In 2024, becoming a successful Forex Algo trader is more accessible than ever. Forex algorithmic trading, or Algo trading, is transforming the way traders approach the market, offering the ability to execute trades with precision and consistency. If you’re wondering how to become a successful Forex Algo trader, this guide will walk you through the steps you need to take in 2024.

Unlike traditional trading, which relies heavily on emotional decisions, algo trading uses automated strategies to place trades, helping you overcome the psychological pressures that come with manual trading.

With SureShotFX Algo, it’s easier than ever to dive into automated Forex trading, even without previous trading experience. So, let’s explore how you can become a successful Forex Algo trader and take your trading to the next level.

What is Forex Algo Trading?

Forex algo trading is the latest trading process of using automated algorithms to execute trades in the foreign exchange market. Instead of manually executing trades, you let a computer algorithm do all the heavy lifting. These algorithms are programmed with a set of rules based on price movements, technical indicators, and other market data, which means they make decisions and place trades automatically—no human intervention needed.

Algo trading has the advantage of executing trades faster than human traders. It often seizes opportunities in milliseconds, which can be especially beneficial during volatile market conditions. Algorithmic trading is not just for experienced professionals; many retail traders are using SureShotFX to access algorithmic trading easily, without requiring programming expertise.

Who are Algo Traders?

Algo traders are traders who use automated algorithms to execute trades in the foreign exchange market. They are also known as algorithms traders. They rely on pre-programmed rules and advanced technologies to execute trades based on market conditions, trends, and technical indicators, often without requiring manual intervention.

They create, test, and implement automated strategies to gain a competitive edge in the market. Retail traders can also step into algo trading with the right tools, such as SureShotFX Algo, which simplifies the process for all skill levels.

Types of Forex Algo Traders:

- Retail Algo Traders: These are everyday traders who’ve leveled up by using tools like SureShotFX Algo. They’re not coding experts, but they know the power of automation. With pre-built strategies and user-friendly features, they turn trading into a streamlined and efficient process.

- Institutional Algo Traders: Think big players—investment firms, hedge funds, and banks—executing massive trades with pinpoint accuracy. They leverage ultra-sophisticated algorithms and high-speed systems to take advantage of even the tiniest price fluctuations.

- Quantitative Traders (Quants): These brainiacs are the masterminds behind complex mathematical models that drive trading algorithms. With their expertise in math, finance, and data analysis, they create algorithms that can adapt to just about any market condition.

How to Become an Algo Trader in 2024:

In 2024, becoming an Algo trader is not that tough if you can learn the fundamentals of trading, understand the strategies, and have the trading tools like SureShotFX to become an Algo Trader. Here are the following steps you can follow to become an Algo Trader:

Learn the Fundamentals:

Before diving into algo trading, it’s crucial to understand the core concepts of Forex trading. You should be familiar with how the Forex market functions, key economic factors, and the technical aspects that drive currency price movements. Understanding these fundamentals will serve as the foundation for your algorithmic strategies.

- Market Analysis: Master the art of both technical and fundamental analysis. Algorithms rely heavily on historical data, trends, and patterns to make decisions, so understanding how to read and interpret these patterns is critical.

- Risk Management: A key component of any trading strategy is managing risk. Knowing how to set stop-loss levels, take-profit targets, and adjust position sizes will be vital in ensuring you don’t overexpose your capital.

Core Skills and Knowledge:

Successful Forex algo traders combine several skill sets:

- Trading Strategy Development: Understanding different trading strategies, such as trend-following or mean reversion, is essential for developing algorithms.

- Market Knowledge: A deep understanding of the Forex market dynamics, including volatility, liquidity, and news impact, will inform how you set your algorithm’s parameters.

- Backtesting: Understanding how to backtest your strategy under different market conditions is an important skill. You need to be able to assess whether your algorithm is performing optimally and if it is likely to succeed in real-time conditions.

Choose the Right Trading Platform:

Selecting a reliable trading platform that supports automated trading is critical. A platform that provides all the tools needed to trade Forex algorithmically without the need for extensive programming knowledge. The platform offers easy-to-use features, including real-time signals, backtesting, and strategy customization.

Choosing the Right Tools:

To successfully execute an algorithmic trading strategy, having the right tools is essential. SureShotFX Algo provides a powerful set of tools designed to optimize your trading experience. From automated trade execution to comprehensive risk management features, these tools ensure your strategies are implemented with precision.

Platforms like SureShotFX allow you to tweak your strategies based on market conditions. This flexibility can be crucial when adapting to unexpected market shifts.

Test Your Strategy:

Once you understand all the features, it’s time to test it. Using backtesting, you can simulate how your strategy would have performed in historical market conditions. This is a vital step to ensure your algorithm is viable before you risk actual capital. Demo accounts are another excellent way to refine your strategies and see them in action under real market conditions.

Monitor and Refine:

Forex algo trading requires constant monitoring. The markets are dynamic, and you need to adjust your algorithms based on new market data or performance feedback. SureShotFX offers continuous optimization tools to help refine your strategies and improve overall performance.

Even though your strategy runs automatically, you should review its performance periodically to ensure it is still performing as expected. Regularly update your algorithms based on changes in market conditions, such as major economic events or shifts in volatility.

Essential Tools and Technologies for Forex Algo Trading:

- Automated Trading Software: Automated trading tools like SureShotFX offer automated trading solutions that integrate seamlessly with Forex markets. These platforms help you execute trades based on your algorithm’s pre-set parameters.

