The website hosted by this proprietary trading firm is certainly well conceived, interesting and attractive. A lot of attention was given to creating a brand identity that stands out from the competition.

But are the trading conditions really that great, or is it all just a flashy presentation? See our take on this prop trading firm in our Bullo review.

| General information | |

| Name | Bullo / Bullo Platforms LLC FZCO |

| Type of the company | Prop firm |

| Regulation status | Unregulated / Not required |

| Warnings from Financial Regulators | N/A |

| Website link | bullo.com |

| Active since | 2024 |

| Registered in | UAE |

| Contact info | Dubai Digital Park, Dubai Silicon Oasis, Dubai, United Arab Emirates

hey@bullo.com Online form |

| Trading platforms | TradeLocker |

| Majority of clients are from | Italy, India, Spain, United States, Pakistan |

| Customer support | 24/7 |

| Compensation fund | No |

Who Owns Bullo Brand?

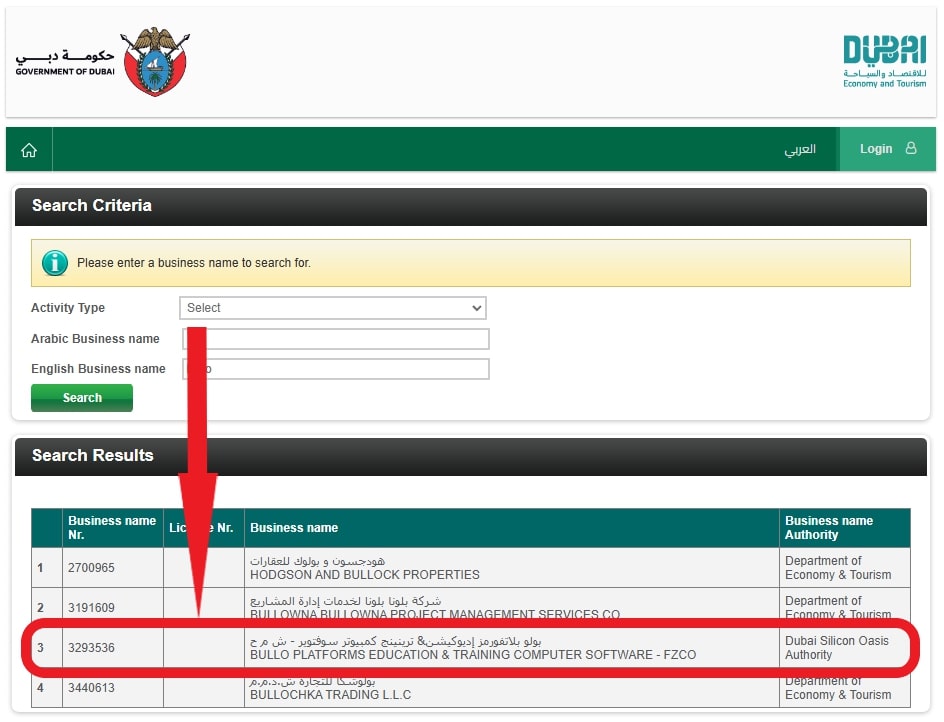

The content seen on the bullo.com website, as well as the website itself is owned and operated by Bullo Platforms LLC FZCO. It is a company incorporated in the UAE, more accurately in Dubai, as can be seen within the Dubai Economy and Tourism business registry.

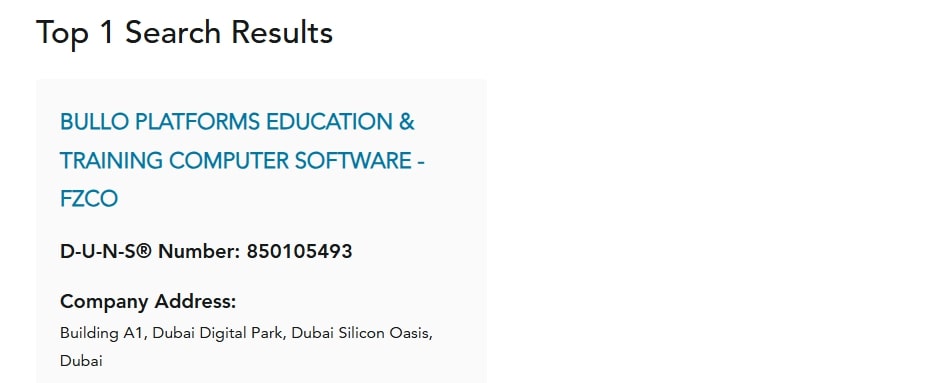

Additionally, the Bullo prop firm is entered into the international Dun & Bradstreet business registry. The unique D-U-N-S number confirms the corporate identity.

