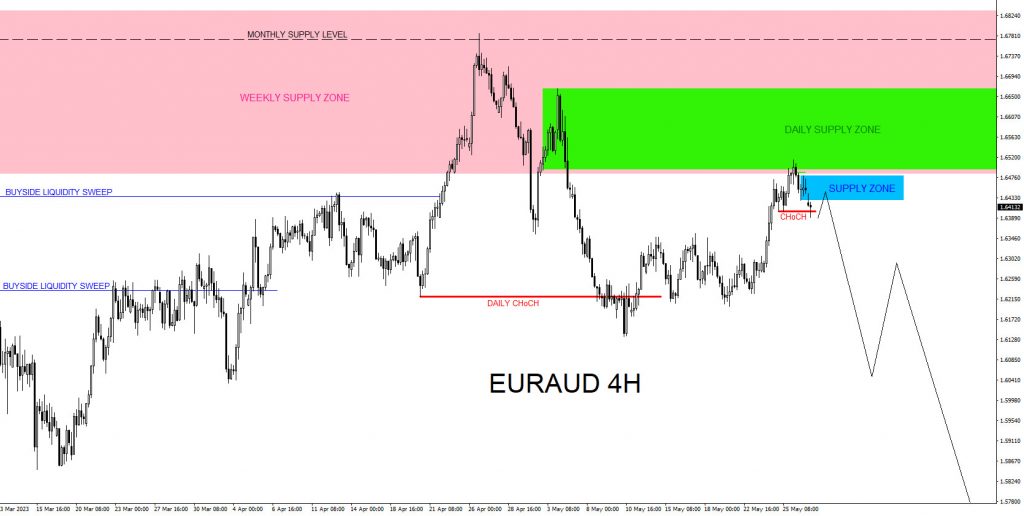

On May 29 2023 I published an article ” EURAUD : Multi Time Frame Trade Setup ” where I explained that the EURAUD pair could be signalling for a move lower using multiple time frame analysis. Using the Weekly, Daily and 4 Hour charts I showed that market structure could be starting to shift bearish. The first chart below was 1 of the charts posted in the article and the following charts after shows the May 31 2023 sell entry in the supply zone and the take profit target levels. EURAUD 4 Hour Chart May 28 2023 (Market open)  EURAUD 4 Hour Chart May 31 2023 (Entry)

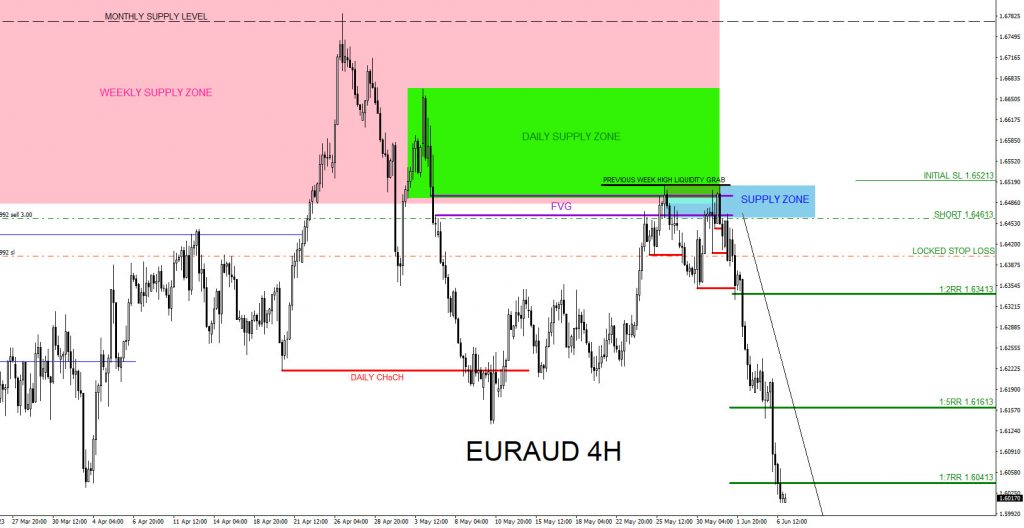

EURAUD 4 Hour Chart May 31 2023 (Entry)  SELL trade entered May 31 2023 at 1.64613 with Stop Loss at 1.65213 and on June 6 2023 EURAUD moved lower to the proposed 1:7RR target at 1.60413 for a +420 pip move (+7% Risking 1% on every trade). EURAUD 4 Hour Chart June 6 2023

SELL trade entered May 31 2023 at 1.64613 with Stop Loss at 1.65213 and on June 6 2023 EURAUD moved lower to the proposed 1:7RR target at 1.60413 for a +420 pip move (+7% Risking 1% on every trade). EURAUD 4 Hour Chart June 6 2023  Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on social media for updates and questions> @AidanFX A trader should always have multiple strategies all lined up before entering a trade. Never trade off one simple strategy. When multiple strategies all line up it allows a trader to see a clearer trade setup. We at EWF never say we are always right. No market service provider can forecast markets with 100% accuracy. Only thing we at EWF 100%, is that we are RIGHT more than we are WRONG. At Elliottwave-Forecast we cover 78 instruments (Forex, Commodities, Indices, Cryptos, Stocks and ETFs) in 4 different time frames and we offer 5 Live Session Webinars everyday. We do Daily Technical Videos, Elliott Wave Trade Setup Videos and we have a 24 Hour Chat Room. Our clients are always in the loop for the next market move. Try Elliottwave-Forecast for 14 days !!! Just click here –> 14 day trial

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on social media for updates and questions> @AidanFX A trader should always have multiple strategies all lined up before entering a trade. Never trade off one simple strategy. When multiple strategies all line up it allows a trader to see a clearer trade setup. We at EWF never say we are always right. No market service provider can forecast markets with 100% accuracy. Only thing we at EWF 100%, is that we are RIGHT more than we are WRONG. At Elliottwave-Forecast we cover 78 instruments (Forex, Commodities, Indices, Cryptos, Stocks and ETFs) in 4 different time frames and we offer 5 Live Session Webinars everyday. We do Daily Technical Videos, Elliott Wave Trade Setup Videos and we have a 24 Hour Chat Room. Our clients are always in the loop for the next market move. Try Elliottwave-Forecast for 14 days !!! Just click here –> 14 day trial

The post EURAUD : Catching the 420 Pip 1:7 Risk/Reward Move Lower appeared first on Elliott Wave Forecast : Analysis and Trading Signals.