Highlights

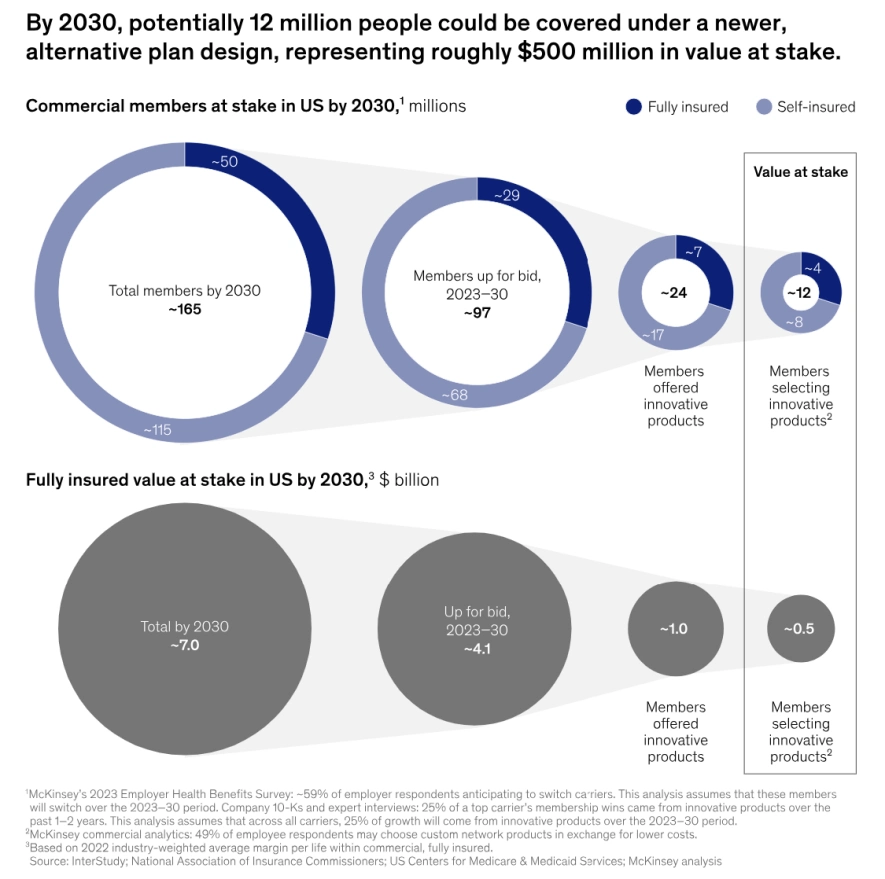

- A new McKinsey report finds that by 2030, 12 million employers are expected to move to more innovative health plan models, representing $500 million in revenue opportunities.

- Sixty-six percent of employers plan to switch carriers within the next four years to improve cost transparency, reduce premiums and enhance employee satisfaction.

- Group captives are emerging as a preferred solution, offering 20 percent savings, control and flexibility for employers.

A major shift is coming to the employer health benefits market.

The employer-sponsored health benefits market is undergoing a transformative shift. Up to 12 million members—representing 7 percent of the commercial market—could transition to innovative health plan models by 2030, according to a new McKinsey report.

This shift offers a significant growth opportunity for benefits advisors as traditional plans struggle to meet employers’ needs.

How the Market Is Changing: Key Statistics and Market Forces

Source: McKinsey & Company

According to McKinsey’s report, Reimagining US Employer Health Benefits With Innovative Plan Designs, several forces are driving this change.

Key Statistics and Insights

- Membership shifts: McKinsey projects that by 2030, 12 million members will transition to innovative health plan models, representing $500 million in revenue.

- Carrier dissatisfaction: Two-thirds of employers plan to switch carriers within the next four years to improve cost transparency, reduce premiums and enhance employee satisfaction.

- Rising demand for alternative funding models: Employers are increasingly turning to group captives for control, flexibility and cost savings.

Benefits advisors who position themselves as experts in self-funded insurance plans and group captives can capitalize on these trends to grow their business while helping employers meet their goals.

Market Forces Reshaping Employer Health Benefits

Employers are dissatisfied with traditional, fully funded health care plans because they struggle to manage unsustainable cost increases while also meeting the growing demand for better benefits experiences.

Alternative funding models like group captives are becoming the go-to choice for employers seeking control, flexibility and cost savings.