As proprietary firms do not fall under strict regulation, this is proof enough of the Bullo legit status. The firm is also registered with Dubai International Free Zone Authority, although this information cannot be verified online. The company does not disclose their partnered broker, however, which raises some concerns.

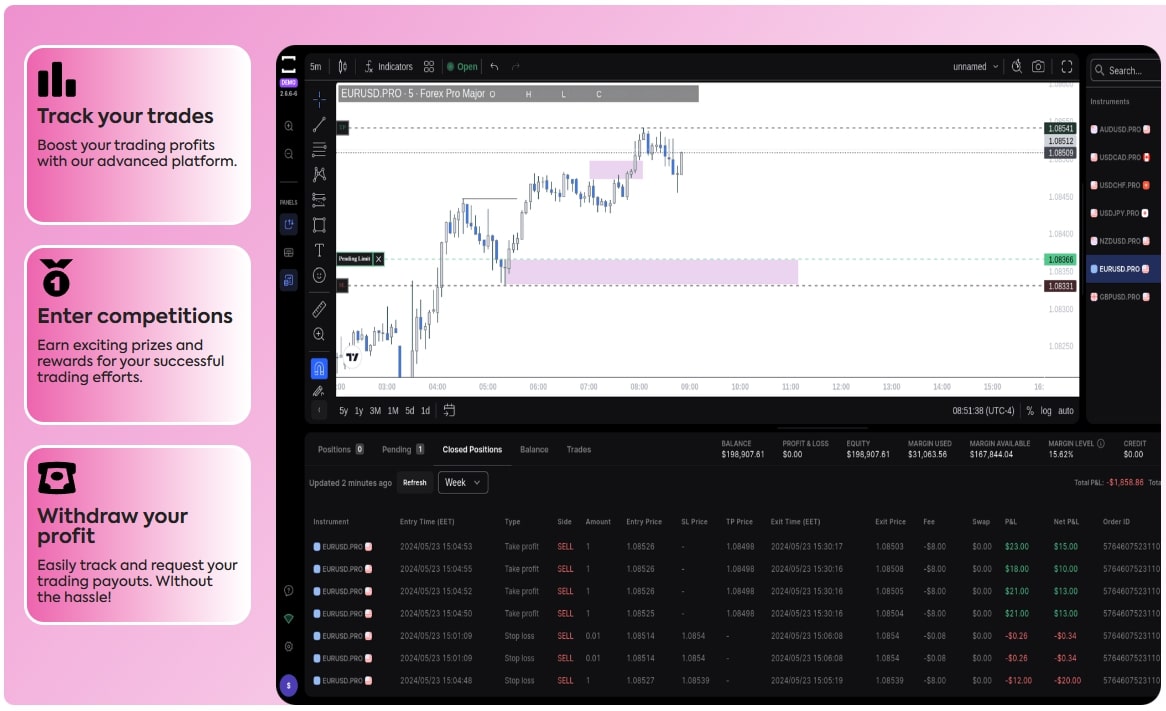

Bullo Platform Overview

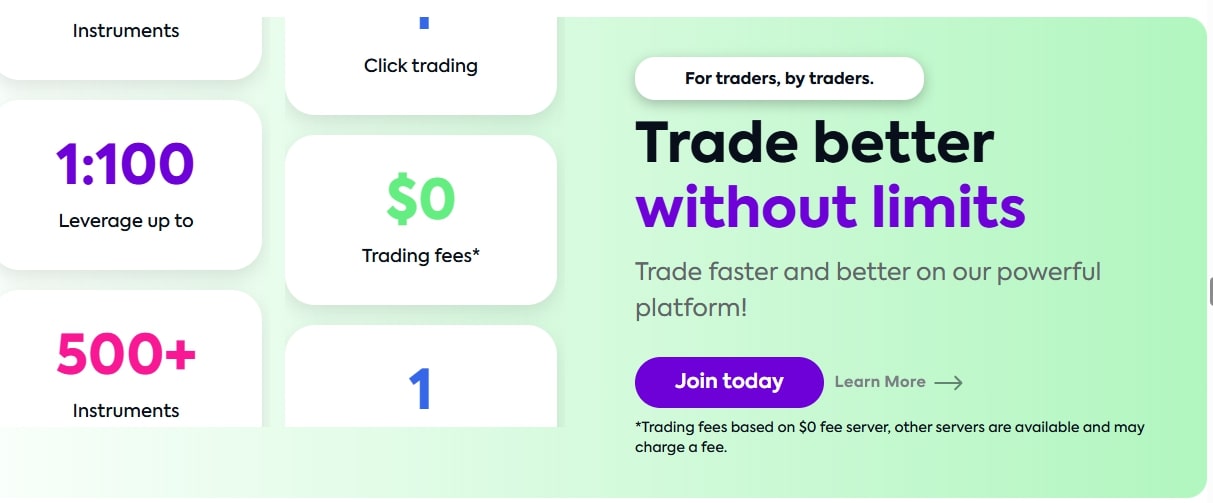

For simulated trading, the leverage can go as high as 1:100, which is over the legal limit in many nations. The firm states that they do not provide actual trading in MIFID II countries or the US. Trading fees depend on the server, with 0% on select servers.

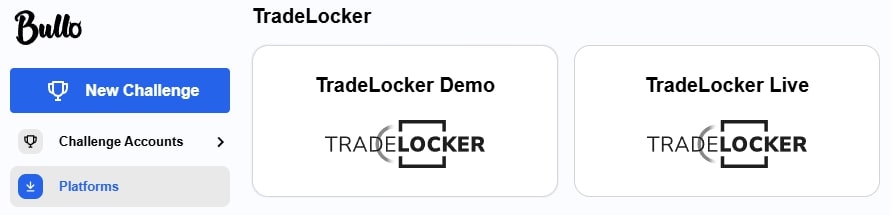

The Bullo platform itself is TradeLocker, a less popular solution. The software is regarded by the Reddit’s trading community as being less reliable then competitors like MT4, MT5 or cTrader.

There’s one problem, however – the app itself is inaccessible with a free account. Clients are supposed to make a purchase before they can even preview it through a demo interface. The info on the website is merely illustrative, with no interactivity whatsoever.

