Building the WatchBox Brand

Having placed his company on a successful growth trajectory, co-founder and CEO Justin Reis is now ready to focus on expanding the brand’s global reach and creating awareness of and investing in watchmakers, with the aim of uplifting the industry.

For his friends who grew up with him in Singapore, Justin Reis has always been the perfect student. Says Matteo Mango who went to high school with him, “He always got the best grades; he was amazing at math; he was always the guy that we knew would succeed. At the same time, he was always humble, soft-spoken and understated. Even at that age, he was the consummate gentleman.” Reis went on to a successful career in finance before he, along with Danny Govberg and Singaporean retailer Tay Liam Wee, founded WatchBox when they identified that the pre-owned or secondary watch market was potentially larger than the primary market. But after a few years finding their feet, it was clear that WatchBox needed some dynamic impulse to truly kick over into high gear. That happened when Reis was appointed the company’s CEO and moved to the company’s headquarters in Philadelphia.

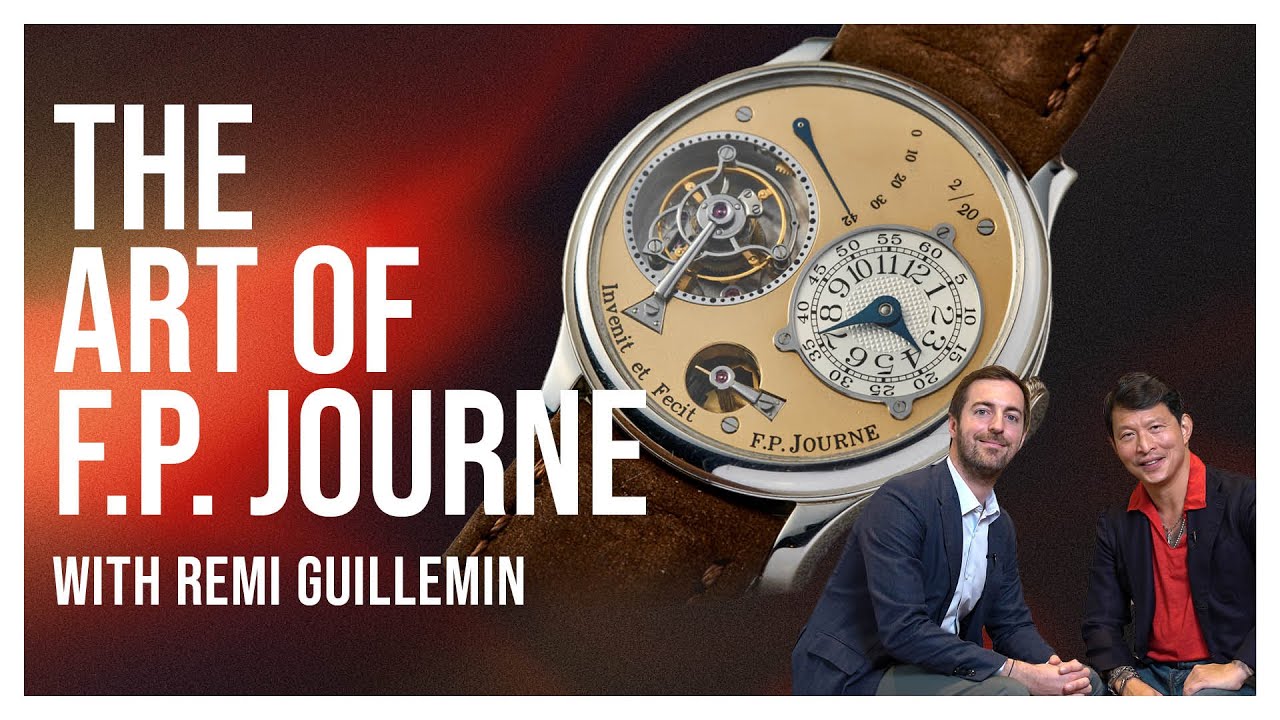

Says Lee Chong Min, one of WatchBox’s board members and early investors, “WatchBox really became successful and accelerated when Justin moved to the U.S. and began working closely with Danny [Govberg]. They are incredibly complementary and, together, they took the visionary stance not simply to be a pre-owned player but to dominate the high-end category and become key tastemakers and communicators.” It was in Philadelphia where Reis demonstrated his capacity to learn, assimilate and innovate with extraordinary speed and efficiency. Soon, WatchBox was not just a key secondary market player, but had a decisive role in championing independent watchmakers like François-Paul Journe, H. Moser & Cie., Greubel Forsey, and more.

