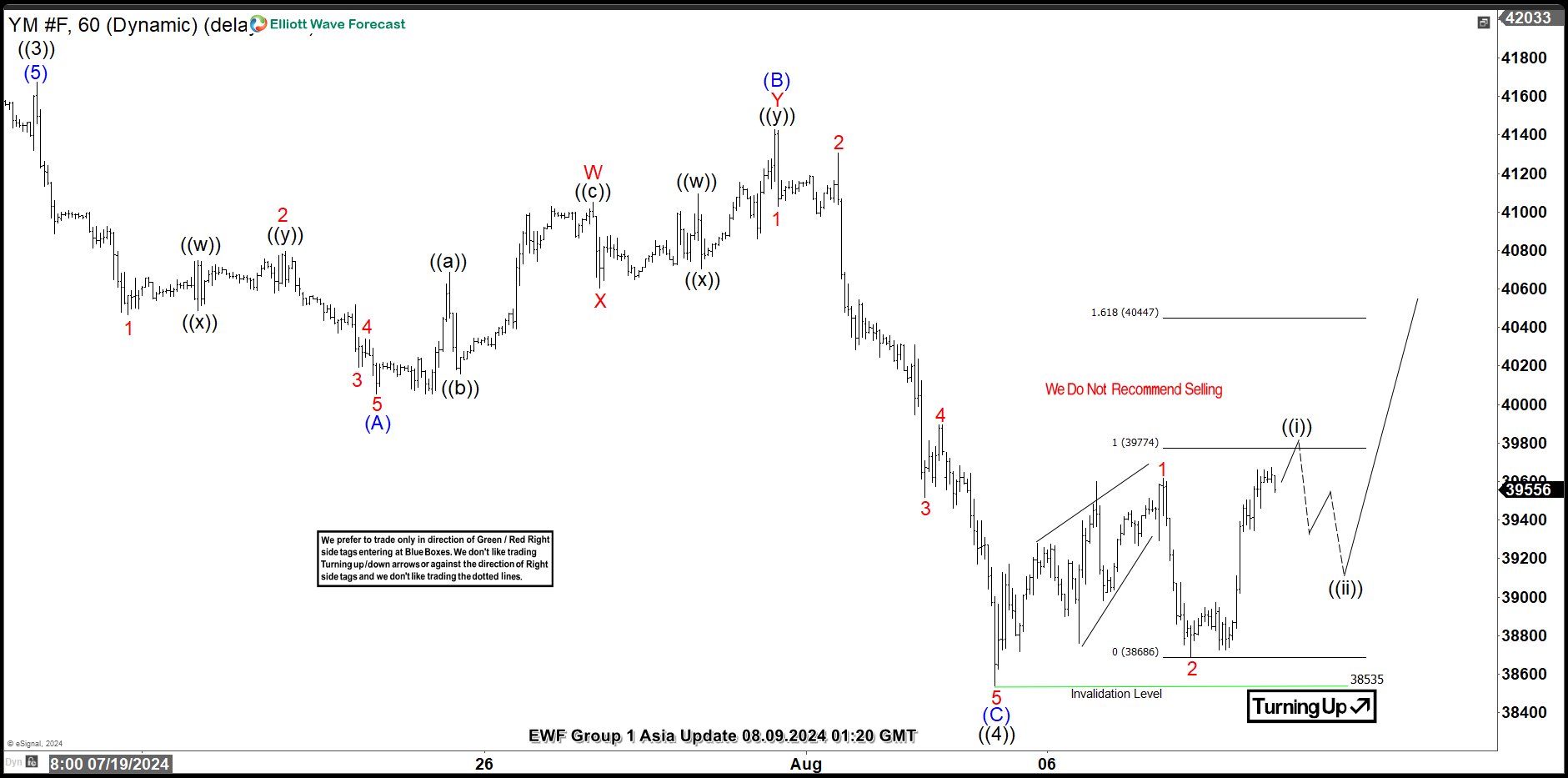

Short Term Elliott Wave View in E-Mini Dow Jones Futures (YM_F) suggests the trend should continue higher within the sequence started from April-2023 low as the part of daily sequence. It favors upside in wave ((5)) while dips remain above 38535 low. Since April-2024 high of (3), it starts to move sideways for almost 3 months to build a triangle structure. This triangle completed wave (4) at 39284 low. The market resumed the rally building an impulse as wave (5) ended at 41672 high and also wave ((3)) in higher degree. YM_F begins a big correction in July 18 high. Down from wave ((3)), the index did an impulse structure to complete a wave (A) at 40053 low. Then, the market did a bounce developing a double correction as wave (B). Up from wave (A), wave W ended at 41051 high. The connector (X) ended at 40606 low and last push higher completed wave (Y) at 41427 and also wave (B). The market resumed to the downside forming another impulse as wave (C) of ((4)). It placed 1 of (C) at 41028 low, 2 at 41305 high, 3 at 39518 low, 4 at 39880 high and finally 5 at 38541 to complete wave (C) and wave ((4)). While price action stays above 38541 low, we are calling for more upside to continue the rally as wave ((5)).

E-Mini Dow Jones Futures (YM_F) 60 Minutes Elliott Wave Chart

YM_F Elliott Wave Video

The post Elliott Wave Intraday Analysis: YM_F should Resume the Rally appeared first on Elliott Wave Forecast : Analysis and Trading Signals.