Basic info about day trading

Scalping can be a good way to make money. Still, it is hard, but in this guide, I will teach you more about it.

Remember: this guide contains ideas and information based on my experience. There is no one correct approach to scalping. Other traders may use a different set of tools, different strategies. You are responsible for your trading results. You have to take all that knowledge and test it on demo account or with smaller position size.

Goal of this guide

The main goal is to teach you about scalping. I want you to build (and test!) your own strategy based on information from this post. Remember, scalping is much more than set of technical indicators. You need a complete strategy with money management, position management, rules of entry and exit. I will try to teach you all that things.

THIS GUIDE WAS PUBLISHED ON MARKETSURVIVAL.NET. DON’T SCRAP AND STEAL MY CONTENT. ALL RIGHTS RESERVED.

About forex scalping

There are some disadvantages when it comes to forex scalping:

- If you are scalping without EAs then you have to be in front of the screen most of the time.

- Sometimes there is very little time to make a decision.

- You have to follow the news, be ready to react to some unexpected news.

- You invest with bigger leverage so it is much easier to lose money in a short time if you do not follow your trading plan and don’t cut losses fast.

But there are also good sides.

- You do not close any positions over the night. You finish the day and you know how you did.

- If you have a good strategy which is based on technical tools then you can automatic the whole strategy or part of it.

- You can make big money in short time.

- You can trade few hours per day (not always, but possible) for example during time with the best volatility.

Scalping is not for everyone, but when you have a good discipline then it can be a good choice.

Forex scalping or long term

Both are great ways to trade and make good money. Form many years of my experience I can say that in long term trading you have much better chances to be profitable. The old truth is that the more you spend in front of chart more chances to make mistakes. With long term, you open a trade based on your entry criteria and you wait. You can keep trade open for few weeks or months or even longer.

It is not easy with scalping. It is a constant fight with you, with your emotions. And it is so much easier to lose money than let’s say by long term investing in stocks.

So yeah, for most people long term is a better option. There are many demo accounts. You can try your strategy and see if this is for you.

Forex scalping vs swing trading

Similar to long term, swing trading is also a better choice for most traders. In swing trading, especially on higher time frames, you can catch some really big moves. It doesn’t require you to be most of the time in front of a screen.

Scalping on Forex vs Dax, SPX, and futures

I prefer scalping on Forex. Markets are open longer (5 days per week x 24h) and it is easy to trade with even really big positions.

There are some other factors to consider.

I would say that there is more automated trading in Forex so it can be harder to trade. Also, in Forex you have pairs. You have to watch for news for both of them.

Still, it is possible to mix scalping and swing trading but it is recommended for people who mastered swing trading in a first place.

Forex scalping and day trading for beginners – tutorial

This is an introduction to day trading and scalping guide.

I wrote before that scalping and day trading are not the best way to start your trading journey. Still, if you really want to learn how to day trade I have few tips for you.

One pair is enough

Probably it will be some major pair. You want a pair with good trading conditions (volatility, low spread…). EUR/USD, USD/JPY, and few others are ok to scalp. Do not fall into a trap that more pairs you trade at the same time means you can make more money. It doesn’t work like that.

There are many pros of trading one pair. It is easier to follow economic data, to get familiar with price behavior during different sessions during a day. I highly recommend trying focus just on one FX pair.

Small leverage

You are a beginner so you want to learn more about scalping and trading during a day. There is no need to take a big risk – it is not a casino. Think about your trading strategy, money management, and other important things. Learn. Do not try to be some superstar of scalping from day 1.

Different strategies

Learn about different strategies. Do not fall into the trap of one correct approach. Some strategies work for some traders and for others don’t. You should try and test few different approaches. Maybe price action is for you or scalping with indicators. There are so many different ways to make money. Test them.

Forex scalping for a living

Is scalping and day trading, in general, a good way for a living? I do not think so. Not for everyone and what is most important – not for new traders.

There are few reasons for that.

Capital

To be a serious scalper you need trading capital. Without capital, you will be only playing around with small leverage. Scalping is not easy, you have to be most of the time in front of the screen and it can be frustrating that you spend all that time to make few dollars.

Experience

Day trading and scalping are not best ways to learn about trading and get experience. On lower time frames things are happening fast. It is easy to forget about fundamental things like trend lines, support and resistance and many others. There is to little time for new traders to think about it. When you trade let’s say 1h time frame or 4h you have time to draw important support and resistance lines, to check the current trend, situation in the higher time frames and so on. You have time to make decision. You can think about it.

Time

As I mentioned it few times before, scalping and day trading are specific. Sometimes you must wait for a good setup for many hours. It is not a so simple that you trade for 1-2 hours a day and you are done. It doesn’t work like that. You have to watch things on your screen, it is a normal job. If you start scalping with little trading capital then it is almost sure that you will try to trade with too big positions because you want to make profit bigger than few dollars. If you do not have trading capital and experience, it is better to use that time to earn that capital somewhere else. You still can trade on higher time frames and learn about trading. You can come back when you have proper trading capital.

Expectations

This one is important. People have huge expectations when it comes to day trading and scalping. Maybe the reason for that is because of how many traders promote their courses like it is an easy way to get rich fast. I know one thing for sure – it isn’t.

Scalping and day trading are the most difficult areas of trading. You have to be in front of your screen most of the time, stress can be sometimes huge. It is easy to get depressed, to not follow your trading plan when you are losing.

It is really hard. Still, people believe that this is a fast and easy way to make money. They are wrong. I know many traders who make very good money and they trade only 1h+ time frames. So it does not matter if you are scalping, swing trading, long-term trading… You can make money in so many ways.

So what can you expect from scalping? You can expect that you can make good money if you have trading capital and working strategy which you can execute.

You can’t expect to make money fast with scalping if you have little trading capital and you are new to trading.

Psychology

Trading can destroy you and I am 100% serious about that. For many people, it is much better to trade on higher time frames. The less time you spend in front of the chart the better chances are that you won’t take decisions based on emotions.

When you are day trading or scalping you must follow the charts and price actions for most of the time. Hence the risk of the bad trade is bigger. It can be a reaction to some news or move you see. Remember, we are talking here about trading with leverage. It is easy to open a really big trade. Yes, if all goes well you can make like 2000$, if not you will lose half of your trading account. That is not trading – it is betting. That is why scalping is so dangerous for new trades who sometimes even don’t understand how leverage works.

So is day trading and scalping so bad?

No, actually I prefer day trading to longer term trading. I like to finish the day with no positions open, to know how I did today. For me, it was a process. For a while, I tried day trading and failed because of many reasons. The main one was lack of trading capital. I was trying to get rich fast. Then I moved to higher time frames, started to save money for my trading account, to learn how markets work.

Step by step.

Now, after many years of getting trading experience, I get back to day trading.

The great thing is that you can change your trading. There are times when I simply do not have time to day trade. I switch to swing trading on higher time frames. It is a good thing to remember.

Forex broker & pairs, trading hours for scalping and day trading

Selection of a broker and currency pair is very important.

There are many dishonest brokers, there can be problems with money withdrawing, trade execution, slippage and many others. If you read few topics from Forex Peace Army you will know what I’m talking about.

It is also important what you trade, on which time frame. Trading EUR/USD and USD/CAD is very different, each currency pair is unique.

Selecting a broker

First, we need to start from most important thing when we talk about scalping – selecting a broker. There are many brokers out there, but only small part of them allow scalping. You can look for all alternatives you have. I can recommend brokers that I use with my daily trading – Yadix and TickMill. They are scalping friendly, they also have an account for scalpers – Check it here and here.

It is not only about spread

What is the difference? It is not only about the low spread. It is about setting stop loss and take-profit orders. With a standard broker you are not allowed to set them nearer than few pips (usually 3-5 pips are minimum). And that is a big problem. Because of that limitation, you can’t scalp.

When you are scalping, you plan to take more trades during a day. If something goes wrong, you close your trade. If you are profitable, you are not holding a position for long period of time. You take small profits. To be able to do that you have to place your stop loss and take profit near to the entry points. For some reason, this is a problem for most brokers and they do not allow that. That is why you want a broker which allows you to scalp.

It is not only a problem for scalping. In normal day trading or trading on lower time frames like 5m, 10m, 15m sometimes you want to move your stop loss near to the entry point or to break even. If the price is near to that level, with most brokers you won’t be able to do that. That is why you want a broker with no limits for stop loss and take profit orders.

Others broker you can check for scalping account:

- Markets.com

- AvaTrade

- AvaTrade

- FOREX.com

- FXCM

- FxPro

Selecting currency pair(s)

You want to scalp on Forex pairs where you have low spreads and good volatility. So it is a good idea to stick to major pairs like EUR/USD, GBP/USD, USD/JPY, USD/CHF and few others. If you have a spread around 1 pip or lower than you are good to go.

Another important thing – spread can be higher during news or economic data publications. In some cases, this difference can be huge so make sure that your broker offers decent trading conditions when the market is more volatile because of news.

The last thing – one pair at a time. If there is some strong move on EUR/USD then probably there is a similar strong on other dollar or euro pairs. Do not try to trade few pairs at the same time because in scalping it is not a good thing. Focus on one Forex pair. I recommend starting with EUR/USD or USD/JPY. If you look for more swings and you have good spreads then GBP/JPY can be a good alternative.

But probably you will start from EUR/USD – this is the most popular pair and you should have here the lowest costs of trading.

Trading hours

Most people trade during London and New York sessions. There are few reasons for that:

- better volatility

- market are trending more often

- we have news and economic data release during a day

Asian sessions and scalping

Of course, it does not mean that you can’t scalp during the Asian session. You can, but you should use a trading strategy which works better in conditions like:

- lower volatility

- range moves

If there is no important news during Asian session then very often markets can be quiet. There are times that week is packed with news and important changes and you can see nice trends.