In 2021, they unveiled an even more ambitious strategy with the announcement by their parent group of the acquisition of De Bethune. Within a short time, they had demonstrated the power of WatchBox by transforming the brand into one of the hottest properties in the horological stratosphere. Such was the rising collectibility of De Bethune watches that they surged dramatically in price on the secondary market. But even more impressively, Reis and WatchBox demonstrated what no one had thought of — to harness the power of the secondary market to empower the creation of a new mini group. Sitting down with Reis, the biggest takeaway for me was his sincerity in creating true value for the watch industry and, in particular, for the collectors that comprise the WatchBox community. The fact that he has done so while still retaining a remarkable sense of humility and understatement — as an example, his office is on the floor amongst his staff and is no larger than anyone else’s — affirms that he is indeed the perfect gentleman.

How did the investment in De Bethune come about?

As you know, I didn’t start in the watch industry. So, when I got involved, I started looking at the various operators and entities that sit within the industry. I immediately found the independent watchmaking sector very interesting. The majority of them are actually quite handicapped by where they sit in the watch ecosystem, given their general lack of marketing and financial resources; hence, it is harder for them to succeed. Unless they really hit it out of the ballpark to begin with, it is a struggle for them. A lot of this has to do with the fact that most of them don’t have adequate starting capital. As such, they are unable to market their brand powerfully, and they don’t have the infrastructure to distribute globally. When they are able to find distributors, these distributors often dictate terms that are unfavorable to them. Basically, the watch world is not really set up for independent brands to succeed.

Our focus became finding really interesting brands and watches for our clients. At WatchBox, we are surrounded by a team that really loves watches, which Danny leads admirably, and we eventually landed on the independent watchmakers. This segment really resonated with me, as I have always liked to support the underdog. I wanted to find a way to help promote them so they would be as respected and recognized in the same realm as the leading watch manufacturers. We asked ourselves, how can we be supportive of the category, bring great product to our audience, while also creating much greater awareness for these brands and watchmakers? Well, the first thing was to identify what was truly great. That was when we recognized how special De Bethune and Denis Flageollet are. De Bethune is such an incredible brand with unique DNA, and we felt we could help it reach its full potential with support building global awareness and help architecting a more effective distribution model.

Interestingly, this was never part of our original strategy when we started WatchBox. But it became clear there would be great synergy if we invested. We provided them the capital they needed and connected them with our family of customers. We have no intention of disrupting what they do; we just wanted to give them our support and shoulders to sit on.

There were initially some skeptics when the acquisition was announced last year. How do you think people regard it now?

Of course, there were naysayers when we first announced our investment, but we have always believed in letting our actions speak to what we do. And so, the doubt was short-lived. What we’ve really tried to do is help build the brand’s profile and their credibility in the market where they were underrepresented and introduce them to collectors they don’t normally speak to. What we have seen is that this is a really strong, mutually beneficial relationship. I think that their CEO Pierre Jacques has done a phenomenal job, and he and Danny work really well together. We’ve seen the success for the brand in the United States now in terms of awareness, collectibility and also the considerable increase in secondary market prices — though I would put this more as a correction in their secondary prices, as there was a period where their watches were very undervalued. However, many of the strongest brands also had periods of vulnerability; they just took the requisite steps to ensure the market correctly reflected the true value of their watches.

I am sure what everyone wants to know is, how does WatchBox rapidly increase the secondary values of watches from brands like De Bethune?

WatchBox as a company, and as individuals, does not dictate the market value; however, we do contribute to the environment in which these watches are sold. If you look at independent brands, they are in general set up to produce a relatively small number of watches a year.

Frankly, none of us want this to change—it is important to keep the quality and rarity of their watches intact. It has been challenging for independents like De Bethune in the past, in that they have to spend a lot of time and energy to form a management team that is out there selling their watches. If you want to use the analogy of a sporting event, what WatchBox does best is fill the seats in the stadium; we create the buzz and the energy which allows the independent watch brands to do what they do best — to create extraordinary watches that make us dream.

So, this is really an easy partnership. We work on two things: The first is creating awareness and bringing real content creation to the brand; the second thing is helping them bring economics back to themselves to create a strong sustainable brand for the future. Putting them on a stronger footing lets them be able to negotiate the best win-win arrangement with retailers. The brand is no longer worried about selling its watches for immediate capital return; now they can think of how to place their watches in a way that best strengthens their brand equity.

