Demographics Advantage

India has a young and growing population with a median age of just under 29 years, a large and growing middle class, and a rapidly expanding skilled workforce. It also has the largest English-speaking population after the U.S., making it the preferred destination for outsourced manufacturing and services. In addition to this, the nation’s progress in enhancing literacy levels and education standards has positioned India as an emerging powerhouse of the world.

Strengthening Global Ties

India has witnessed growing ties with the West and has formed alliances such as QUAD (a four-country military alliance consisting of Japan, India, U.S. and Australia) to counter China. It has also gradually diversified its defense imports from Russia, which were down to 45% in the last five years as opposed to more than 75% a decade ago. France and the U.S. accounted for 29% and 11%, respectively. Strengthening Global Ties

Earlier this year, the Indian Prime Minister visited the U.S. for a state visit that had significant outcomes in areas such as defense, renewable energy and critical minerals cooperation. India and the U.S. cracked several deals on space and defense, along with signing an MoU on Semiconductor Supply Chain and Innovation Partnership.

India’s growing inclination toward the West was also illustrated during the Indian Prime Minister’s visit to France as guest of honor in the Bastille Day parade. India placed multibillion dollar orders to purchase 26 more Rafale fighter jets and three Scorpène class submarines, which will be jointly developed by the two countries, and add to the existing fleet of 36 French jets and six submarines. It will also further strengthen the strategic partnership between the two countries.

Infrastructure Growth

In recent years, India has carried out a transformative surge in capital expenditure dedicated to infrastructure growth in its quest to modernize and revitalize its aging infrastructure and ensure that development reaches the remotest villages.

Under the National Infrastructure Pipeline (NIP) initiative, 2,476 projects are under development, at an estimated investment of $1.9 trillion. Nearly half of the under-development projects are in the transportation sector, and 3,906 are in the roads and bridges sub-sector.

The Indian Railways also continue to expand and modernize while generating record revenues. The overall revenue of Indian Railways at the end of August 2022 was $11.5 billion, showing an increase of $3.1 billion (38%) over the corresponding period of last year. The number is expected to grow to $28.3 billion by the end of fiscal year 2022/23.

Additionally, India’s logistics market is expected to reach $556.97 billion by 2027, growing at a compound annual growth rate of 6.28%. India intends to raise its ranking in the Logistics Performance Index to 25 and bring down the logistics cost from 14% to 8% of gross domestic product, a reduction of approximately 40%, within the next five years.

In December 2022, the Airports Authority of India and other airport developers targeted a capital outlay of approximately $11.8 billion for the airport sector in the next five years for new terminals, expansion and modification of existing terminals, and strengthening of runways, among other activities.

Airlines reciprocated by making large investments into fleet expansion. Two of the largest airlines in India, Air India and Indigo, placed orders of almost 1,000 jets with Boeing and Airbus, which stood out as the largest orders by number of aircraft in the history of modern aviation. The growing fleets will cater to an estimated surge in air passengers to 350 million by 2030, up from 144 million in 2019.

Push toward Manufacturing

With the prevailing sentiments in the West to reduce dependency on China, India could emerge as a promising contender for diversifying manufacturing operations. Historically a service-dominated economy, India has been making strides in the past few years to reinvigorate its manufacturing sector by investing in skills, technology and policy reforms. The ‘Make in India’ push has been one of the central themes of Prime Minister Narendra Modi’s tenure. Some key successes of the campaign have been the turnaround in the smart phone manufacturing sector, which witnessed net exports of $9.8 billion in FY 2022/23, up from net imports of $3.3 billion in FY 2017/18, and growth in defense equipment exports from a measly $100 million in FY 2013/14 to upwards of $2 billion in FY 2022/23.

