Chargebacks911

Hotel Chargebacks

What Consumers & Merchants Need to Know About Hotel Chargebacks

There are some verticals that are more susceptible to chargebacks than others. High-dollar items like camera equipment, computers, and designer fashion are at risk. That said, dispute-to-transaction ratios in the hospitality space tend to be among the highest in all verticals.

The epidemic of hotel booking chargebacks isn’t slowing down, either. In fact, it’s gaining even more steam over time. In this piece, we’re going over chargebacks in the hotel industry, providing advice to help both cardholders and merchants.

Chargebacks in the Hotel Industry: At a Glance

In the hospitality industry, chargebacks occur after a cardholder books a stay through the hotelier’s website or a third party online travel agency like Expedia or Booking.com. Later, the cardholder claims their booking was unsatisfactory and files a dispute with their issuing bank.

The hotel industry’s chargeback challenges are unique due to the service-based nature of its business, where the product is the experience itself. In retail, a chargeback might be resolved by returning a physical item. In lodging and hospitality, though, services rendered cannot be returned. This inherent difference complicates the resolution process, as hotels must provide compelling evidence that the service was delivered as agreed upon to fight the chargeback successfully.

Furthermore, hotels must deal with the high costs of vacancy when a room is booked and unused due to a last-minute cancellation or no-show, which can also lead to disputes. The combination of high-value transactions, advance bookings, and the subjective quality of service makes hotel chargebacks particularly challenging to manage.

Common Causes of Hotel Chargebacks

Cardholders file chargebacks in the hotel industry for several reasons, each stemming from different experiences and expectations. Here are some of the most common claims that lead to disputes:

There are valid reasons to file a hotel booking chargeback. This does not imply that cardholders should file a chargeback as a first recourse, though. Customers should always try to resolve the issue with the hotelier before calling the bank to dispute a charge. They should also be aware that the bank may request evidence to substantiate any claims made.

Important!

When cardholders file chargebacks without a valid reason to do so, they’re engaging in a practice known as friendly fraud. If a cardholder believes they have a valid claim, they should always try to contact the merchant first. Resolving the issue with the hotelier will likely get the money back faster and with little incident, whereas filing a dispute with the bank could take weeks, or even months to finally resolve.

Breaking Down Criminal Fraud in Hotels & Hospitality

Fraud tends to impact the travel and leisure industries even more heavily than other sectors like retail or digital goods. We can attribute this to five specific factors:

The American Hotel and Lodging Association asserts that as much as 55% of all card fraud in the US takes place within the hospitality industry. Of course, that only takes criminal fraud into consideration. When you factor in other loss sources like friendly fraud, the real figure is much higher.

So, why is hospitality a target for fraudsters? Well, hotel stays are often a very personal experience. As such, they can constitute an uncomfortable gray area.

From the bank’s perspective, it can be difficult to ask a customer to relay the personal details of a recent visit or ask what made that visit uncomfortable. By the same token, a hotelier might mistake a polite response for approval of an unsatisfactory service. You can see how a fraudster might view this as an opportunity to capitalize on miscommunication.

How to Respond to Hotel Chargebacks

TL;DR

Hotel operators can respond to chargebacks by following four steps. First, understand the chargeback reason code and response time limits. Second, compile compelling evidence. Next, draft a rebuttal letter. Then, submit a representment package and wait for the issuer to respond.

Much like other merchants, operators can fight chargebacks through a process called chargeback representment.

As mentioned before, however, hotels have the added challenge of proving that the intangible and consumable services they sell were not defective. For this reason, you need to be particular about the evidence you furnish throughout the dispute response process, the steps to which we outline below:

Merchants who receive chargebacks will be provided with reason codes from the cardholder’s issuer. Reason codes identify why a dispute was filed and can help you craft a targeted response.

You should also take note of the time window they have to submit a response. Card networks impose strict time limits for merchants; your acquiring bank may have even tighter deadlines. These deadlines cannot be extended, so make sure to file your rebuttal on time.

Learn more about chargeback time limits

The next step is to show you upheld your end of the bargain. This can be difficult, because you may not be able to provide the same forms of evidence as a physical goods retailer, like proof of delivery or pictures of shipped goods.

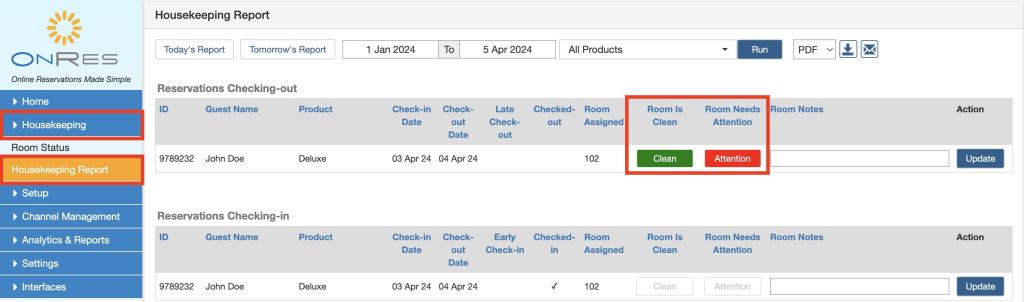

What you can offer, though, is evidence that the guest showed up for the booking and checked out on schedule. You can also provide more unorthodox documentation, like housekeeping records, with the logic here being that unoccupied rooms wouldn’t be serviced.