- Backtesting Platforms: Backtesting allows you to evaluate how your strategies would have performed under historical market conditions. SureShotFX offers built-in backtesting features to test your trading logic.

- Real-Time Data Feeds: Reliable data is essential for algo trading. With SureShotFX, you’ll have access to low-latency data feeds, ensuring that your algorithm reacts to the market in real-time.

- Risk Management Tools: Effective risk management is crucial to mitigate potential losses. SureShotFX provides tools for setting stop-loss and take-profit orders, as well as adjusting trade size based on market volatility.

- Analytics Tools: Use platforms with integrated analytics that can give insights into your algorithm’s performance. This will help identify areas of improvement and opportunities for growth.

How SureShotFX Algo helps you to Become an Algo Trader:

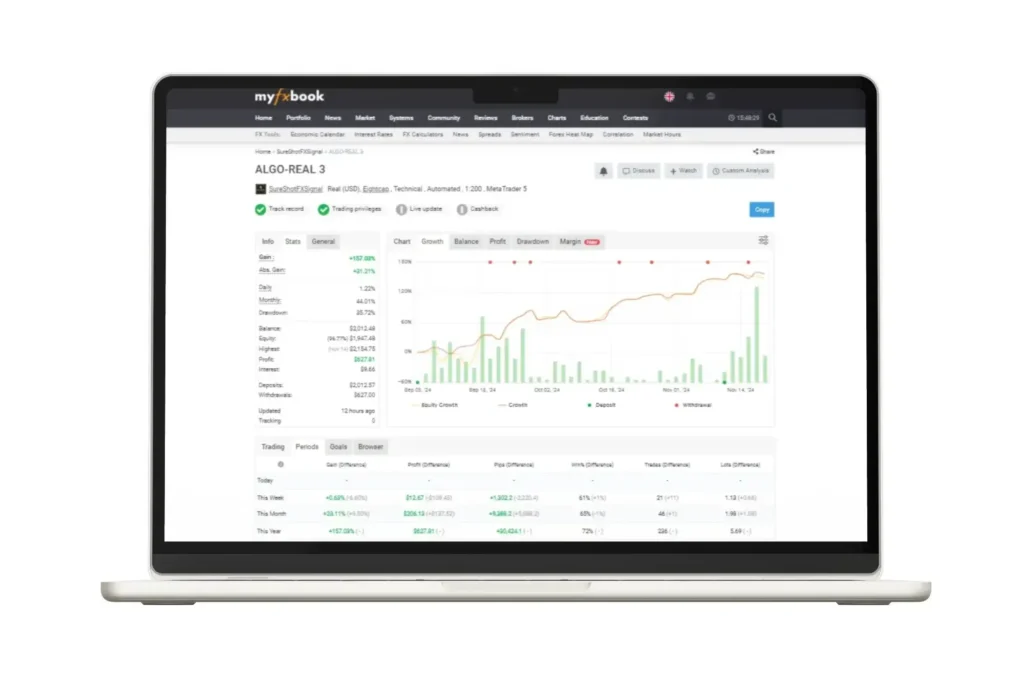

SureShotFX Algo provides a powerful and user-friendly platform designed for both beginner and experienced Algo traders. With its advanced signal delivery system, real-time market data, and robust backtesting capabilities, SureShotFX allows traders to develop, test, and implement profitable strategies with ease. The platform’s automation features ensure your trades are executed quickly and accurately, all while offering continuous support to refine your approach.

Challenges to Be an Algo Trader:

While Forex algo trading offers many advantages, there are challenges to overcome:

- Market Volatility: Rapid changes in market conditions can impact the effectiveness of your algorithms, requiring constant adjustment and fine-tuning.

- Overfitting: Over-optimizing your algorithm based on past data may result in a strategy that doesn’t perform well in live market conditions.

- Costs: Setting up the right infrastructure, such as reliable data feeds and execution systems, can come with substantial costs.

Tips for Succeeding as a Forex Algo Trader in 2024:

- Start Small: Begin with smaller trade sizes and use demo accounts to test your algorithms before committing significant capital.

- Continuous Learning: Stay up-to-date with the latest developments in the Forex market and algorithmic trading techniques.

- Refine Your Strategies: Regularly monitor your algorithm’s performance and adjust it based on market conditions and feedback.

- Leverage Technology: Use platforms like SureShotFX to automate your trading and access powerful tools that support your strategy.

- Diversify: Test different strategies and avoid putting all your capital in one approach to reduce risk.

Conclusion:

Forex algo trading offers traders a powerful tool to automate decision-making and enhance their trading efficiency. By leveraging the right platforms, tools, and strategies, you can position yourself for success in 2024. SureShotFX Algo provides an accessible and effective solution for traders looking to enter the world of algorithmic trading. With its advanced features, real-time data, and automation capabilities, SureShotFX ensures that you have everything you need to succeed.

FAQs:

SureShotFX offers an intuitive platform with powerful automation tools, real-time signals, and backtesting features that help you test, refine, and implement successful trading strategies.

Yes, platforms like SureShotFX are designed to be beginner-friendly, providing all the tools necessary to get started with algorithmic trading without requiring programming expertise.

Yes, SureShotFX provides backtesting features that allow you to test your strategies using historical data before applying them to real-time trading.

Like all forms of trading, Forex algo trading carries risks, including market volatility and the potential for algorithmic failures. It’s important to implement strong risk management strategies.

No, SureShotFX is designed for traders of all experience levels. You don’t need to be a professional trader, as the platform provides pre-built features that make algorithmic trading accessible.

The post How to Become a Successful Forex Algo Trader in 2024 appeared first on SureShotFX.