When the US sneezes, the world catches a cold. Despite the increasing importance of many other countries, including China, US hegemony continues to affect global economies, and as a safe-haven currency gold is not immune. The US presidential elections are a pivotal political and economic moment for the country, and therefore the world. So how could the November elections affect gold demand, and is this an opportunity for investors across the pond too?

Key moment

All US elections impact gold in some way, not only because it is the largest economy in the world, but also because gold is denominated in dollars so any movement in the currency will affect how attractive gold is to investors. In the run up to the election, there is a notable rise in political uncertainty, especially where the outcome is likely to be a close-run race. As a safe-haven asset, gold demand increases during times of instability, especially if there is perceived risk to other markets like stocks and bonds.

Gold has risen ahead of all the most recent US presidential elections, but because there are many factors that affect the gold price, it is not possible to ascribe the rise to the election alone (for example the pandemic and the global financial crisis had a substantial impact on the 2020 and 2008 elections). That said, the level of political uncertainty that precedes a US presidential election will invariably have some impact on safe-haven demand.

What could a Harris win mean for gold?

If Kamala Harris wins the election, she is unlikely to make any swingeing changes to the political policy she has endorsed through her Vice Presidency, which means investors can expect similar democratic ideology and fiscal policy. This likely means she will continue to push through government spending, especially on social programs, infrastructure, and climate change initiatives, as have dominated the US government for the past four years.

These programs cost money, and any overspending could lead to higher inflation expectations, which is bullish for gold. This is because gold is often seen as a hedge against inflation. Gold tends to rise when inflation expectations increase, as it is viewed as a store of value during times of currency devaluation.

Harris is also expected to support policies that are designed to keep interest rates low. The first interest rate cut in four years was implemented on 18 September, and there may yet be another one just after the election at the Federal Reserve’s next rate setting meeting on November 7. Low interest rates reduce the opportunity cost of holding gold (since gold doesn’t pay interest or dividends), making gold more attractive as an investment. If the Fed continues a low-rate policy under a Harris presidency, gold could benefit from this environment.

Compared to Trump, whose previous term was punctuated by trade tensions and impulsive tariffs, Harris is not expected to adopt a confrontational stance on global trade. If a more sedate policy on trade cools the geopolitical tensions that can flare when countries implement protectionist policies, this could ease uncertainty in markets. But that is far from a given. Actual state aggression and war, as is already ongoing in Ukraine and the Middle East, would override any peaceful dealmaking in the geopolitical melting pot. If global instability rises, demand for gold could increase as investors look for a stable store of value amid heightened risks.

Finally, the democratic ideology on taxation and the distribution of wealth may compel Harris to advocate for higher taxes on companies and wealthy people, similar to Biden’s policy proposals. If this leads to a perception of a less favourable business environment, stock markets could react negatively, prompting a flight to gold. Higher taxes could also slow economic growth, leading investors to seek gold as a hedge against a weaker economy.

What could a Trump win mean for gold?

A Donald Trump election win could influence gold prices in several ways, particularly through market reactions to his economic policies, geopolitical stance, and the potential for market volatility.

Trump’s approach to governance is unconventional. His decisions can be erratic and volatile, which is how the markets reacted to some unexpected choices he made during his last tenure as president (for example the China trade war in 2018 and the US government shutdown in 2019). This unpredictability, combined with potential legal or electoral challenges (as seen in 2020), could cause uncertainty in financial markets, driving investors to gold as a safe haven.

Looking Into Gold Investment?

Book a FREE consultation with our expert brokers at The Pure Gold Company.

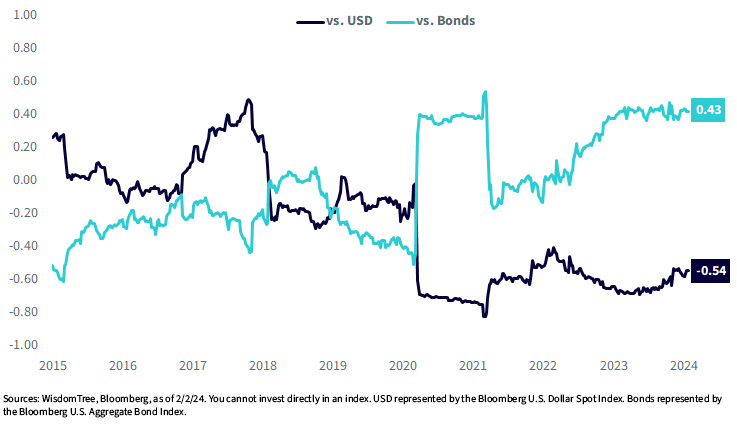

The impacts of potential policy changes from a democratic to a conservative government are also a possible source of uncertainty. Trump has supported significant spending, not on social welfare but on large tax cuts and stimulus packages. If he restarts or expands these policies it could lift inflation expectations, increasing demand for gold as a hedge against inflation. Meanwhile if he decides to spend lavishly without the required increase in revenue, the US debt burden could rise even higher than it already is ($35 trillion) and this could impact the value of the dollar. Gold tends to move inversely to the dollar so it could benefit in that scenario.

Like Harris, Trump is also a fan of lower interest rates as a way to boost economic growth, so he too could encourage the Fed on this path. On the flip side, if his erratic trade policies hinder economic growth, the Fed may be inclined to lower rates anyway to try and stimulate growth. Both of these outcomes would support gold.

At least with Trump, the markets have some previous experience on which to base their expectations. He is seen as pro-business, which would likely initially provide a boost to the stock market, and his preferred tax cut policies could also underpin market strength. But markets also prefer stability and there could be some volatility caused by his erratic decision-making.

Winners and losers

US elections are always an uncertain time for the geopolitical and economic environment, not just across the pond. There are so many ‘what ifs’ – possible policy changes, trade decisions, political relationships and economic pressures – that add to the instability and volatility of the election process, either in anticipation of change, or after it all changes.

It’s not the only factor that will affect the value of gold over the next six to 12 months, but it will likely be at least one driver, with buyers looking for a safe-haven asset or an inflation hedge, or buying into lower interest rates. Gold’s current trajectory has been strongly upwards for many months now, and the various scenarios that could play out as Harris and Trump battle for control of the largest economy in the world could provide even more forward momentum for the precious metal.

The post Gold and the US elections – Harris v Trump appeared first on The Pure Gold Company.