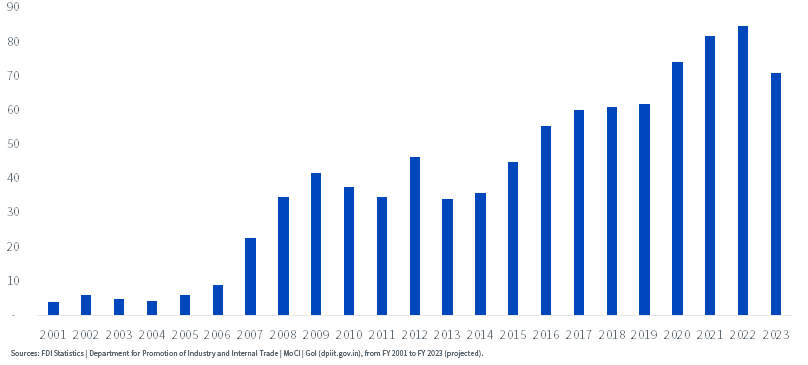

Foreign Direct Investments (FDI) Inflows in India (in billions USD)

Digitalization

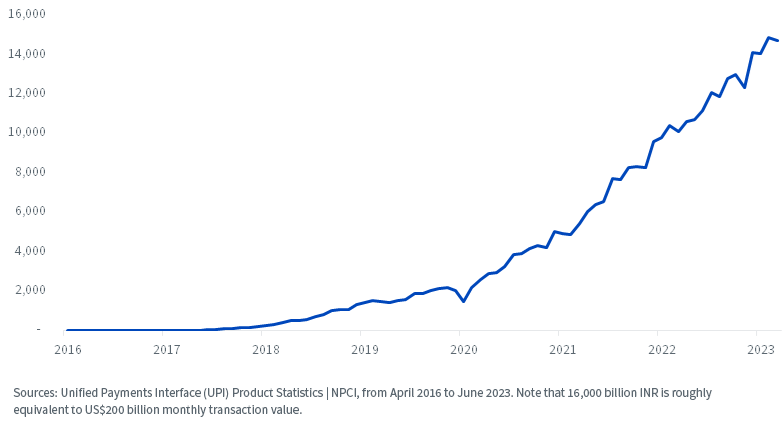

Unified Payments Interface (UPI), an indigenously developed payments system launched in 2016, is a remarkable story of digital innovation and financial inclusion. Today, you can see QR codes at small and big vendors alike, from urban metropolitans to the remotest villages—all have embraced the technology allowing free bank-to-bank transfers in a few clicks. The technology has evolved to allow for transactions to take place without internet to cover the approximately 45% of the population that does not have access. In 2022, UPI accounted for over 74 billion transactions, worth over $1.5 trillion in value. Given India’s huge reliance on cash just a decade ago, the adoption rate has been phenomenal. The technology, while useful for quick and easy transactions, has also allowed the government to better track the money transfer footprint and include a large section of the population under formal financial institutions.

Growth of Monthly UPI Transactions in India (billions INR)

Another ambitious project, Aadhaar, is aimed at providing digital biometric identities to the population of 1.4 billion. Since the start of its tenure in 2014, the current government has heavily invested in the idea to make it a reality and, as of January 2023, 1.359 billion Indian residents hold the biometrics-linked identity card. It comes with a number of advantages, including direct benefits transfer, an exercise previously plagued by corruption, and prevention of identity theft, by connecting with mobile SIM cards, among many others. Aadhaar continues to be integrated with banking, pensions, taxation, the criminal database, voter cards and so on.

Telecommunications and E-Commerce

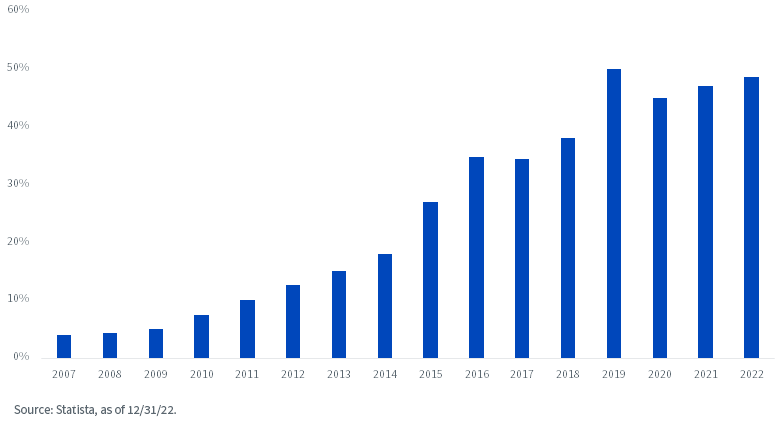

Impressively, internet penetration in India has witnessed a remarkable surge, soaring from a modest 12.6% in 2012 to a substantial 48.7% in 2022. This significant leap can be attributed to the widespread implementation of fourth-generation broadband cellular network technology, offered at remarkably competitive rates, ranking among the most affordable worldwide. To illustrate, the cost of 1 gigabyte of 4G cellular data has plummeted to under $0.10 on average from $5 just seven years ago.