Rising Health Care Costs

- Annual increases: Commercial health care costs are projected to rise 9-10 percent annually through 2026, according to McKinsey—two to three times higher than the average increases of the past five years.

- Unsustainable strategies: Employers have exhausted traditional cost-shifting strategies, such as higher deductibles and reduced benefits.

Adoption of high-deductible health plans has decreased by 1 percent annually since 2020, signaling a need for more sustainable solutions.

Changing Employee Expectations

Today’s workforce has growing expectations for their health benefits:

- Clear cost transparency: Employees want to know their coverage and costs upfront, not after receiving a bill.

- Digital-first experiences: Modern consumers demand seamless access to benefits information and user-friendly tools for managing care.

- Affordable options: High out-of-pocket costs contribute to dissatisfaction and turnover, forcing employers to prioritize health care affordability.

The market is ready for solutions that address both the cost challenge and employee demand.

Benefits advisors who position themselves as experts in self-funded insurance plans and group captives will help their clients achieve these goals and grow their own businesses at the same time.

What Employers Want From New Solutions: Cost Savings That Matter

The McKinsey report shows employers are seeking substantial improvements, not incremental changes.

Their demands reflect the growing pressure to manage health care spending effectively:

- Double-digit savings required. Two-thirds of surveyed employers say they need cost savings greater than 10 percent to justify making a change.

- Real transparency into spending. Employers want clear visibility into how their health care dollars are being used, moving beyond the black box of traditional insurance.

- Predictable costs year over year. Organizations need to budget confidently without facing unexpected increases or hidden fees.

- More control over plan design. Beyond pure cost savings, employers are demanding greater autonomy in how their health plans work.

- Freedom to customize benefits. Plans must be flexible enough to match each organization’s unique employee population and health needs.

- Access to claims data. Employers want the ability to analyze their health care spending patterns and identify opportunities for improvement.

- Cost containment options. Organizations need the ability to implement targeted solutions when they spot areas of high spending or inefficiency.

The traditional one-size-fits-all approach of fully insured plans no longer meets these evolving demands. Employers are actively seeking alternatives that give them both the savings and control they need to manage their health care investment effectively.

The Rise of Group Captives

Group Captives as an Innovative Health Care Solution

The market is responding to employer demands with several alternative funding approaches, including stop-loss captives.

Captives offer small and midsize employers to pool resources to gain the advantages typically reserved for large organizations, including risk-sharing, flexible stop-loss programs and enhanced buying power.

Benefits of Group Captives

This innovative funding model delivers multiple advantages that address employers’ key concerns:

- Significant savings potential. Group captive solutions can save employers up to 20 percent compared to traditional, fully funded insurance plans.

- Enhanced cost control. Employers gain the tools and transparency needed to manage health care spending effectively.

- Better member experience. Digital tools and flexible plan designs help create more satisfying health care experiences for employees.

- Data-driven decisions. Access to claims data and analytics enables smarter health care strategy and spending choices.

Partner with Roundstone to Capture This Opportunity

Build Your Alternative Funding Expertise

To thrive in the changing market, successful advisors will position themselves as experts in alternative funding models.

- Master the mechanics. Understanding how group captives work allows you to customize a plan to meet your clients’ needs.

- Develop data literacy. Learn to analyze and explain health care spending data to help clients make informed decisions about their benefits strategy.

- Stay current on solutions. Keep up with emerging cost containment strategies and innovative plan designs to provide maximum value to clients.

Partner With Experienced Providers

Success in the alternative funding space requires strong partnerships with established solution providers.

- Choose proven partners. Work with captive managers, like Roundstone, who have a track record of success and the infrastructure to support your clients.

- Access implementation support. Look for partners who provide tools and resources to help you guide clients through the transition process.

- Leverage expert teams. Align with organizations that offer ongoing support through dedicated client service teams and cost containment specialists.

Wrapping It Up

The shift toward alternative funding represents a significant opportunity for benefits advisors who are prepared to lead their clients into this new era of health care benefits.

Download our free ebook, “An Essential Guide to Health Insurance Captives for Benefits Advisors,” to learn how Roundstone’s group captive solution can help you take advantage of this unprecedented market opportunity.

The post Group Captives: A Powerful Growth Opportunity for Advisors appeared first on Roundstone Insurance.