So, a big part of it is educating the customer about the appeal of a brand like De Bethune?

Yes. The increased awareness we create about the brand means greater demand for the watches. This greater demand means that the brand is able to get the pricing (both primary and secondary) that they deserve. Because discounting is the death of brand equity. Once you have this strengthening of pricing, the result is an increase in brand equity. Then their relationships with their retailers change, because the retailers essentially act now as allocation experts, placing the watches with the best collectors, which in turn only strengthens the credibility of the brand. So, you could say we support the uplifting of the brand equity of independents, and everybody wins in this scenario.

Danny has spoken about the changing dynamic of a traditional retail network in today’s climate…

We launched WatchBox just five years ago, and the changes we have witnessed in this relatively short period have been monumental. Given the strength in today’s market, the brands don’t actually need the retailers to sell their watches. However, I also recognize that there is a lot of loyalty built up over the years between brands and their retail partners, who tried to support them when things were more challenging. I respect this loyalty. I admire this and, of course, support the brands also wanting to respect this loyalty, even though the power dynamic has now changed — for example, for De Bethune.

My approach has always been to approach what we support with total sincerity. When we began to support Journe, it was because we truly loved the watches. We recognized that he was a genius and considering their relative rarity, we felt the watches were undervalued. It’s the same thing with De Bethune; what we strive to do is introduce the brand and their watches to our entire network of collectors. But what is of paramount importance here is that our collectors trust us. We’ve had relationships with many of them for years. We partner with them in their collecting journeys. That is the foundation of the trust between us. Because they know we are discerning, that when we recommend something like De Bethune, it is because the watches are genuinely extraordinary and the work of a living genius who is Denis Flageollet. To us, that trust is the most important part of our business.

You mentioned when you support a brand, it’s a win for everyone. Please elaborate.

Yes, it is absolutely a win for everyone. The watchmaker no longer has to worry about keeping the lights on at his factory and can instead focus on creating the most beautiful watches possible. Because we’ve done our job introducing the brand to our clients and creating maximum awareness and educational content, the demand for the watches increases. This means that the retailers can focus on the often-difficult task of placing the watches with the right clients. Because secondary prices are so strong, there will not be discounting on primary watches, and this is the ideal situation for a brand. This also ensures their continued success in any market condition, when times are good or bad. They are insulated because demand for what they create will exceed the supply they are able to generate. And the client also wins because he is able to purchase a watch that is truly a work of art backed by amazing authenticity. And as an asset, he’s seen the value of his watch appreciate, oftentimes quite considerably.

In the past, many independents created beautiful watches but were so undercapitalized that they couldn’t communicate their value, and so demand was low. This made them desperate to sell their watches, which in the end were discounted by retailers and all this created poor secondary values for them. The end result was damage to their brand equity.

When we spoke last year, you had 300 million dollars in annual revenue and double digit EBITDA margins. How do you get such amazing margins on pre-owned watches?

We spent the first three years really investing in the infrastructure to support a business of this size and bigger. That is so that we didn’t have to incur high variable costs as we expanded. This investment was significant because we have to be able to authenticate, service where needed, and polish every watch that comes to us before putting it to market. For many secondary businesses, they allocate a lot of energy to finding watches. For us, because we were able to grow our customer base, the super majority of our inventory actually comes to us through end customers. That’s given us a huge advantage in being able to source great product from great collectors that trust us.

We also knew that we had to price watches competitively in order to keep customers returning, so our pricing strategy is a very transparent one. The most important thing for us was to focus on the high value collector who is making watch purchases in the range of 20,000 US dollars and above. One of the key factors in this was building a portfolio of inventory that really attracted that customer. If you focus on buying inventory that retails for between 3,000 and 5,000 dollars, that’s where your business will be. We took a riskier approach by investing in inventory at a much higher price point.

When we first started, we definitely covered all spectrums in terms of price. But looking at us today, you can see that our average price point is 25,000 dollars. A few years ago, that was 8,000 dollars, so we made a concerted effort to refocus on the high end. We pay very close attention to anyone that is purchasing anything from us at a higher category, but at the same time, we welcome and love collectors at every price category. Because for a lot of people, they start their collecting journey with something more accessible but can also grow very rapidly from there. We like to act as advisers to our clients throughout their journey. As a company, we have been very disciplined in terms of where we put our energy and resources. We recognize that the high-end client was in fact under-served and set out to make WatchBox the primary destination for them. We wanted to become the dominant player in this segment.