Moreover, the growth has continued unabated, fueled by the rapid expansion of the 5G network, which promises to unlock a plethora of new possibilities and use cases. As this cutting-edge technology continues to unfold, India stands at the cusp of even greater digital advancement and connectivity, propelling the nation toward a more innovative and connected future.

Internet Penetration Rate

Remarkably, the e-commerce industry in India has emerged as a crucial pillar of the economy, experiencing unparalleled growth in recent years. Predictions indicate that its value will skyrocket to a staggering $163 billion by 2026, from $63 billion in 2022. This surge can be attributed to multiple factors, including the rapid expansion of internet users and the widespread adoption of digital payment methods, which have been facilitated by a number of fintech startups like Paytm, Cred and PhonePe, among others. The convergence of these factors has fueled the phenomenal growth of e-commerce in the nation, making it a pivotal driver of economic progress and transformation.

Pharmacy of the World

The country’s pharmaceutical market, which has been playing a key role in the wider global industry, was estimated at $42 billion domestically in 2021 and is projected to expand to $120 billion by 2030. India ranks third worldwide for pharmaceutical production by volume and exports pharmaceuticals to more than 200 countries and territories.

Living up to its title of the ‘pharmacy of the world,’ India has cemented its position as a dependable nation when it comes to health crises like that of a pandemic. India not only administered 2.2 billion doses of indigenously developed vaccines but was also one of the earliest countries to export vaccine doses to other countries. As of June 15, 2023, over 300 million does were exported to 101 countries in total.

Conclusion

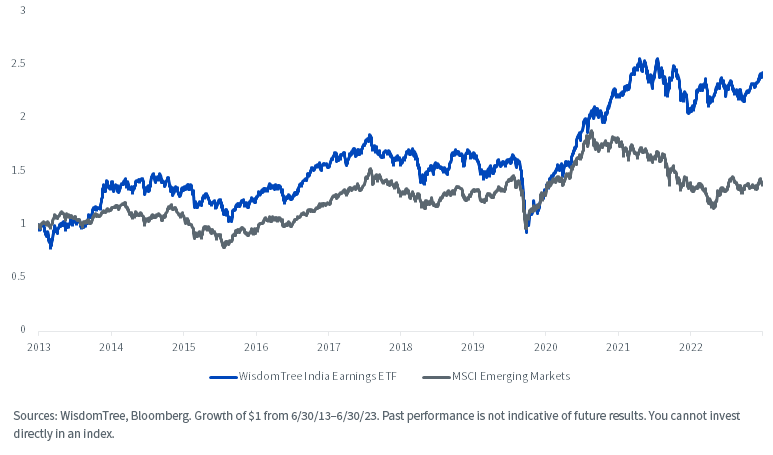

Strong macro tailwinds propelled India’s rise to the world’s fifth-largest economy earlier in 2022 and put it on track to become the third-largest economy by 2027, surpassing Germany and Japan. Economic growth has also been evident in the country’s equity market performance, with WisdomTree India Earnings ETF outperforming the MSCI Emerging Markets Index by 104% over the last decade.

We are confident that India enjoys a favorable alignment of macro factors, coupled with unique advantages stemming from its vast workforce and the growing perception of being the preferred partner of the West in the region. This advantageous position is further bolstered by a series of growth-oriented initiatives implemented by the government. As a result, we anticipate that Indian stocks will maintain their outperformance compared to their emerging markets counterparts over the next decade.

WisdomTree India Earnings ETF vs. MSCI Emerging Markets Index

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. This Fund focuses its investments in India, thereby increasing the impact of events and developments associated with the region which can adversely affect performance. Investments in emerging, offshore or frontier markets such as India are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. As this Fund has a high concentration in some sectors, the Fund can be adversely affected by changes in those sectors. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

]]>