Still, Asian sessions are harder to scalp but you still can find good opportunities. Just check Yen, Aussie and Kiwi pairs. There should be more movement on them during Asian sessions.

How many pips, how many pairs

It depends on trader and strategy. Some scalpers prefer to take just small profit of few pips. The common range is somewhere between 10-30 pips, but some traders prefer to scalp 2-5 pips. I personally do not have a problem to hold trade little bit longer if I see a strong trend.

How may pairs at once

If you are new to scalping then most definitely only one. You have to react fast, follow the price action. It is hard to do that, even with few monitors on board. The other reason is education. Every pair can act a little bit different, trading can be different. It is hard to create and improve your trading strategy when you trade few pairs at the same time.

Of course, you can trade few pairs, but first, you should be profitable when you trade only one. Them, if you feel confident to trade more then go and try it.

Anyway, your choice will be narrowed down to few pairs with best trading conditions (spread, volatility). Remember that these pairs are connected with each other. In the example, when there is some big news about dollar then it can affect both EUR/USD and USD/JPY at the same time. So in many cases, it does not help if you trade similar pairs.

The higher time frame is also important to remember. You should know what is going on on highest TFs. If you want to trade few pairs, you have to follow few higher time frames. For new traders that might be confusing.

How many pips

Think about profit and not about a number of pips. In some situations, you trade with bigger leverage and it is ok to take a quick profit. Sometimes trend will be stronger, important support and resistance lines far away and it will be wise to hold on to trade a little bit longer. So no one magic value here.

Forex scalping and day trading without indicators

You can scalp Forex with no indicators. There are traders who are profitable with trading based purely on price. If you are interested in this kind of trading then you should learn more about:

- patterns

- price action

- candlesticks and candle wicks

These topics are too wide to describe them in depth here. There are some good sources about them which I share with you below:

Patterns in forex scalping

Patterns work great in every market. If you are new to the topic, I always recommend Bulkowski’s books:

https://www.amazon.com/Encyclopedia-Chart-Patterns-Wiley-Trading-ebook/dp/B0086KPSQC/

Check also his blog here: http://thepatternsite.com/Blog.html

yeah, it looks like site from 90s (probably is), but it is still updated. He writes mostly about stock, but you can

Another good blog: https://thepatterntrader.com/blog/.

Price action in Forex scalping

It is good to know even basics of price action. You can use it together with other inidcators. There are many traders who trade mostly only with price action. I highly recommend:

- https://www.theforexguy.com/

- http://www.learntotradethemarket.com/

OK, maybe they trade on higher time frames, but you will learn alot about price action. You can find free articles on their sites, they also have premium courses.

With that knowledge, you can put it into scalping practice.

Candlesticks in Forex scalping

You need to know candles even if you want to trade with indicators. You use candlesticks in price action or pattern trading. Still, it is good to read first about candles itself.

Time frame in Forex scalping and day trading

In scalping traders usually trade on lowest time frames. Most often it will be 1m TF. Of course, you can find systems which are created for other time frames like 5m or 15m. What is best time frame?

If you trade on timeframes like 15m or higher then it is hard to be all the time in front of a screen.

Time frames for scalping

The most popular is forex scalping on the 1-minute chart during London and NY sessions. On 1m TF you can scalp for few hours and finish your trading. It is hard to do the same on higher TFs.

Time frames for day trading

You do not have to trade on 1m. Many day traders use 5m or other time frames larger than 1m. It depends on strategy, but in many cases, you will get a much clearer picture and better signals.

Time frames in Metatrader 5

If you want to trade on less typical time frame like 2m, 3m or other then you should check Metatrader 5. For example, XM broker gives you a possibility to open an account for Metatrader 4 or Metatrader 5. If you choose MT5 then you will have a wide selection of time frames. To be precise, you can choose from time frames like:

- 1 min.

- 2 min.

- 3 min.

- 4 min.

- 5 min.

- 6 min.

- 10 min.

- 12 min.

- 15 min.

- 20 min.

- 30 min.

- 1 hour

- 2 hours

- 4 hours

- Daily

- Weekly

- Monthly

Time frames lower than 1m

If you want to scalp on time frames less than a minute than you can check Oanda – they have TFs like 5s, 15s or 30s. These TFs are available in their custom software, they are not available in MT4.

Remember that on such a low periods you will see mostly noise. They are very hard to trade, even with help of EA.

If you still want to trade on charts lower than 1m then you can also look for a broker with tick chart.

Still, in most cases, you will be good to go with 1m, 5m, and other standard time frames. I do not think that exotic time frames like 2m or 15s will give you a big advantage over the rest.

Trading desk for scalping and day trading

You do not need any fancy trading desk. Still, there are some things you can get to trade more comfortable.

First, you have to decide where is your trading place? Is it specfic room in your house or maybe you are more mobile and travel a lot?

If you trade from one place you can set up trading desk with desktop and LCDs.

If you travel a lot, you can go with set up like Cameron did:

Obviously, in mobile scenario, you will go with a laptop and some smaller extra monitor.

As a minimum, you need one extra monitor. It does not have to be 40′ wide. You simply need that monitor so you can have a chart open all the time.

My setup

My current setup is temporary. It is Thinkpad 15′ laptop (T560) and 32′ LG display connected through HDMI. Nothing fancy here. I work on my laptop and I have charts open on LG display. In the past, I had two extra displays. I switched to LG because it is 32′ wide so I can follow easily more charts at once.

In future, I plan to travel more. I plan to switch to 15′ MacBook Pro and one additional display. Similar setup to the one showed by Cameron in a video before.

Do you need 5 monitors?

No, Jesus…

I know. You saw pro traders with professional desktop stations. They had probably like 6 or 8 displays. You don’t need that. One additional display is enough for a start. Truth is that you probably will be scalping only a few FX pairs or only EUR/USD. Another thing is that is really hard to scalp on more than one pair. It is better to focus on one pair, master your strategy.

Of course, if you feel that you need 2 or more additional screens then get them. Hardware is so cheap that it is not a problem. Just remember that more displays won’t make you a better trader- it doesn’t work like that.

Money and Risk Management in day trading

Money management and trading capital in Forex scalping and day trading

In this part, we will talk about money management and trading capital.

The minimum trading capital for day trading

In my opinion, a decent minimum is around 5,000$. Why 5000? There is a math behind it.

Lets assume that:

Lets assume that:

- you risk 1% of your capital

- you look for trade opportunities with risk / reward ratio 1 / 2

That means that with trading capital of 5000$:

- you risk 50$ of your capital (1%) per trade

- you look for trade opportunities which will give you 100$ of profit (risk / reward ratio 1 / 2)

That way even if you are winning less than 50% of your trades, you can have nice profits.

It is not that great if you have less than that. Lets do the math again:

Trading capital 2000$

- you risk 20$ per trade

- you look for trade opportunities which will give you 40$ of profit

Trading capital 1000$

- you risk 10$ per trade

- you look for trade opportunities which will give you 20$ of profit

Trading capital 500$

- you risk 5$ per trade

- you look for trade opportunities which will give you 10$ of profit

Trading capital 100$

- you risk 1$ per trade

- you look for trade opportunities which will give you 2$ of profit

You can see clearly that the lower your trading capital is, the lower potential profit.

There is also a psychological aspect involved. It is really hard to follow your trading plan (and risk only 1%) when your potential profit is something like 2, 5 or 10$. It leads to overtrading or trading with a too big position. So you end up risking much more than 1%.

It is really hard to stay motivated with small capital. Trading is hard, you work hard for your profits and as a result, you get few dollars of gains. That’s why you need big enough capital. My recommendation is 5000$ as a minimum.

Read, test…

Money management is the fundament of your success. When you grow account, it will get even more important. I would recommend two things which may help:

- keep a track of your results

- learn from others

There are great tools like MyFXBook, which help you to analyze your results. You have great statistics about drawdown, gains and many more. You can see right away if you are following your trading plan or not. It looks lke this:

You should see what other people are doing. How they manage their money? There are books about money management in trading. You can also follow traders on social media, read their blogs. Maybe you will see something interesting which you can use in your trading.

What if you have only a few hundreds?

Well, that’s not the end of the world.

If you have only something like 100-200$ then, of course, you can scalp on a smaller position as a training. Do not expect to make fortune with scalping when you start with 100$. You still should follow 1% risk rule. Master your trading plan. At the same time, work a way to get trading capital.

You need that capital. Do not expect that you go from zero to hero in few months with 100$.

How to get trading capital

There are many ways to do that. You know, classic things like saving or getting a job. There are so many ways to earn money. It doesn’t have to be online. You can go and work on the weekends. There are many different approaches. Just figure it out.

There are many ways to do that. You know, classic things like saving or getting a job. There are so many ways to earn money. It doesn’t have to be online. You can go and work on the weekends. There are many different approaches. Just figure it out.

Don’t borrow money for trading

This is super important. Just don’t, even if you have a big plan to earn huge money and payback from the earnings. It is so easy to lose money in trading that you do not want more psychological pressure from trading money you do not own. Trust me on that.

It is enough that you invest with a leverage.

Do not dream about going pro with 100$

It may be possible, but that is a risky road to chose. Some people believe that they are super traders and can go from 100$ to 1000$ or 5000$ in a short time. That is a dangerous thinking. Because of that approach, you will most probably trade very risky, not follow a trading plan and you will lose that money very fast. Remember, if you have 100$ then use it to practice with small positions. In the meantime, try to find some extra source of income.

Protect your capital

You worked hard to save money for your trading capital, don’t waste it in a stupid way. Chances are that you are not a trading star, so you have to fight with the market like everyone else. Stick to your trading plan, cut losses, manage your positions wisely, don’t be too greedy. The common mistake risking too much. Just trade with positions which are adequate to your trading capital (so it means risk 1% and so on).

