One of my friend asked if the period starting in 1999 or 2000 is a challenging sequence to live through.

Indeed, in the history of the S&P 500:

- There is one four-consecutive down year (1929-1932)

- There is two three-consecutive down years (1939-1941, 2000-2002)

- There is one two-consecutive down year (1973-1974)

Consecutive down-years are uncommon, so is the period beginning in 2000 challenging? I would think it may not be because the inflation during this period is quite manageable.

We won’t know if we can last thirty years if we retire in 2000 because we have not seen thirty years yet, but we can see if it will last for 21 years and how much value is left.

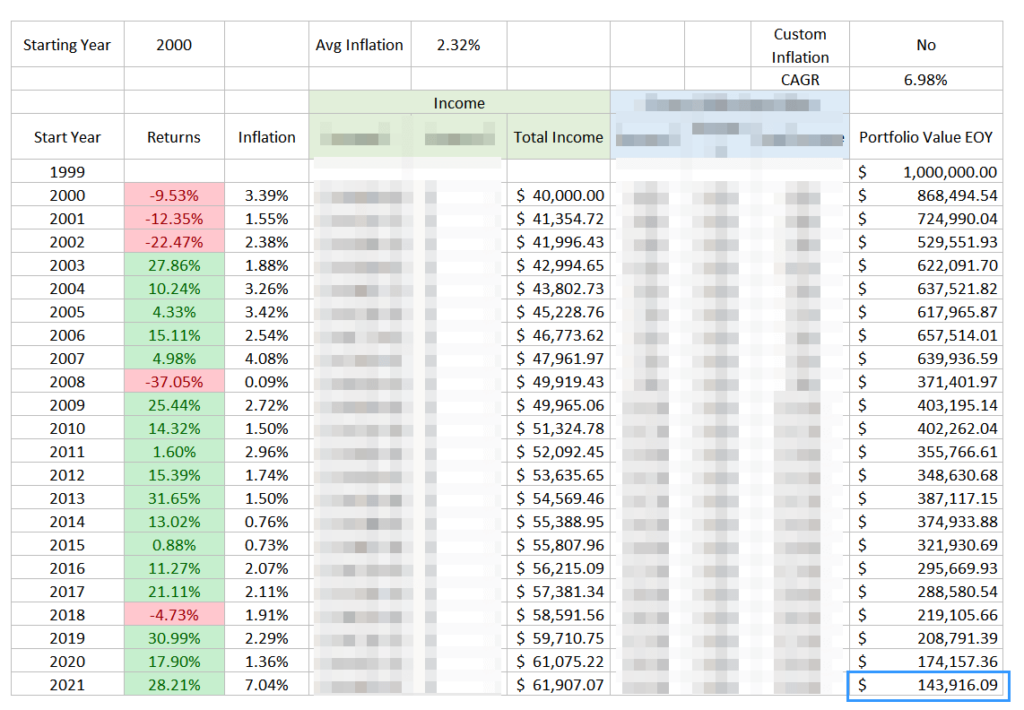

Retiring from 2000 to 2021 with a 100% S&P 500 Portfolio

Suppose we want to spend $40,000 in the initial year and adjust the income for the subsequent years based on the prevailing inflation on a $1 million portfolio.

Let us embed an annual all-in cost of 0.50% p.a.

Here is what a 100% S&P 500 equity portfolio looks like:

We only have 22 years (well we can have 24 years if we finish 2023, I would do an update) but a $1 million portfolio is left with $143k in 2021. If the total all-in cost is 0.80% instead of 0.50%, you would be left with $23k!

Cost is so sensitive during retirement.

Take note that the average inflation during this period is 2.3% p.a. and the compounded average growth is 6.98% p.a.

