The countdown for the next Bank of Japan meeting has started. Friday’s inflation report will play a key role in any possible announcement we get from the July 28 BoJ gathering. In the meantime, the yen has managed to record a correction against the euro lately, but a resumption of this pullback depends on inflating the various BoJ expectations.

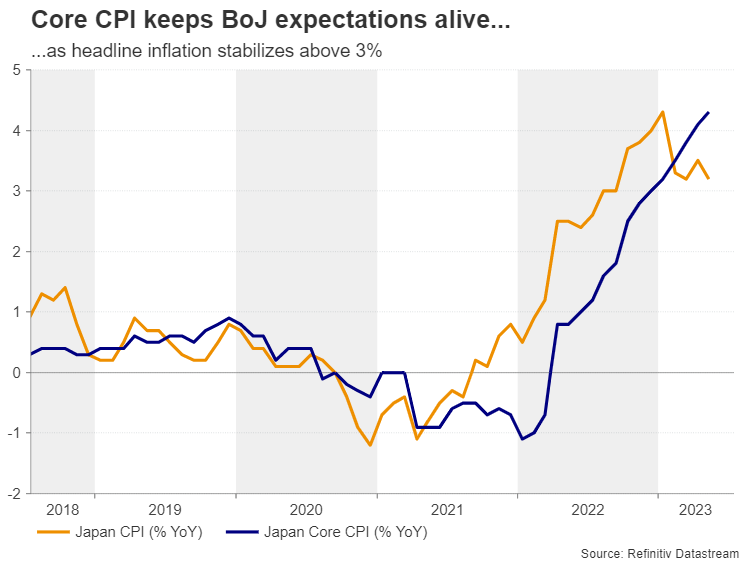

The inflation report for June 2023 will be published on Friday morning. The market expects a small acceleration at the headline figure but a small drop at the core index, matching the late-June downside surprise at the Tokyo CPI print. More specifically, the headline is forecast to record a 3.5% year-on-year increase, up from May’s print of 3.2%. Crucially, the core subcomponent is seen at 4.2%, a tad below the previous month’s figure but above the 3% threshold for the seventh consecutive month.

It is hard to believe that the US headline inflation is currently below the Japanese inflation, with the usual caveat of the different weights used in the construction of these indices. Having said that, the recent Japanese CPI levels have not allowed the BoJ to make any changes at its yield curve control framework and/or its interest rate profile in the first four months of Governor Ueda’s tenure. However, the market is rife with speculation that the BoJ has reached a critical stage, especially following last week’s upside surprise at the May labour cash earnings figure and with the core CPI component being north of 3%.

A good part of the growing expectations for a BoJ announcement next week was based on the speculation that, in agreement with the Japanese finance ministry, the BoJ would act in order to halt the continued underperformance of yen against other major currencies. The yen, though, has managed to record a correction recently, especially against the US dollar, thus temporarily removing a heavy burden from BoJ’s shoulders. Therefore, next week’s decision will probably be a pure monetary policy decision based on the inflation outlook and the updated projections that will be released after the meeting.

In the meantime, BoJ members are keeping their cards very close to their chest. Governor Ueda continues to highlight that they have not reached their target of sustainably achieving 2% inflation. However, a strong inflation show on Friday morning should allow some of the BoJ hawks to become more vocal.

Euro/yen again above the 155 level again

Should Friday’s CPI report surprise on the downside – for example if the headline CPI drops below the 3% threshold for the first time since August 2022 – the BoJ hawks’ wings will probably be significantly clipped. In this scenario, the yen will come under renewed pressure with the euro bulls targeting the 16-year high of 157.99.

On the other hand, a positive set of figures on Friday, and particularly if the core component makes a new high, should help yen bulls to record another correction. A successful break of the June 23, 2023 low at 155.05 would open the door for a retest of the March 24, 2023 upward sloping trendline.