to have an Intelligent Core and advanced data and analytics running your business? Check out Majesco’s latest webinar, The Dawn of Intelligent Core Insurance Software, for a peek at how data and AI/ML, working together, will rewrite the rules of P&C insurance.

[1] Sams, Jim, “APCIA Says Property Insurance Market ‘Hardest in a Generation’,” Claims Journal, March 28, 2023, https://www.claimsjournal.com/news/national/2023/03/28/316110.htm

[2] “Facts + Statistics: Homeowners and renters insurance,” Insurance Information Institute, https://www.iii.org/fact-statistic/facts-statistics-homeowners-and-renters-insurance

[3] Taglioni, Giambattista, et al., “The Power of the Internet of Things in Commercial Insurance,” BCG, October 4, 2021, https://www.bcg.com/publications/2021/commercial-insurance-should-start-testing-the-power-of-the-internet-of-things

[4] Vailshery, Lionel Sujay, Internet of Things (IoT) in the U.S. – statistics & facts, Statista, October 27, 2022, https://www.statista.com/topics/5236/internet-of-things-iot-in-the-us/

[5] “Report: How Many US Homes Are Underinsured?” Kin, April 12, 2021, https://www.kin.com/blog/underinsurance-report/

[6] “Home Prices Spiked In Nearly All Metro Areas In 3Q 2021,” National Mortgage Professional, November 12, 2021, https://nationalmortgageprofessional.com/news/home-prices-spiked-nearly-all-metro-areas-3q-2021

[7] Cook, Sam, “60+ IoT statistics and facts.” Comparitech, December 13, 2022, https://www.comparitech.com/internet-providers/iot-statistics/

The post Insurers Poised to Transform Property Insurance if Data & Analytics Can Catch Up appeared first on Majesco.