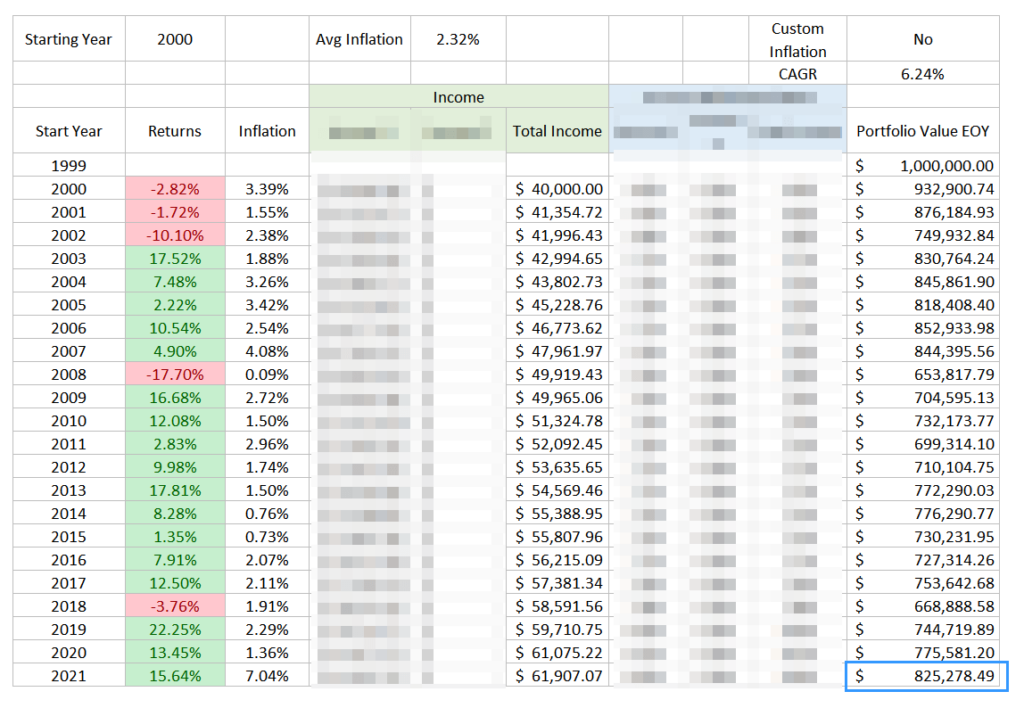

Retiring from 2000 to 2021 with a 60% S&P 500 and 40% Five-year Treasury Portfolio

I would often say to respect the safe withdrawal rate, then think about the asset allocation but the ideal asset allocation is not 100% equity but closer to 40%-75% equity allocation.

Here is what it will look like if we have a 60% S&P 500 and 40% Five-year Treasury Bill Portfolio:

The 3 consecutive years of drawdown at the start became much blunted in this sequence. At the end of 22 years of spending, the portfolio is still left with $825k.

This is much healthier than being left with $143k. The compounded returns are slightly lower at 6.3% versus 6.98% but it works out better.

This shows us that high returns are not the only thing, the sequence of return is more important.