Withdraw profits, be carefoul with forex broker

Let’s say that you make money in trading on a regular basis. That is great. It is a good practice to withdraw some of your profits every month. The main idea here is that you risk only money from your broker account. If you put part of that money (from profit) in the saving account then you can’t lose them.

There is another thing – some brokers, ever big ones can’t be trusted for 100%. Everything can be fine and suddenly there will be a problem with your account, with money withdraw etc. There are many histories like that. You should be careful and always move part of the profits to the saving account.

Money management

This topic is very wide, below I will only scratch a surface.

It is all about money and risk management

First, you need to understand and accept fact that money management is fundamental to your success. This is the common mistake – new traders look for that magic strategy, for this best setting for indicators. Yes, it is important, but it is only a part of your trading success. The rest are other factors like money and risk management, psychology.

Read about money management

There are publications about money management in trading. Maybe not in scalping, but still it is good to read them. You can learn from them more about concepts around money management, risk management. I can recommend publications:

- https://www.amazon.com/Traders-Money-Management-System-Trading-ebook/dp/B003L784FC/

- https://www.amazon.com/Forex-Management-Currency-Strategies-Beginners-ebook/dp/B071ZVYBSM/

- https://www.amazon.com/Traders-Money-Management-System-Trading-ebook/dp/B003L784FC/

But there are many others. Try to search for the best one for you.

Cut loses

You have to know when to close a trade with a loss. Many people struggle with it. They hope that price will reverse. Sometimes it will, sometimes it won’t. Cutting losses is part of every strategy. It is like in football (soccer) – you have to score but you also have to know how to defend your own goal. Without that you will never be profitable in trading, especially in scalping where discipline about cutting loses is so important.

Use leverage wisely

Leverage can be your best friend or worst enemy.

Monitor your progress

You can start your own diary or use online tools like MyFX BOOK. It is important to know more about your decision making.

This is important. In scalping and day trading, you trade with higher leverage so you need trading capital.

Forex scalping, day trading – news and economic data

There are two types of traders:

- traders who trade during news release

- traders who avoid this periods

I am personally somewhere in the middle ;). If there is some very important news publication I rather stay away from trading. Sometimes I trade but with much lower leverage. You have to watch for NFP (once a month). Also, every news from the central bank can be important.

Which news is important and which is not? You have all information in online scheudles like:

Of course, it is recommended to learn more about each economic data factor.

Anyway, during a day we have many data publications. I normally trade during that time. I simply have calendar opened from DailyFX. Thanks to that I know when volatility can be higher.

How to trade during a news

If you want to learn how to trade during a news release, I recommend monthly webinar with Wayne McDonell on fxstreet. The first webinar took place ten years ago. I highly recommend it, you can learn here a lot. Read more here.

Position management in Forex scalping and day trading

It is important to learn how to manage position when you are scalping. There are few important aspects:

Stop loss in Forex scalping

Cut yours loses quick. You will trade with bigger leverage so you can’t afford to have big loses. Hope is a false advisor. There is always the next trade.there is no 100% winning system and you have to accept that there will be losing trades. You have to learn when to close a trade so you can survive and stay in the game.

Moving stop loss higher (when in profit) – manually, trailing stop loss

Simple and effective. With stop loss, you want to protect your money and do not lose too much. With Moving stop loss you want to protect your profit. You can keep it at a distance from the current price. The main idea is that when a price is moving in the direction you want and you are profitable then you move your stop loss.

You can do it manually or use a trailing stop loss.

In Metatrader you simply select value from trailing stop loss menu:

When the price moves in the right direction, it will first move stop loss to break even position. Later it will raise the stop with a value you selected.

It is important that trailing stop loss works only when Metatrader terminal is open. Read more about trailing stop loss in Metatrader here.

Break even

Another very important concept. It takes time to master it, but I believe that it is worth a try. The idea is rather simple. We can divide it into steps:

- you open a trade and set stop loss

- when price moves in the direction you want and is some distance from the entry point then you move stop loss to the entry point

- if price moves more in the direction you want, you move stop loss even higher

That is very important. Thanks to that you are sure that in the worst case scenario you won’t lose any money. That is important for both your trading capital and psychic. It is never a good feeling to lose money. You can’t avoid it, but with avoiding loses with break-even you start to think more about money and position management.

That is opposite to situation when you are losing money and you hope that things will change. With break-even approach, you start to realize that you are in control of your trading money and results.

If you have a problem with it, you can use simple expert advisor like Breakeven Expert. Below is an example for Metatrader, but you should find similar solutions for other platforms.

It is a custom indicator, first you have to install it. When you are done, simply add it from Navigator to the chart:

Next, you have to define pips value, when indicator will move stop loss. Value may be different for different brokers (depends if you have format x.xxxxx or x.xxxx). In this case we have 30 value which represents 3 pips for pairs in format x.xxxxx:

We should make sure that autotrading is on:

And three should be a confirmation that everything is ok in form on smiley face in a corner:

When you open a trade, you can set an initial stop loss. Then, after a move of the value entered by you, EA will move stop loss to the entry point.

Download Breakeven Expert for Metatrader here.

Taking profits

Set take profit target

It is important to know where are possible support and resistance lines. This can help you to decide where is a good take profit target. You should remember that markets move very fast when they are close to these levels. That is why in so many cases it is better to close at specific take profit area than to wait for a signal which will lag.

Partial close

Another great technique to protect your profits. Let’s say that you have a profitable long trade. It is still open and you are a good few pips in profit. You want to close it but there is an important resistance 15 pips ahead. Should you close all or move stop loss higher?

Another solution is a partial close. There is an option to do that in Metatrader (other platforms too). It is simple. You just go to the options menu and close part of a trade. It doesn’t have to be equal – so you don’t have to close half or something. You can specify how much you want to close.

In Metatrader, simply select Modify option:

And select the size of position you want to close:

It is very helpful expecially for longer time frames trade. You want to take some profit, rise the stop loss and let the rest go with the flow. Like in the example below:

It is a great option.

Use data from Pivot points and Fibonacci

When you select potential places to close a trade, many traders look at resistance and support levels from a higher time frame. That is a correct approach, still you can get more information like:

- Pivot Points levels

- Fibonacci levels

Price really respect them and you can partial close your trade to book some part of your profit. The good example is this chart of USD/JPY. Here we can see that we have 1h time frame with weekly Pivot Points. Price stopped (from the left) at weekly S1, weekly R1, weekly S1. If you were in a trade, this was good places to at least close part of your position or take whole profit and exit.

That is an example of higher TF, but it works the same if you are using daily Pivot Points and you are scalping on the lower time frame.

It depends on your trading strategy. Still, it is good to know in advance where important levels where you can take profit and exit.

Indicators in daytrading

Forex ATR – trailing stop loss in scalping and day trading

Trailing stop loss is one of my favorite tools. It gives you clear signals, helps you to catch bigger moves. There are many popular variations of this tool. If you use Metatrader4 then I recommend Chandelier Exit – it is a custom indicator so you have to download it and install in MT4.

When you add it to the chart, you should specify Inputs. I recommend a little bit longer range and period, so you can catch easier bigger moves. ATR Multiplier is very important – standard one is around 3.0 value. Remember that you can change it every decimal value so it can be 3.7, 4.0, 4.4 etc. This small decimal changes can be clearly seen on chart and thanks to them you may have many signals and short-term trades or fewer signals but with the possibility to catch more trend moves.

I usually go with settings like this below: Still, when I am on hiher time frame or more trending pairs (yen pairs) then I will go with higher multiplier (> 4.0).

Still, when I am on hiher time frame or more trending pairs (yen pairs) then I will go with higher multiplier (> 4.0).

There is no single correct set of settings for trailing stop. You have to set the best parameters based on price history. For every time frame and pair, it can be different.

About time frames. Trailing stop loss works on every time frame, but if your goal is to scalp on trends then I suggest to try it on 5m or 15m. You can catch really big moves. Still, if you want to scalp on 1m TF then you should be fine.

To the charts!

Trailing stop loss is a simple line for long and short positions:

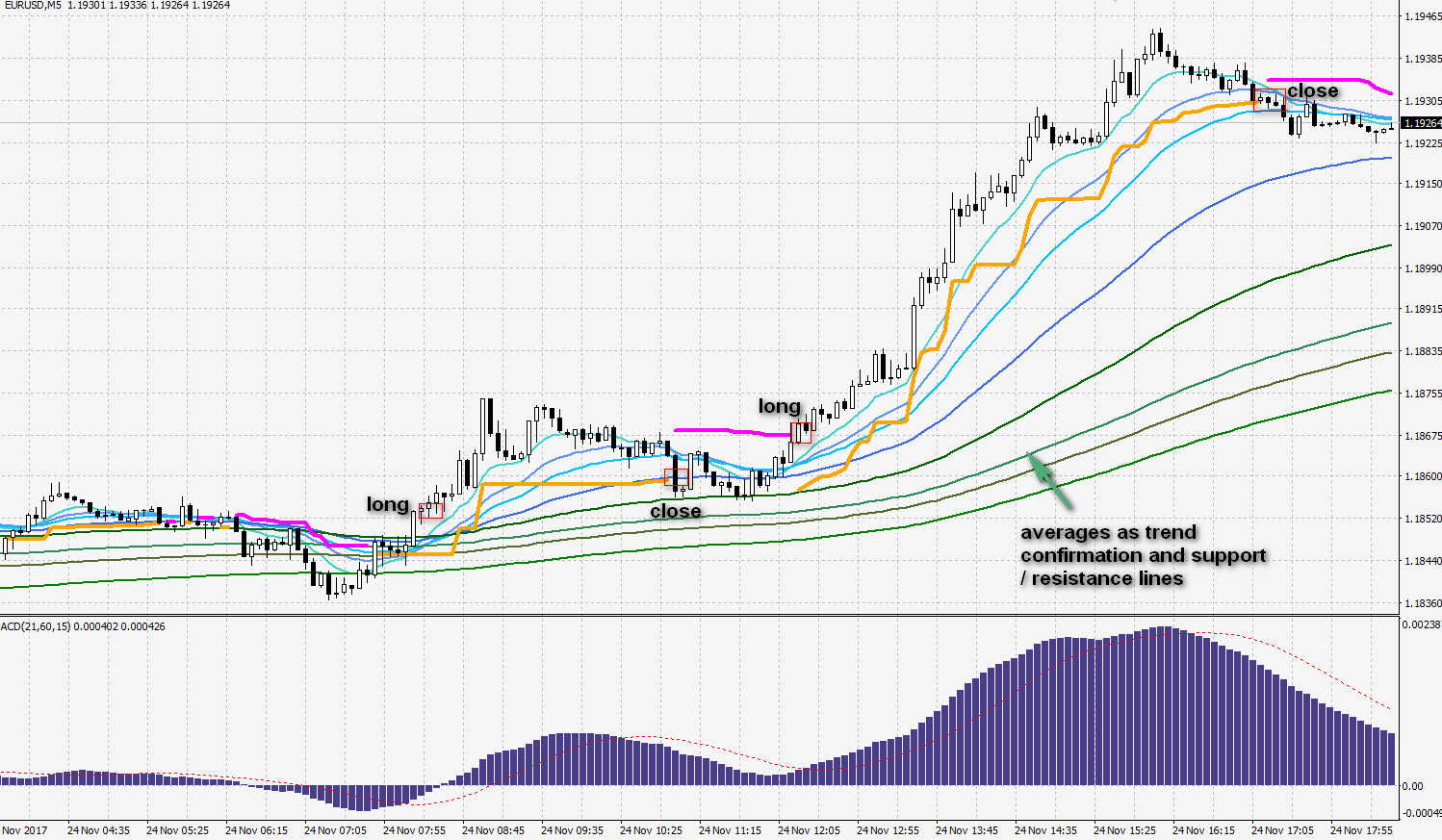

It is best to join trailing stop loss with other tools. The main reason for that is that you want to trade in a trend direction (unless you are a counter-trend trader). There are many combinations here. Below you can see trailing stop loss joined with averages and MACD with longer parameters.

It is best to join trailing stop loss with other tools. The main reason for that is that you want to trade in a trend direction (unless you are a counter-trend trader). There are many combinations here. Below you can see trailing stop loss joined with averages and MACD with longer parameters.

The main idea here is to go with the main trend because the chances for success are best. In the example below we can see from averages and MACD that trend is up so we look only for long opportunities. We close trade when there is a close below trailing line:

I don’t want to make false statement that trailing stop loss is so ideal. As every technical tool, it can be hard to trade during a range move:

So yeah, it is still important to draw support and resistance lines so you can have better picture of situation in the markets.

So yeah, it is still important to draw support and resistance lines so you can have better picture of situation in the markets.

Trailing stop loss can be joined with Pivot lines. If you follow me long enough, you know that I can join almost everything with pivots :). There is a reason for that. They give you very valuable information about potential entry and exit points. Just like in the example below. We could see that trend is up so we were looking for long trades. After entry, there was a strong move up. If we would follow only signals from trailing stop loss then the close should be around 1.1635 level. Thanks to the pivot lines we could see the price approaching R3 line – that is always a great place to exit and take profit. It was also in that case – if you close at R3 line that was around 1.1643. 8 pips higher, but remember that we are talking about 1-minute chart!

There are many other examples how trailing stop loss joined with Pivot lines can give you much better results. Even on a 1m time frame as you could see above.

Forex Parabolic SAR in scalping and day trading

Parabolic SAR is similar to trailing stop loss. The most important parameter to set is step: Every decimal change makes a huge difference.

Every decimal change makes a huge difference.

Similar to trailing stop loss, Parabolic SAR works great in trending markets:

In a range move it is not that great: But it is normall with every other tool. You should join Parabolic SAR with other tools so you can be sure to trade with the trend.

But it is normall with every other tool. You should join Parabolic SAR with other tools so you can be sure to trade with the trend.

Forex scalping and day trading using moving averages

Ahh, averages. Almost everybody started trading adventure with them. They are not that bad if you use them for something more than signal from the cross.

What type of averages? Expotentiaand Linear Weighted averages should be the best choice in most cases.

When we talk about scalping with averages then it is most likely that we want to:

- have information about trend (and therefore trade) direction

- have signals based on averages

When it comes to signals, we should remember that signals can occur:

- after the cross of averages

- when price close above or below average (for example 100 or 200 or other)

So we have few combinations here.

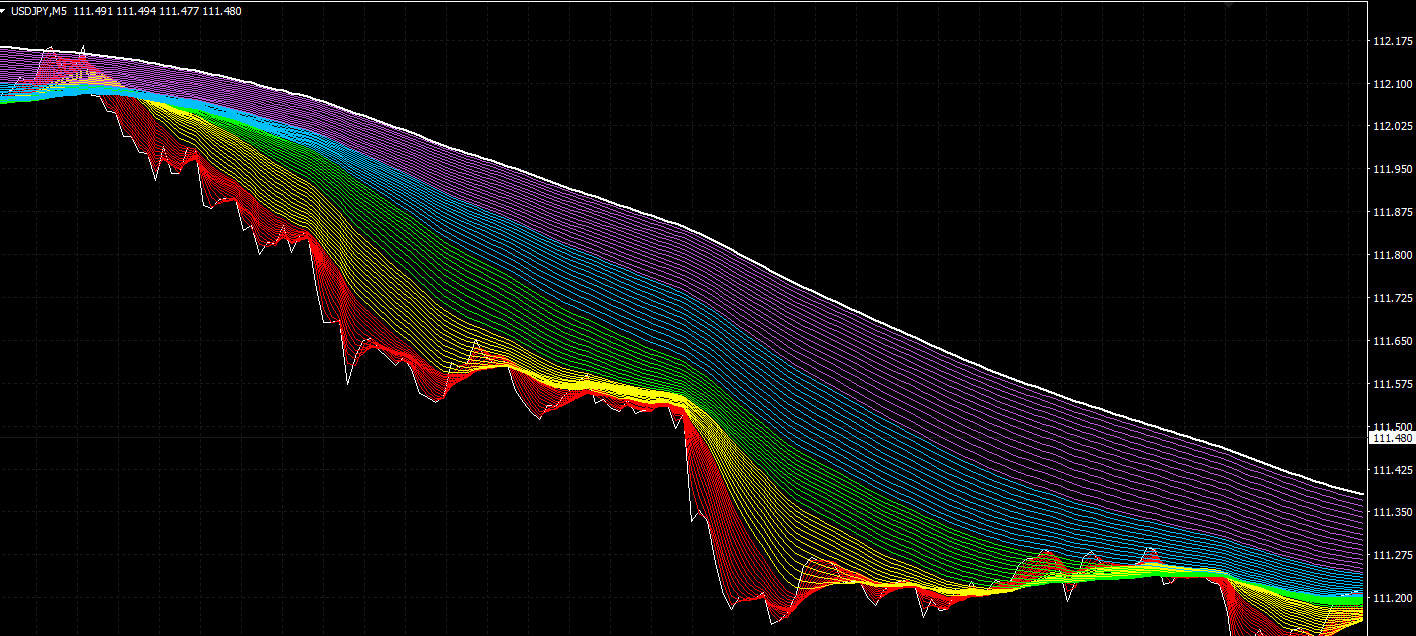

When we talk about averages in scalping then we have to talk about Rainbow chart. There was a day when it was a very popular approach to trading and especially scalping Forex.

As you can see, Rainbow chart is simply a set of averages divided into groups. Each group has a different color. When averages are wide, we can see that trend is strong.

Also, in classic approach price chart is set to line. The main goal here is to make things simple. When you see that the price line is above all averages you go short. When averages are positive and price line is above them you go long:

Of course you can use candles and join Rainbow with other tools like MACD:

It takes time to learn how to scalp with Rainbow. It has pros and cons, but it is a good strategy for new traders. They can understand and see the difference between the range and trending markets.

Another, rather popular use of averages is GMMA. This strategy was created by Daryl Guppy and it is named after him (Guppy’s Multiple Moving Averages). It is similar to rainbow chart, but we have two groups of averages: short term and long term. It is recommended to also add longer trend averages like 100 and 200 like in chart below:

A nice modification is to build it from Rainbow average which has three colors (for a move up, down and range). You can download all here.

Of course you do not have to use rainbow charts. You can go with most important ones or play a little bit like I did below:

On the chart, you can find averages 10, 20, 30, 60, 120, 240, 300, all expotential. Short ones work as a signal, long ones as a trend indicator.

Forex scalping and day trading with bollinger bands

Forex scalping with bollinger bands

Bollinger Bands can be used in Forex trading and scalping. They work similarly as in other markets like stocks or commodities.

When there are no trend and price moves in a range then we can see that bands are narrow. Price oscillate around the middle of the BB.

When there is a trend, bands get wider. Price stays at one side of Bands and middle average from BB works as a support (or resistance in a downtrend).

So nothing new here. All the good things you now from trading with Bollinger Bands works in Forex too.

Still, you should join them with other tools.

First, I like to join Bands with longer average as a confirmation of trend direction. In my case, it is usually 100 EMA, but you can go with 200 EMA or other. It is simple, when middle average from BB is above my longer average (100) then I can look for long opportunities. If the middle is below 100 average, then I look for short.

Next, there is a MACD to clear false signals. I keep it with longer settings like below (33, 200, 21). I check it to see if MACD is positive or negative (by that I mean if MACD line is above or below the signal line). That is a nice indication of a current trend.