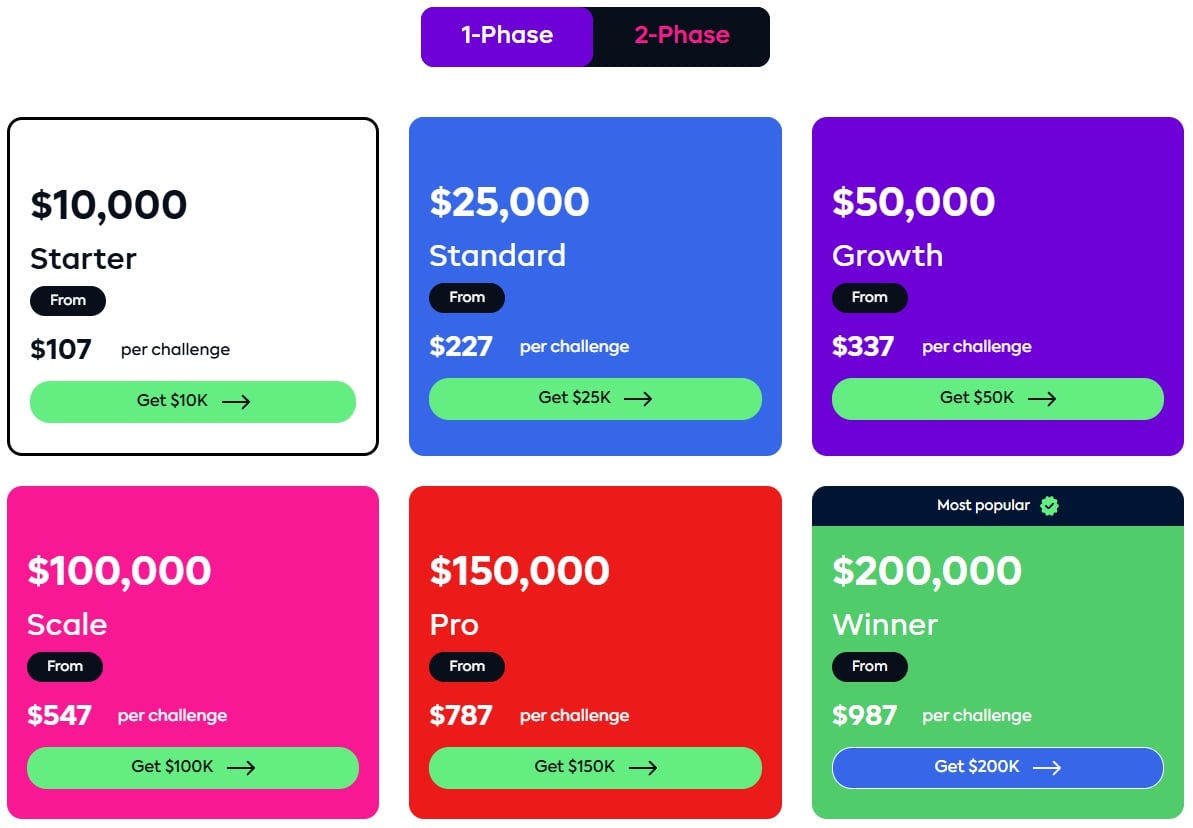

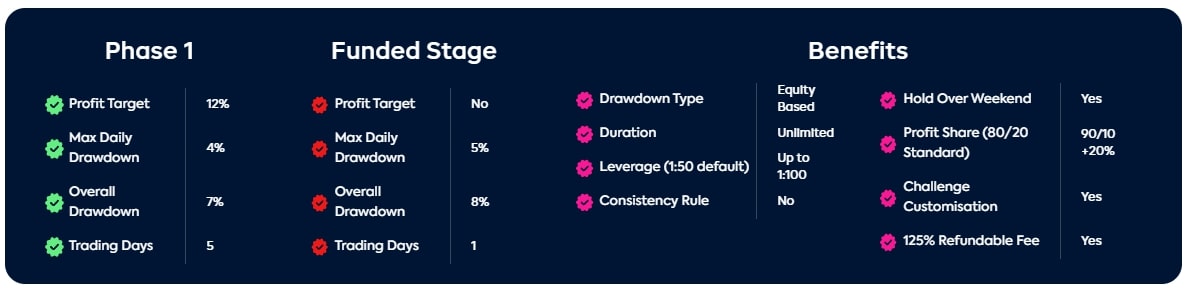

Clients gain access to a Bullo funded account after completing one of the challenges. These are divided into 1-phase and 2-phase evaluation plans. Here’s an overview of 1-phase challenges:

While the prices are not exactly cheap, it’s worth noting that the company offers a high amount of funding. The requirements for completion of 1-phase evaluation challenges are quite strict when it comes to drawdown:

One thing that undermines the whole image of a reliable business venture is the unfinished state of the website. Granted, the platform was launched only in 2024, but the developers could have at least grayed out the inaccessible portions of the site. This is not something you’ll find with reliable firms like Andreas Capital.

With all that in mind, the company enjoys a good reputation in Bullo reviews. On TrustPilot, the firm has only 2% negative reviews, and has responded to each one so far.

How to Request a Payout?

Traders funded by this prop firm can expect a starting profit split of 80%. This scales up to 90% after reaching certain milestones.

The advertisements on the website make multiple claims of lightning fast payouts. The Terms & Conditions, however, state that it may take up to 5 business days or longer to process a request.

Bullo payout providers are Arise and AstroPay, less popular but reliable payment processors. The firm allows payments through several channels, including cards, bank transfers, e-wallets and crypto wallets.

One thing that is worth nothing about payouts is that per terms and conditions, no customer is entitled to a payout. Payments are all conducted at the discretion of Bullo Platforms, the owner of the site, which may create some friction with the clients. See our review of Accelerated Prop Group to see why this is concerning.

If you’re looking for a reliable prop trading firm, take a look at what we have to offer as well. We are ready to provide as much as $180,000 in funding to talented traders.

FAQ

What is Bullo?

It is a proprietary trading firm based out of Dubai, UAE. The firm is a new arrival to the scene, but is enjoying a good reputation so far.

Is Bullo Legit?

Yes, the company is registered with all relevant authorities and is operating within their legal boundaries.

Who Owns Bullo Prop Firm?

The prop firm is owned and operated by Bullo Platforms LLC FZCO.

The post Bullo Review: Can Trusting a New Firm be Good For Business? appeared first on Fundevity.