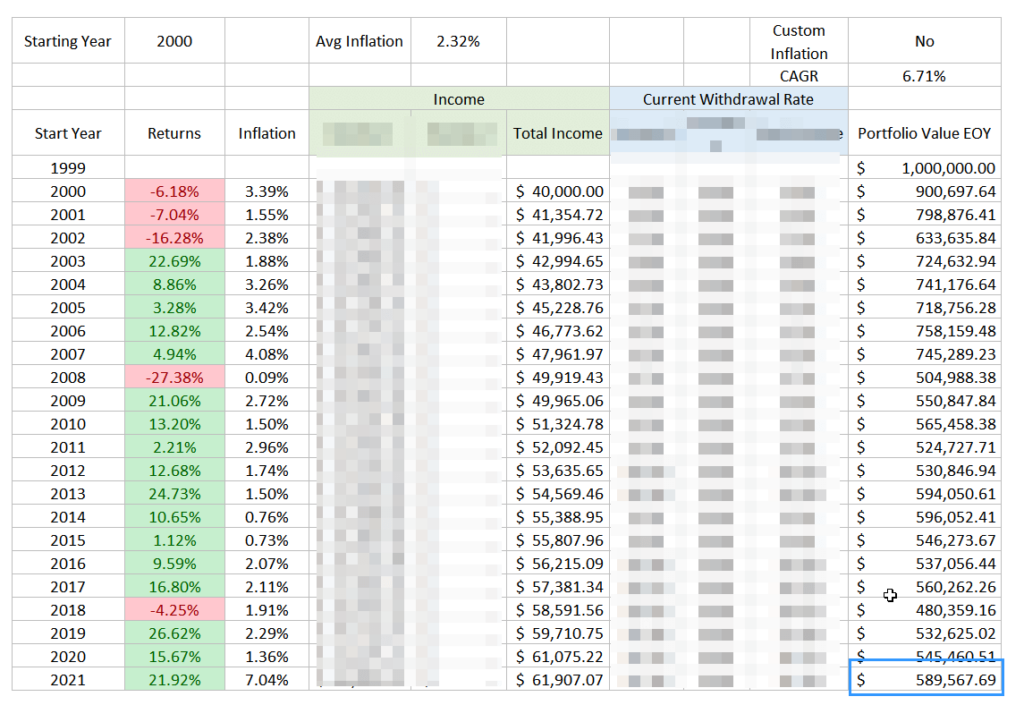

Retiring from 2000 to 2021 with an 80% S&P 500 and 20% Five-year Treasury Portfolio

Here is what it will look like if we have a 80% S&P 500 and 20% Five-year Treasury Bill Portfolio:

The portfolio still lost 31% in the first three years, but the portfolio survived better with just 20% in bonds.

Last Word

The 2000 to 2002 sequence may not be so challenging if we are allocated with a balanced portfolio but if you really wish for a 100% equity portfolio, then perhaps lowering the safe withdrawal rate closer to 3-3.5% would be better. The 3% initial safe withdrawal rate has always

Through this mini-case study, we learn more about the negative sequence of return risks matters more than high return.

I think I will update this post in January when the data is done and when I updated my spreadsheet.

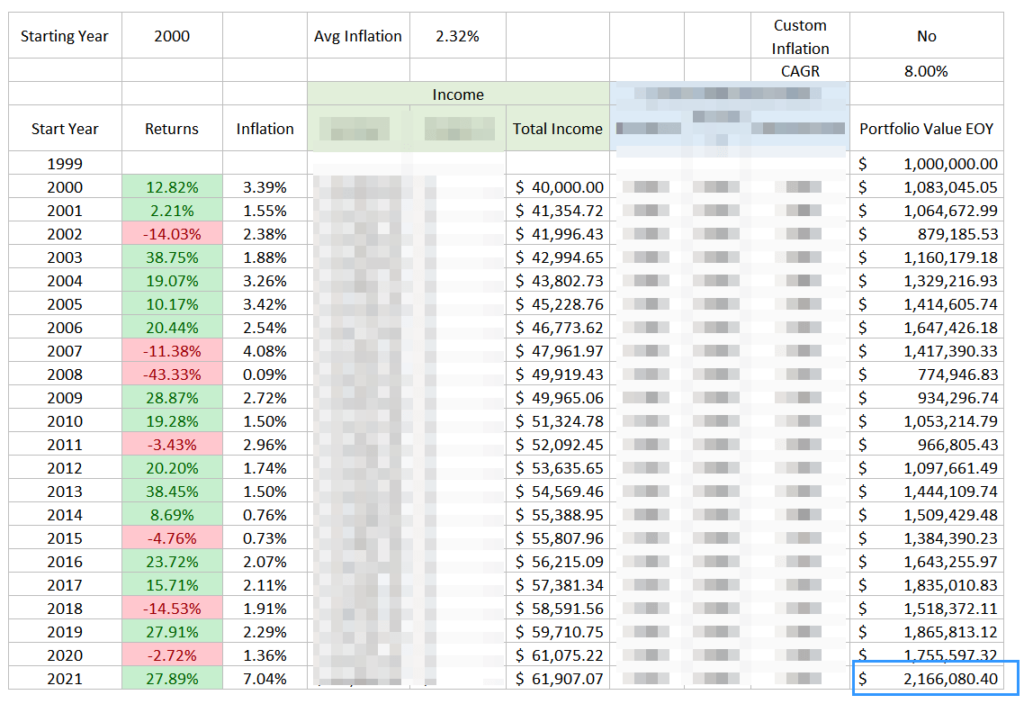

On another note, the 2000 to 2021 sequence wasn’t so bad if the equity composition is different.

This is with 100% US Large Cap Value Index instead:

It’s the same period, with a very different outcome.

I am not saying this portfolio is better, but just showing that in the same challenging period, a different portfolio mix will have different outcome.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

The post From 2000 to 2002, the S&P lost 50%. Would this be a Challenging Period to Retire At? appeared first on Investment Moats.