Last, there is a Stochastic. It gives signals to enter or exit a trade.

One more important thing. On the chart above you can see that I wait for confirmation from price and BB (I wait until price closes above middle line of BB, then I know that I can go long).

This is only my approach to trading and scalping with Bollinger Bands. They work well in Forex and you can build many other strategies where you combine Bollinger Bands with other tools.

Forex scalping and day trading with Fibonacci retracement

Fibonacci tools are my favorite. They work on every time frame, also on the short ones like 1m, 5m or 15m. You can use them in different ways when you scalp:

- trade standard ABCD patterns

- trade between B and C

I show it on examples so it should be more clear.

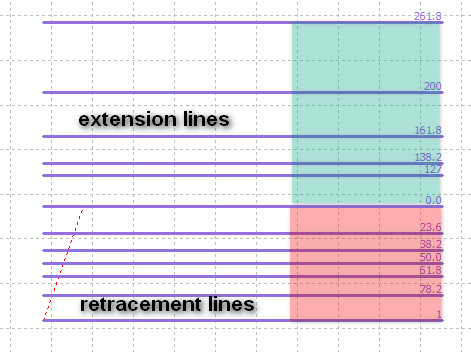

First, some basics. We have retracement and extension lines:

You want to add some confirmation tools like averages, MACD or other. Basically, if you trade ABCD you look for trade in trend direction. When you have confirmation of trend, you place trade (based on signal) near retracement lines. In the example below we looked for short trade, entry would be between B and C, exit at one of extension lines:

You want to add some confirmation tools like averages, MACD or other. Basically, if you trade ABCD you look for trade in trend direction. When you have confirmation of trend, you place trade (based on signal) near retracement lines. In the example below we looked for short trade, entry would be between B and C, exit at one of extension lines:

As always, Stochastic is a good option here for a signal to entry. So the main idea for a trade is:

As always, Stochastic is a good option here for a signal to entry. So the main idea for a trade is:

- open a trade near reatracement based on signal from Stochastic

- close a trade at extension. You do not wait for signal, you simply decide to close at 138.2 or 161.8 extension (or other).

Like in this example:

Try to join Fibonacci with Pivot points. This will give you more information about potential support and resistance lines. You look for places when Fibonacci lines are near to the Pivot lines. Like below. Normally you would try to exit at 161.8 extension and for moment price stopped here. There was a continuation of that move and you could see that 200% extension is near to the pivot line. This would be a good exit point for a short trade (our D would be at 200):

ABCD is a one way to trade Fibonacci’s. Another popular approach is to trade between B and C. Idea here is that you have better chances to take profit when you open a trade near a retracement and close at B. You do not know if the price can go to the extension, B is very often a resistance for a price.

You can see what I mean on the chart below. 38.2 was a resistance for EUR/USD. From that, we saw a move down. There was a false break below B but the price turned up. It did not hit any extension. If you managed to go short near C and close at B you would be profitable.

It is a common picture that price reacts near B and C and many traders use that to trade between them.

Forex scalping and day trading with Ichimoku

It is possible to use Ichimoku in your scalping. First, you want to play a little bit with parameteres. You can go with default ones:

Some people like to change it to faster: 7, 22, 44. Yes, they are faster, but they give you also more false signals.

I like the other approach whith longer settings 9, 68, 177 like below:

As a result, you have less false signals.

It is Ichimoku so you have many signals from it. Cloud works as support, resistance. Same situation with Kijun line. Thanks to that you have many valuable information:

As you can see above, it was best to wait for a breakout above cloud and Kijun line.

Ichimoku can give you good signals when you are in a trade. If you want it to keep your trade really short then you can close it after it crosses with Tenkan-Sen (shorter average). If you hope to catch a bigger move, you can wait for a cross with the longer average which is Kijun-Sen. Just like in the example below:

Of course, there are many more ways to use Ichimoku in your scalping. I traded witch Ichimoku for a long time (I started my trading career with it). I have few tips:

Do not be afraid to join Ichimoku with Indicators

Some people are against it, but I think it is ok. Sometimes Ichimoku can be too slow or you can have mixed picture of the current situation in the market. I like to join Ichimoku with MACD, CCI or Stochastic.

Do not use crosses

Crosses (Tenkan and Kijun) are useless. These are not good signals to open or close the trade. Learn to use Kijun and Tenkan as support and resistance lines.

Remember about higher time frame

Sometimes Ichimoku can give you mixed signals. The best way is to check higher time frames. When you trade on 1m then you check 5m, 15m and higher. What to look for? What is the current trend, where are important support and resistance levels, where are important averages…

Higher time frames should give you a better understanding of the situation.

Remember about support / resistance lines

Form current time frame and higher time frames. They give you potential entry and exit points.

Join Ichimoku with Pivot lines

Similar to support and resistance lines. You can close your trade in the best possible place before price turns over.

Support and resistance, Pivot Points in Forex scalping and day trading

Scalping with support and resistance is effective because these are points when you can expect some reaction from the price. You can:

- look for breakout

- look for correction from support or resistance line

Below you can see example of price consolidating around 1.1855 level. Breakout was a good place to enter a long trade:

Another way of trading this situation was to short every time price gets near to the resistance line. So scenario is simple – after move to the resistance we wait for signal, short and go for 10-20 pips profit:

Another way of trading this situation was to short every time price gets near to the resistance line. So scenario is simple – after move to the resistance we wait for signal, short and go for 10-20 pips profit:

You can use important averages like 100 or 200 as a support / resistance areas as well:

Forex scalping – Pivot Points

Pivot Points give you very valuable information which you can use in many different trading strategies. In scalping too.

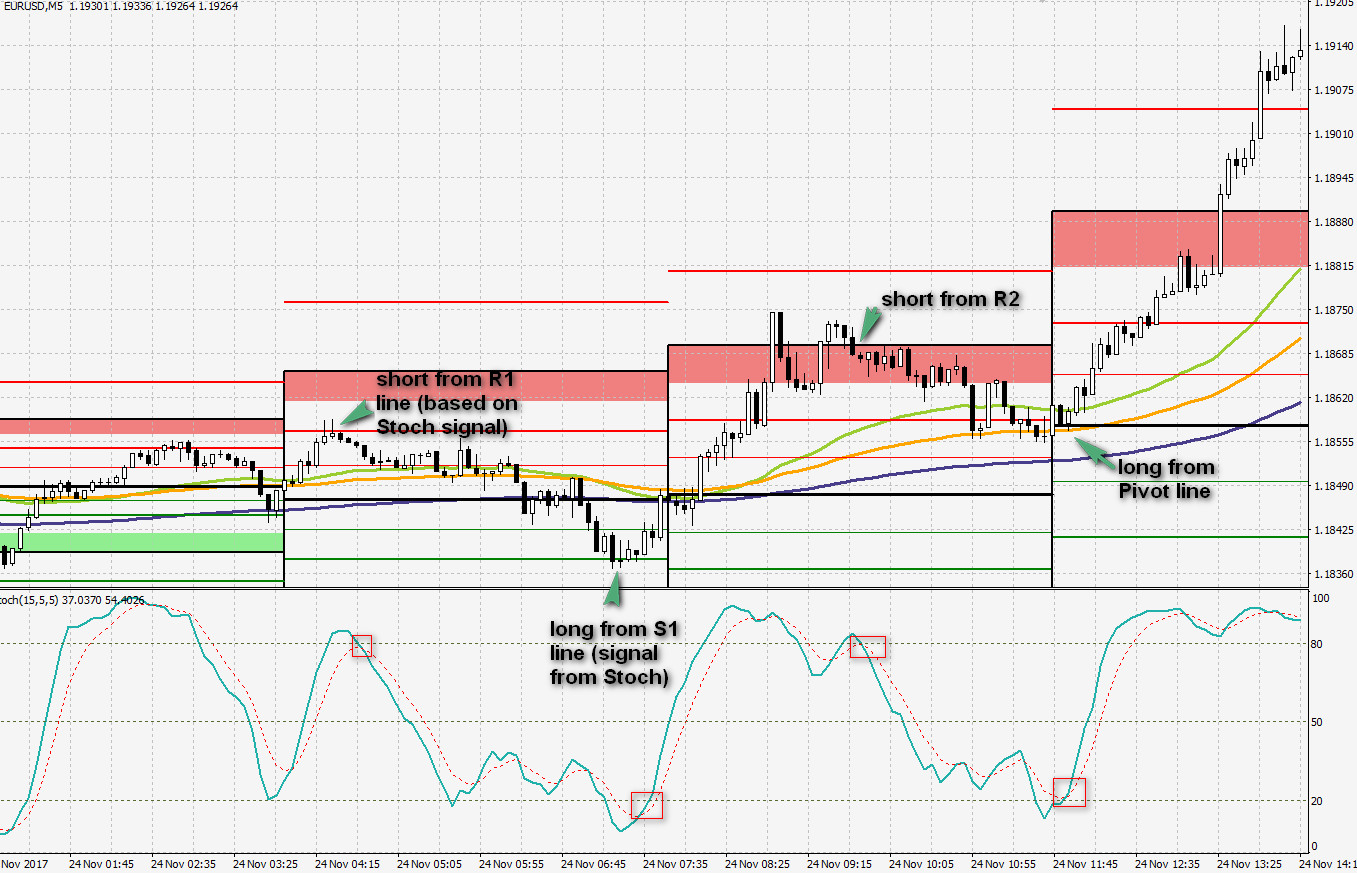

To be effective, you want to go short when a market is overbought (near resistance lines) and buy when it is oversold (near support lines). Take a look at an example below. After a strong move up price get near the daily R2 line. It was a good place to go short, after confirmation from Stochastic:

So nothing new here. You simply want to use support and resistance line to open a trade with confirmation (from price, pattern or oscillator).