Calls placed to the front desk can also help. If you happen to record those interactions, you can show that the guest did not raise concerns or objections during their stay. While this alone does not mean the guest was wholly satisfied with their experience, it may lend further credence to your rebuttal.

Learn more about compelling evidence

A rebuttal letter is a bit like a cover letter; it helps you summarize your argument as to why a chargeback should be reversed. In every rebuttal letter, you should furnish the chargeback case number and reason code, along with the card number used in the transaction, the card network reference number, the response deadline, and other details.

Next up is the body of your letter. Here, you’ll want to concisely describe the cardholder’s claim, and then counter with your rebuttal and supporting evidence. Be brief and clear; keep your rebuttal letter to one page unless your case is exceptionally complex. At the end of your letter, enclose your name, company, and contact information.

Ultimately, remember that the goal of your rebuttal letter should be to quickly inform and convince the representative (usually a fraud analyst) at the issuing bank that you are in the right.

Learn more about rebuttal letters

With your evidence compiled, it’s time to submit your representment package to your acquiring bank. The acquirer will review the documentation to make sure it’s complete and compelling, then forward it to the cardholder’s issuing bank for consideration.

Usually, the issuer will make a decision within a few business days. Three outcomes are possible here. The issuer can:

- rule in your favor and reverse the chargeback

- rule against you and uphold the dispute

- initially reverse the chargeback, then walk back the decision by filing a second chargeback or a pre-arbitration.

How to Prevent Hotel Chargebacks

TL;DR

Digital check-in and keyless entry systems can help hotels track guests and their itineraries, which could help cut down on illegitimate chargebacks. In addition, good customer service, stringent guest verification measures at booking and check-in, secure payment processing, transparent cancellation and refund policies, robust staff training programs, frequent transaction audits, and open dialogue with guests can all help hotel operators prevent chargebacks, too.

New technologies may help hotel operators cut down on chargeback issuances. Take digital check-in and keyless entry systems, for example, that match the cardholder to their mobile device may help verify users’ identities. They offer better insight into a guest’s specific activities on the property than paper records held by hotel staff.

These systems may not capture every detail of a guest’s stay, but they can confirm that the guest was present at the hotel and used their room. This confirmation is critical during disputes where a guest claims they never visited the property.

In the event of a chargeback, these systems can provide a comprehensive audit trail. It allows for proactive management of the situation, which is more efficient than waiting for multiple parties to respond. Moreover, this approach keeps the hotel updated with regular reports and records, which are valuable for future reference.

Of course, that’s just one option. You can substantially reduce your chargeback ratio and prevent hotel chargebacks with a few more simple steps. Below, we’ve identified some basic best practices you can adopt today that will help you avoid disputes and retain more revenue:

Have Additional Questions About Stopping Hotel Chargebacks?

You shouldn’t be worrying about fighting hotel chargebacks or keeping up with industry regulations. You should be focused on running your business.

Chargebacks911® offers the industry’s most innovative solutions for chargebacks. Our technologies enable merchants to identify the source of disputes and then deploy the right solution to deliver immediate results.

Friendly fraud in the hospitality industry isn’t slowing down. That’s why you need to kick chargeback mitigation into high gear. Contact us today to learn more.

FAQs

How do you win a hotel dispute?

To win a hotel dispute, you need to gather and present clear, comprehensive documentation that substantiates your case, including communication records, receipts, and policies. Respond promptly and effectively to the dispute through your payment processor, adhering strictly to their guidelines and timelines.

Can a hotel reverse a payment?

Yes, a hotel can reverse a payment, typically by issuing a refund directly to the guest’s payment card. This process is managed through the hotel’s payment processing system and is often used to resolve billing errors or guest disputes amicably.

What solutions would you suggest for reducing chargebacks within a hotel?

Hotels should communicate policies and charges clearly, ensure accurate billing, and provide exceptional customer service to address issues proactively. Additionally, using secure payment processing technologies and maintaining thorough records of transactions and guest interactions can significantly reduce the incidence of chargebacks.

Can you demand a refund from a hotel?

Yes, you can demand a refund from a hotel if the services provided did not meet the advertised standards or if there were billing errors. It’s best to initially request the refund directly from the hotel, providing any relevant evidence to support your claim.

Do hotels fight chargebacks?

Like other service industry merchants, hotels do fight chargebacks. However, the process can be an uphill battle for hotel operators because the service they offer is perishable and intangible. This makes it more difficult for hotels to prove that they are not at fault when they receive a cardholder dispute.

Can hotels refuse to refund?

Yes, a hotel may refuse to refund you in line with their terms and conditions. If you believe you are entitled to a refund but were denied one, you may file a chargeback with your issuing bank.

Can I dispute a hotel charge on my debit card?

Yes. If you incurred hotel charges on your debit card due to error or fraud, you may dispute the charge. You may also file a chargeback if your stay was unsatisfactory.

Can you dispute a hotel charge on your credit card?

Yes. As long as you are doing so for valid reasons, you can dispute a hotel stay purchased with a credit or debit card.

This post Hotel Chargebacks appeared first on Chargebacks911