-

Netflix reports financial results on Wednesday after the closing bell

-

Revenue and earnings set to grow despite stock slide in Q3

-

Valuation at considerably high levels

Poor third quarter jeopardises a solid year

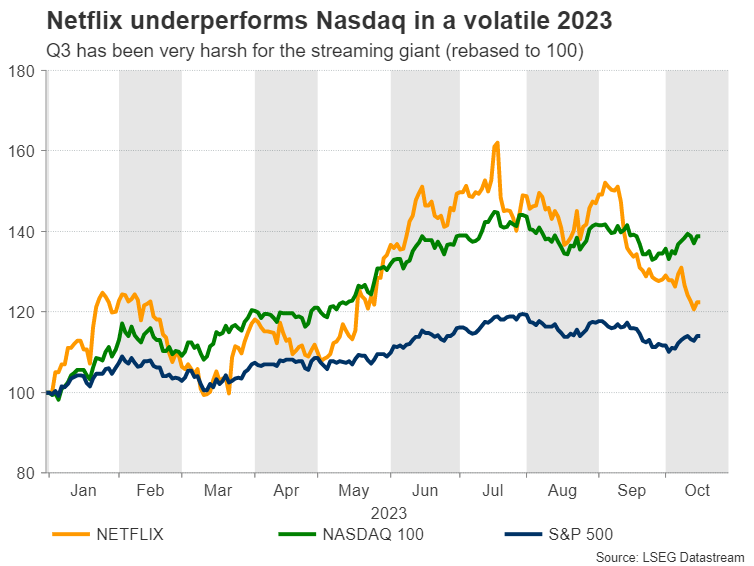

Undoubtedly, Netflix has been the best performer in the streaming sector in 2023 as its competitors have been struggling to achieve profitability. The online streaming giant’s share price had gained more than 60% in the first half of the year, but it has been in a constant decline since its Q2 earnings call, currently being around 23% higher year-to-date.

In its effort to retain its pandemic performance, Netflix was forced to shake up its business in late 2022 and proceed with groundbreaking changes in its strategy to reignite subscriber growth and increase monetisation of its services. Even though financial metrics have been endorsing management’s initiatives, it seems that markets had priced the stock for perfection, thus the latest pullback could be attributed to the bar being set extremely high.

The quarter of truth

The upcoming earnings call is likely to provide markets with substantial insights on whether Netflix’s restructuring plan is delivering the expected results. Firstly, investors will be able to assess how the crackdown on password sharing has impacted both revenue and net subscriber figures. Meanwhile, the streaming giant has launched a wide range of pricing tiers to ensure that violators would not be tempted to continue sharing accounts.

Another centrepiece of the new strategy, the newly ad-supported segment, will exhibit its performance for the second time ever. Although the company has stretched that this is a long-term growth lever, a relative underperformance against the last quarter could have a devastating impact on the stock price. At the same time, the ongoing strikes in Hollywood might have played a big role for Netflix by lowering the firm’s operational costs for Q3. Nevertheless, in the longer term, the strikes could weigh on the content capacity.

Solid financials

The entertainment powerhouse has spent a lot of cash in recent quarters for the expansion and diversification of its business operations, with markets expecting the firm’s strategy to start coming to fruition from Q3 onwards. For the examined quarter, Netflix’s earnings per share (EPS) are expected at $3.49, which would represent a 12.56% increase on an annual basis. Meanwhile, revenue is anticipated at $8.53 billion, marking a 7.70% jump against the same quarter last year

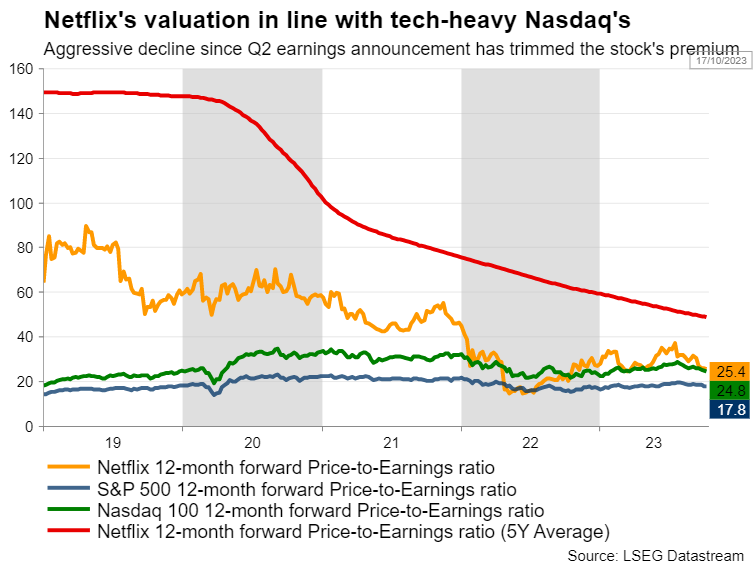

Valuation corrects retaining minor premium

At current levels, Netflix’s valuation suggests that investors continue to bet both on the firm’s status within the streaming sector and its long-term growth prospects, albeit not as much as they used to in the past. Specifically, the 12-month forward price-to-earnings ratio, which denotes the dollar amount someone would need to invest to receive back one dollar in annual earnings, currently stands at 25.4x, appearing relatively inflated compared to heavy-tech Nasdaq’s figure of 24.8x.

Although Netflix retains a premium against both its competitors and Nasdaq, its valuation is significantly lower than its five-year average, with the latter declining rapidly. So, this could either mean that Netflix is currently trading at attractive levels or investors are pricing in lower growth prospects.

Can the retreat halt?

From a technical standpoint, Netflix’s share has been trending lower since mid-July, erasing a big part of the first half’s rally. On October 10, the price dropped below its 200-day simple moving average for the first time since November 2022, appearing unable to reclaim this crucial technical zone.

Therefore, if earnings surprise to the downside, the price could extend its retreat towards the $350.00 hurdle. Should that barricade fail, the attention could shift to the May low of $317.00.

Alternatively, an upbeat earnings announcement could propel the price towards the recent resistance of $395.00, a break above which may bring the September high of $453.00 under examination.