So nothing new here. You simply want to use support and resistance line to open a trade with confirmation (from price, pattern or oscillator).

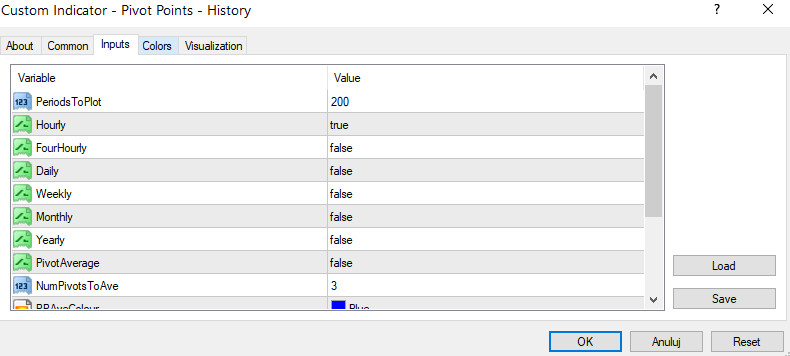

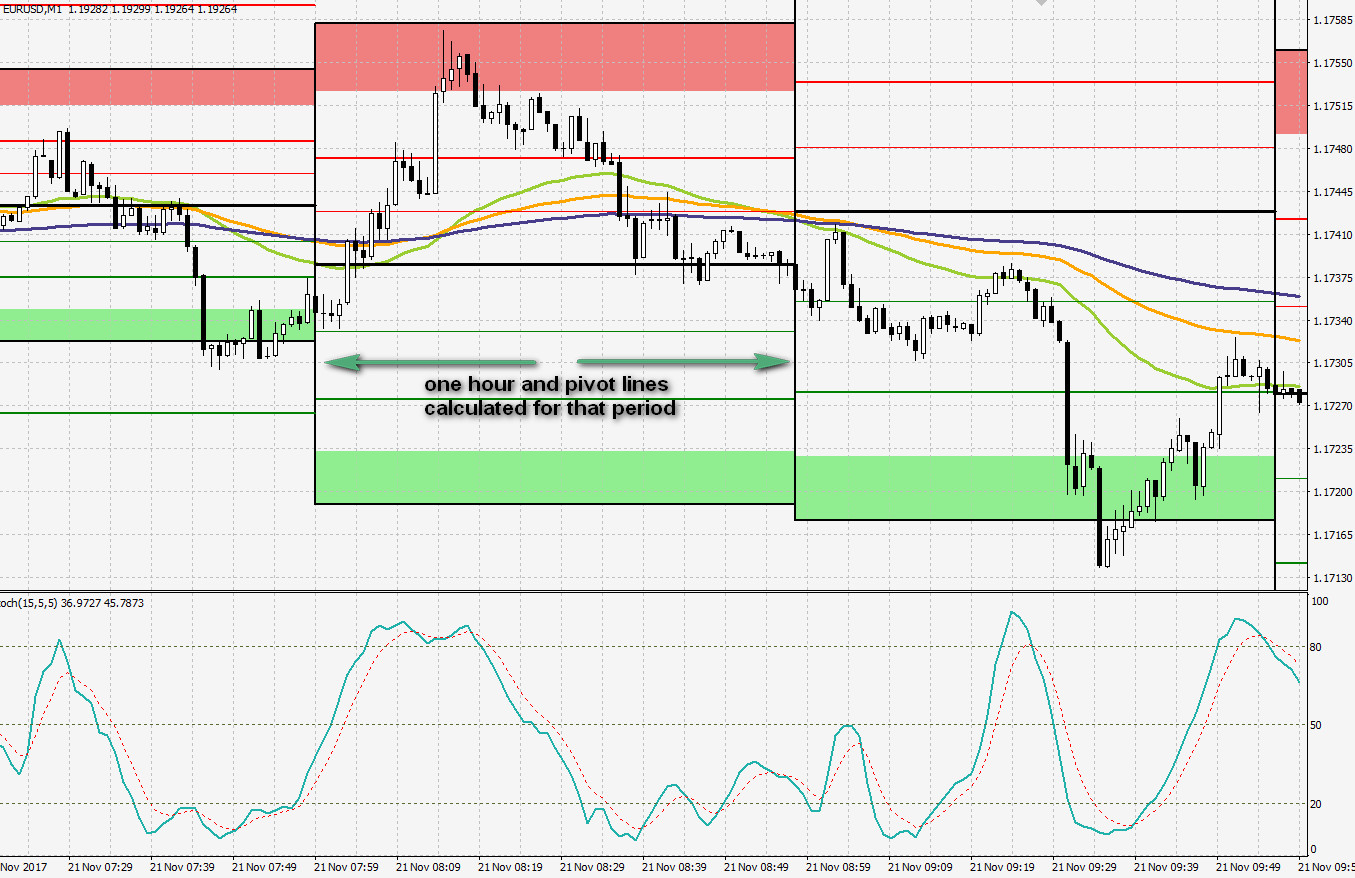

In scalping, you can use daily pivot points which are calculated on previous day data. If you trade on lowest time frames and you want to keep trade for a short time then you can try hourly or 4-hourly pivots. Go to settings and select true next to hourly:

You should see pivot lines plotted on chart for each hour. These lines are calculated on previous hour data.

You trade it similar to how you would trade normal daily pivots. You look for short opportunities near resistance lines and long near supports.

Ine the example below you can see that in the first hour there was a short opportunity near R2 line. Price stopped in a halfway to the R2, later we saw a signal from Stochastic.

The second hour did not give us any trade chances.

In the third hour similar to first one, R2 was a good place to short after a signal from Stochastic. This time price managed to close right at R2 line.

4-hourly pivot lines work also great. It is a good choice for people who prefer to scalp on 5m time frames. Just change it in options tab like below:

4-hourly pivot lines work also great. It is a good choice for people who prefer to scalp on 5m time frames. Just change it in options tab like below:

And business as usual ;). You can see a 5m example with pivot lines plotted every 4 hours. There were good signals to go short and long with confirmation from Stochastic.

Notice that you can look for trade opportunity near the Pivot line itself. Like below, around 12 am. Pivot line was almost in the same place as 100 EMA and it was a support for the price. We also had a signal from Stochastic. As it turned out, it was a start of a really strong move.

To sum things up. Pivot points work great and it is always good to have them on chart. I showed you how you can use Pivots based on previous our or 4 hours. If you like to scalp actively then it is a good choice for you.

To sum things up. Pivot points work great and it is always good to have them on chart. I showed you how you can use Pivots based on previous our or 4 hours. If you like to scalp actively then it is a good choice for you.

Forex scalping and day trading with MACD

MACD is one of my favorite oscillators. You can use it in so many ways. It is possible to join MACD with many other tools. When we talk about MACD in Forex, we have standard (built-in) MACD, but I prefer MACD True (it is a custom oscillator, you have to download it). You can see the difference below:

Next thing you have to decide about are settings. Standard settings for MACD are 12, 26, 9. You can play with these parameters. Below there is a difference between standard MACD and MACD with longer settings:

With shorter settings, you will have faster signals, but more false ones. With longer settings, MACD works more like trend indication. As you saw before, I use MACD with longer settings joined with Stochastic as a signal oscillator. This is me, you may prefer to go with MACD and shorter settings and based your entry on MACD.

When trading with MACD you should remember that we have signal after line crosses. Another important signal is when MACD crosses 0 line.

Scalping forex and day traidng with stochastics

Stochastic is very popular for scalping. There are many reasons for that – signals are fast and it allows you to open positions in good places.

