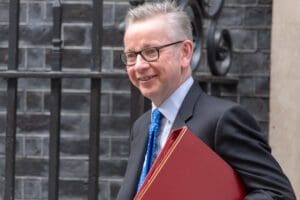

Help for people struggling with their mortgages is being kept “under review”, cabinet minister Michael Gove has said.

But any financial assistance would be a decision for the Treasury, he told Laura Kuenssberg during an interview on her television show on Sunday morning.

He also warned any help similar to Covid or energy bill schemes risked driving up interest rates further.

It is understood that the Treasury has no current plans to give mortgage relief.

It comes as the average interest rate on a new two-year fixed mortgage is likely to breach 6% in the coming days as lenders grapple with upheaval in the sector.

Asked on Sunday with Laura Kuenssberg whether the government would consider stepping in to help those struggling to repay their loans, Mr Gove said there is a “difference between keeping under review and ruling out” a scheme similar to the wage support given during Covid.

But he said that using public money to “deal with particular crises” inevitably added to public debt, which put pressure on interest rates.

“The worst thing to do would be to spend money to provide a short-term relief which would then mean that our overall finances were in a weaker position, and interest rates were higher for longer, and inflation was higher for longer,” Mr Gove added.

It means people re-mortgaging face sharp increases in their repayments, while the purchasing power of first-time buyers is squeezed.

According to new figures from financial data firm Moneyfacts, a person fixing a £250,000 mortgage for five years back in 2018 would have paid an average rate of 2.92%, or £1,175 per month.

Today the average rate is 5.62%, with a monthly payment of £1,553. That’s £378 per month more, or nearly £23,000 more over the five-year term.

Mr Gove acknowledged people moving off fixed-rate deals faced “significant increases” along with broader cost-of-living pressures.

But he said the best way to tackle this was to bring down inflation.

A Treasury source added that a bailout for homeowners would be “self-defeating” because it would push up inflation and prompt the Bank of England to further raise interest rates.

The Sunday Times reported that the Treasury has ruled out mortgage support for this and other reasons. Instead, it will ask banks to do more to stop people losing their homes.

Read more:

Government help for mortgage holders is being help ‘under review’, says Michael Gove