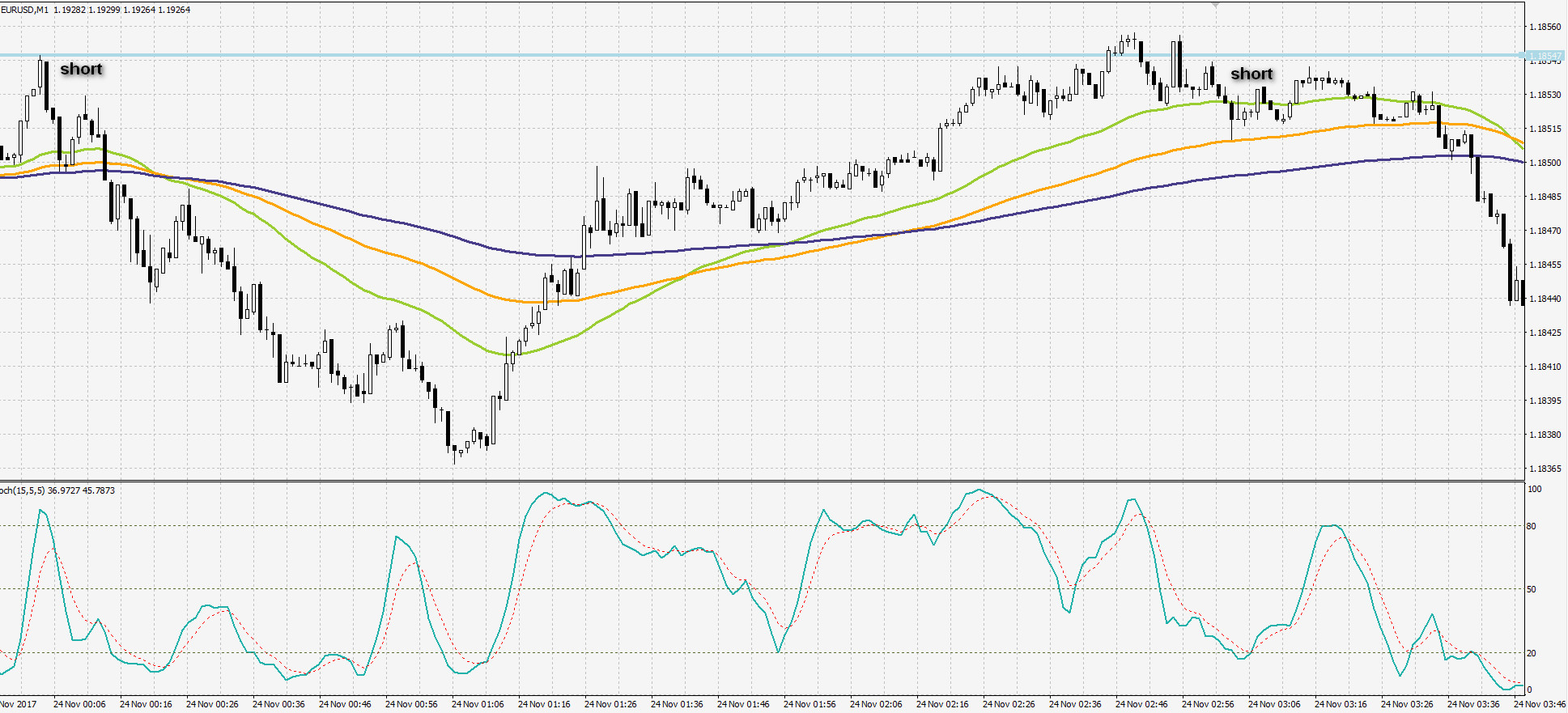

Parameters are very important here. Even small changes result in different signals and lines you see in Stochastic. In scalping, popular are fast parameters because thanks to them you have fast signals. Popular settings are 13, 3, 3, but my recommendation would be to go with little bit bigger numbers – 15, 5, 5 like on the screen below:

Next thing to decide is Price field. You can set standard Close or go with Low/High. I prefer the second one.

MA method – I suggest expotential.

Remember: these are only my suggestions. You may be trading different pairs, different time frames and you may need other settings. That is why this is very important to check your settings based on price history.

There are few ways you can open and close your trade. You can do it after a cross of signal lines just like in the example below:

Or you can wait for confirmation and close above or below 20 and 80 lines. If stochastic is below 20 line that means that price is oversold if it is above 80 line that it means that it is overbought. We may have multiple signals in that areas so it is a good idea to wait for confirmation from Stochastic and cross of signal line with 20 or 80. Compare the chart below with the previous chart and it should be clear for you:

It is best to build a system around Stochastic. I mean by that joining Stochastic with other tools so you can have a confirmation of signals. You can add basic moving averages like 50, 100 or 200 so you can have a confirmation of a trend. Another way is to draw trendlines, look for patterns. When you join it together you can have very good entry and exit signals and your scalping will be much more effective.

Stochastic can help us to enter a trade when a price is getting near to the important support or resistance line. In the example below we have Pivot line, we know from higher TF that trend is up. We want to enter long position near Pivot, but after some confirmation. Sure enough, we had a confirmation from Stochastic oscillator and it was a very good place to enter a trade:

Of course, you can join Stochastic with other tools. In the example below, you can see Fibonacci joined with Stochastic. We waited here for correction to C so we can go long near one of the retracement lines. We go long after confirmation from stochastic and as you can see this was a very good place to enter a trade:

Forex scalping and day trading with CCI

CCI is a very popular indicator. You can use it in long-term, swing term or swing trading. It also works great in scalping joined with other indicators or by itself.

First, few words about parameters. Default period for CCI would be 21 or similar. I recommend trying longer periods like 50, 100 or 200. With longer periods you get fewer signals, but they are more accurate. It is up to you if you prefer to have faster, but less accurate signals or a little bit slower but more accurate. In my trading, I usually go with 100 and 200.

We change periods in the options window. You can see that below we can change the type of calculation. There are standard options like Close, but you can play with it. I usually go with Typical Price or Weighted Close. There is a difference so check each option and select the best one for you.

There are many ways to use signals from CCI. The most popular are crosses with 0 and 100 line.

For example, when a price is below 0 line and it crosses it then it is a good place to go long.You can see that is not that often for CCI to cross 0 line, that is why this is an important signal.

Another good entry point is a cross with 100 line. Price managed to go far away from 100 average (if you set your CCI for 100) and it is a good indication that move is strong.

As always, you can also draw trendlines on CCI, which can help you to decide when to enter a trade:

About levels on CCI. Basic ones are 0, 100, -100, but you can (and should) use next levels. As a minimum I recommend -200, -100, 0, 100, 200, but you will see in next examples that you can go with even bigger levels.

There are many ways you can use information from CCI to open and close a trade. Let’s take a look at some of them.

One way is to open a trade after cross with 0 line and close when CCI crosses back with 200 line (or 100 if trend is weaker):

On the example above we saw one false signal (first cross with 200). Still, you could close it with profit, re-enter and close after another cross with 200.

Another way is to open at 100 crosses. When a trend is strong then most of the time CCI will be above 0 line (when we talk about an uptrend). In that case cross with 100 line would be a good entry point. If a move is not that strong then we want to close at cross back with 200 line. Sometimes move will be very strong and CCI can help us to close trade near the pick – after cross back with 300 or 400 line. Yes, it is rare, but when you see cross back with 400 or -400 line then in most cases this is the best place to close a trade and keep most of the profits for yourself. Like in the example below:

Another way is to use CCI to open trades in oversold and overbought regions. We hunt here for crosses at extreme moves. In most cases, this will be at -200 and 200 lines. We can book profit on the other 200 line or earlier, depends on our trading plan. These 200 lines are good places to catch moves almost at their beginnings:

That is not over. We can go with 100 – 100 or 200 – 200 open-close approaches. The goal here is to catch trending moves. We open a trade after a cross with 100 CCI. When there is a cross back then we close it. Sometimes it will be a false signal, but with trends, it works very well. On the example below you can see that we also had another confirmation to close from Bollinger Bands:

In most examples above I used CCI with 200. Based on price history on a current time frame, try to check which settings will work best for you.

Day trading Bitcoin – guide

Forget Forex and stock markets. Bitcoin remains to be popular among individual investors and traders. Many of them simply buy and hold Bitcoin, because it will be worth 1,000,000$ one day  Three are some experienced traders who wonder if you can day trade Bitcoin? I try to answer in that part of the guide. I also give you some recommended strategies.

Three are some experienced traders who wonder if you can day trade Bitcoin? I try to answer in that part of the guide. I also give you some recommended strategies.

Is Bitcoin good for day trading?

In general, yes. I wouldn’t say that it is good for scalping. On Bitcoin, you can see strong trends. If you are a scalper who likes to open a trade to get some small profit it may not be the best thing.

Finding a broker for Bitcoin trading

There are few brokers with Bitcoin and other crypto coins in their offer. For example, even XM added it to their offer.

My recomandation would be a crypto account from FX Open:

You can open an account with a small deposit (starts from 10$), you have Metatrader 4 platform and cryptocurrencies offer is good.

Find all details here.

Selecting best time frame

It depends from your trading style, but 1-m time frame may not be the best choice:

Action here can be choppy. In my opinion it is much better to try to catch swing moves and breakouts on 5m, below 5m chart of Bitcoin:

Action here can be choppy. In my opinion it is much better to try to catch swing moves and breakouts on 5m, below 5m chart of Bitcoin:

You can try 15m, but in my opinion this time frame is better to catch swings which can last for few days. Below 15m chart of Bitcoin, white vertical lines seperate single days:

You have to try it with your trading strategy. If you still want to trade 1m chart then I still believe that EUR/USD will be a better choice.

Strategies you may use to trade Bitcoin

Let’s check some good strategies you can use when you day trade on Bitcoin. We can use here normal tools and strategies from Forex or futures day trading.

Below are some of my favorite techniques, but you can also check other strategies in practice.

Trailing stop loss

Trailing stop loss is a great strategy. It allows you to follow trend easily. When you are in profit, you can hold to the trend for a longer period and stop loss line is clear.

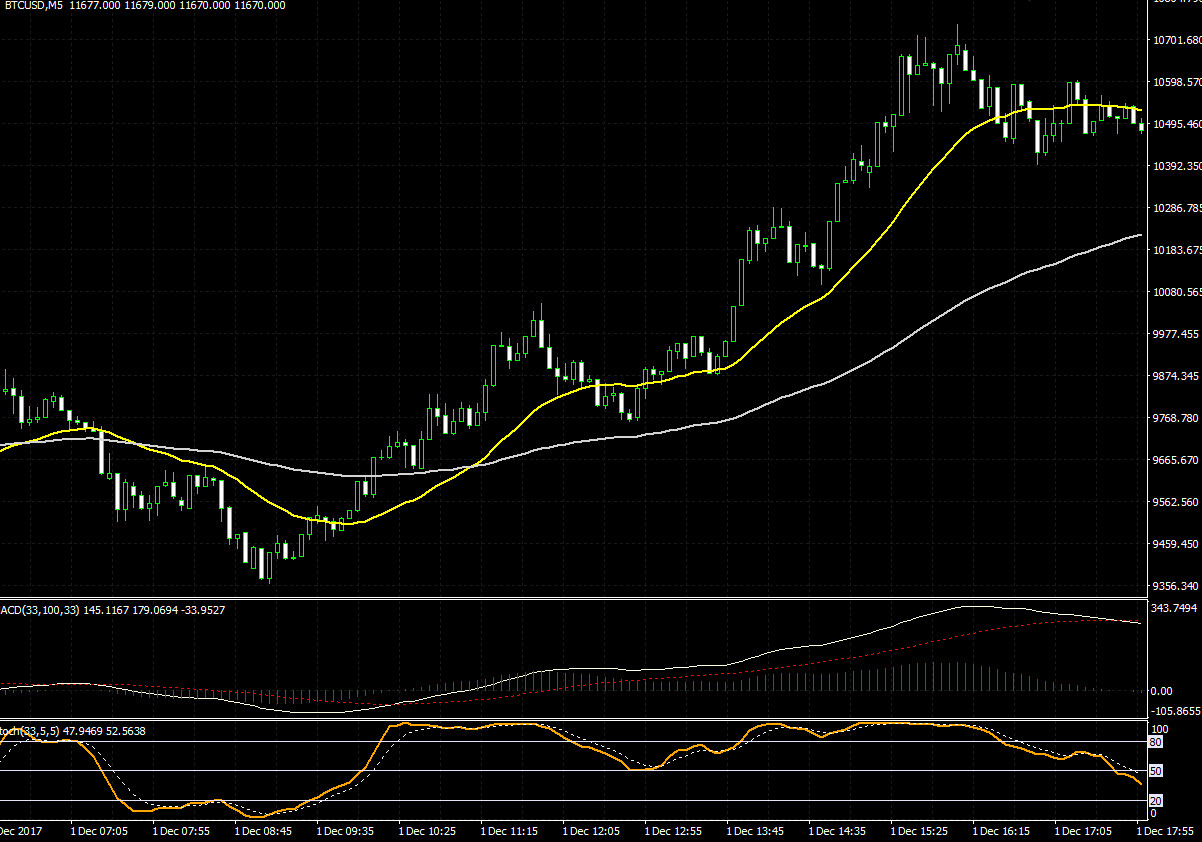

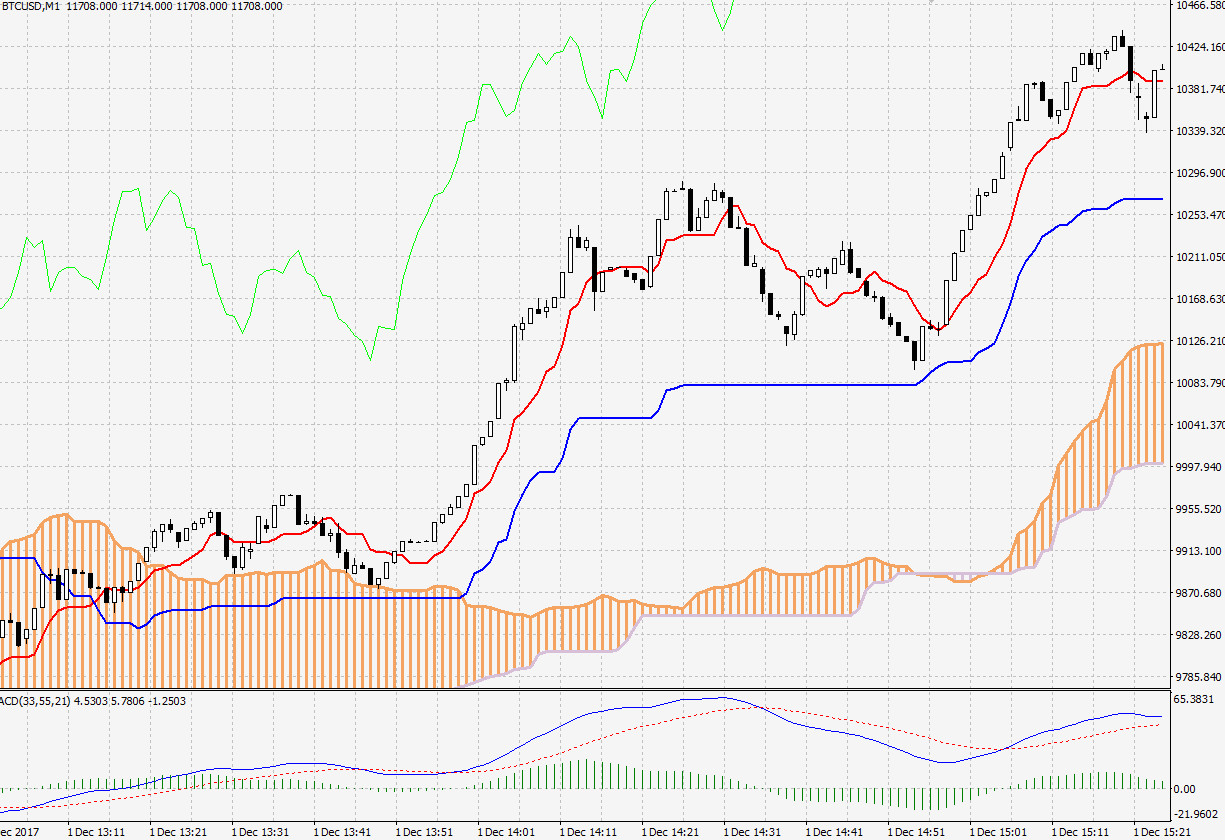

I like to join trailing stop loss with other tools which helps me to verify the current trend. In the example below you can see trailing stop joined with Bollinger Bands and 100 average on 5m Bitcoin chart:

From the start iw was clear where to enter and where to close. Settings for this trailing stop are:

From the start iw was clear where to enter and where to close. Settings for this trailing stop are:

Another idea is to join trailing stop loss with averages. They can work both as support/resistance and trend indicator. Thanks to them you have better chances to invest in the right direction.

The best way to trade with trailing stop loss is to trade with the trend. Especially on lower time frames. You just have to wait for best setup of averages and trailing stop loss. Below Bitcoin again, 5m chart:

Settings for this trailing stop: Take a closer look at two charts above. You can see that both are 5m Bitcoin. On both, with trailing stop loss you could catch most of the 1000$ move. All that on 5m chart! That is the true power of trading with trailing stop loss.

Take a closer look at two charts above. You can see that both are 5m Bitcoin. On both, with trailing stop loss you could catch most of the 1000$ move. All that on 5m chart! That is the true power of trading with trailing stop loss.

You can download templates from examples here:

Remember that you also have to install trailing stop loss. You can download it here:

ATR trailing stop loss (Chandelier Exit) – Metatrader download

Ichimoku

Ichimoku is an old trading indicator which works great in trending conditions. You can also use it with Bitcoin trading. My advice would be to change standard settings to the ones below:

They are longer than standard Ichimoku settings. Thanks to that you will get better picture of current situation.

They are longer than standard Ichimoku settings. Thanks to that you will get better picture of current situation.

You can use it on 1m chart like below:

Or any chart you like. Cloud, Kijun, Tenkan… they all work the same across the board.

Or any chart you like. Cloud, Kijun, Tenkan… they all work the same across the board.

Dwonload Ichimoku template here.

Fibonacci tools and Bitcoin

If you read my blog long enough then you know that Fibonacci is my favorite trading tool. You can trade with Fibonaccis number with many different approaches. My recommendation is to trade ABCD patterns. You can use it in any time frame, all you need is trending price and swings.

Below example of ABCD pattern from 1m time frame for Bitcoin:

Similar pattern on 5m time frame. Here we could see a short pause at 127 extensions, but later Bitcoin price went straight up to 200 extensions.

You can read more about trading with Fibonacci in my guide here.

You have to set up retracement and extension lines by yourself. I wrote a short guide how to set up Fibonacci tools here.

Pivot Points

Pivot Points are great because they show you where are potential support and resistance areas. You can build a good strategy with that information.

There are many Pivot indicators for Metatrader. I recommend to use that one.

When you add Pivot indicator to the chart, you have to decide on which period it will be calculated. Standard is daily but there are many others to choose from:

Do Pivots work on Bitcoin chart? Of course. Just like with any Forex pair, it gives us potential support and resistance levels. Below 15m Bitcoin chart with daily Pivots:

Do Pivots work on Bitcoin chart? Of course. Just like with any Forex pair, it gives us potential support and resistance levels. Below 15m Bitcoin chart with daily Pivots:

If you trade on 1m or 5m time frames then it can be a good idea to trade with Pivot Points calculated on 1h or 4h. You switch that in settings window which I showed you in the beginning. Below you can see 1m time frame. See how Pivot works when they are calculated on 1h (so every hour we have new Pivot lines). It is clear that Bitcoin price reacts with these levels which can be support or resistance for the Bitcoin price:

If you trade on 5m time frame then it is a good idea to try Pivot Points based on 4-hours period (every 4 hours we have new Pivot lines plotted on chart). Again, Bitcoin price finds support and resistance at these lines. Below 5m Bitcoin chart with Pivot Points plotted every 4 hours:

On charts above you can see that I joined Pivot Points with MACD, Stochastic and averages. You can use other technical tools. I just like to have a confirmation of trend and signal to open and close position. I think that setup above works just fine.

Download template from examples here.

Remember that you need to install pivot points from here.

The risks of day trading Bitcoin

You can day trade Bitcoin, but there are some risks which you should be aware of:

Price can change in few minutes

So many people think that Bitcoin goes only up. They are wrong. When you check lower time frames you can see that Bitcoin can go few hundreds dollars up or down in few minutes. Just like that:

Or that:

Of course, if you have a trade opened in a direction of that move then great for you. There will be times when this price will go against you so proper position management is super important here.

It is hard to find broker with low spread for day trading

Bitcoin is right now around 10,000$. Because of that price spread is rather wide. It is hard to find a good broker with low spread to day trade Bitcoin.

Unexpected news

When you trade normal forex pair you have a calendar of economic publications. You know in advance when some major economic data will be published.

With Bitcoin it is a different story. There are many unexpected newses from central banks banning Bitcon etc. Because of that price of Bitcoin can go down in a short time:

As you see, you should be careful. I showed you that normal trading tools work just fine on Bitcoin. You can trade it like any other pair. But there are some risks and you should be disciplined.

Summary

There are many more trading strategies and indicators you can use when you day trade Bitcoin. I presented you some of my favorite trading tools which I tested on Forex. As you can see, they work great also when you day trade Bitcoin.