You have recently attracted investment from some real legends, such as Michael Jordan. How did this come about?

From the very beginning, we wanted to build our community around the passion for watch collecting. When I came over to WatchBox, it became very clear to me that we didn’t want just transactional customers. What we wanted was to convert these customers into real collectors. We spend a great deal of time studying customer buying behavior, and what you can see is when someone becomes a true collector, their engagement is at a totally different level. We recognized that many of these customers were coming to us from sports and media. Now when we built the company, we did it differently from others. We built it in an inverse way compared to traditional venture capital companies. What they normally do is build a brand very quickly, then build the infrastructure over time. You allow the customer to come in and then pivot to a profitable business. We did the opposite — we built the infrastructure, focused on profitability and then built the brand.

It is always challenging to acquire the customer when the brand comes last. So, one of the KPIs we set ourselves was to build the WatchBox brand over the last 24 months. I moved to the United States because that was a lot easier to do here. One of the things I realized was, all these famous names that we know and respect were actually accessible to us because these individuals were our customers and genuinely loved watches. Once we made the connection with these guys, it was really easy to strike up a conversation because of the passion we shared. Once they learned more about the business, for them it wasn’t even about the investment; they just liked the association with the company and our platform. One relationship led to another. With this most recent fund raise [in November 2021, it was reported that WatchBox had raised 165 million dollars in equity capital to support its expansion plans], it was really rewarding to bring on board a group of investors that became friends. I would like to stress none of these are pay-to-play relationships. They were just there to invest and be genuinely helpful to the company. We are super fortunate to have this.

What is the biggest lesson you’ve learned since you co- founded WatchBox?

I didn’t come from the watch industry, so it has been an education for me. One of the first things I learned was that the brands are all very much intertwined in a systemic relationship. But one surprise is that the industry can be very political. It is sometimes not the friendliest relationship between the various participants compared to other industries I’ve been involved in. What I try to promote is my firm belief that there is plenty of space for everybody. When I meet brands or watchmakers, I like to express that we should be an inclusive community. If there is any one thing that I hope changes in the industry is this mentality of traditional competition. We should be helping each other because we as an industry will benefit tremendously if we scratch each other’s backs a little bit more. To believe that the watch business is a zero-sum game is not correct. We have seen that the growth in this business has come from the massive increase in new customers coming to watches. I firmly believe that we are still in the beginning.

Why are watches different from other luxury products?

You see, we were surrounded for so long by commoditized luxury. But people behave very differently when you put a watch in front of them. Because here you suddenly have an object that goes far deeper than something purely material. People in this hobby are driven by knowledge, and you can see when knowledge passes from one group to another how quickly its spreads.

Let’s use De Bethune as an example. Once the first group of our customers understood how innovative, unique and amazing it was, the passion for the brand spread quickly and organically, and that was awesome to see. Our responsibility is to cultivate this emotion and passion in this space. The truth is that men are looking for something to latch on to, but they will never find anything as unique as a watch. We as male consumers use it as a point of connection. If I see someone in a Berluti store wearing an F.P. Journe, I’ll go over and talk to him. We recognize a shared philosophy as human beings— we want to build positive connections through what we love. But at the same time, the watch is a better self-expressive device than anything else — more than cars, houses, art, boats. It is so transportable; you take it with you everywhere. It’s so personal because you wear it on your wrist all the time. It endures forever. So, there is nothing else like a watch.

Why has watch collecting spread so fast to the general public?

There has never been a better time to be a watch collector, because firstly, the knowledge is available everywhere online and on social media. The key to being a great collector is empowering yourself with knowledge. That’s what we like to promote at WatchBox, and today there are innumerable sources for that information. What is amazing is on social media you have guys who are 15 years old to 80 years old, all speaking the same language. That’s very rare today and will only lead to a more vibrant, dynamic world for watches.

What does the future hold for WatchBox?

I feel that we shouldn’t pigeonhole ourselves. To have the freedom to invent and reinvent ourselves is one of our greatest assets. How I look at it is like this: At WatchBox everything begins with the customers and the community. If we start to build keeping this in mind, it helps to define our trajectory for the future. If we always keep in mind our collectors and what they are looking for, everything becomes much clearer. Then we can see the opportunities that allow us to build WatchBox into a much larger business.

For example, we recognize that even in the age of online and social media, we still want to have a physical connection with our community. This gave rise to the idea of our Collectors Lounges. These are mini–Soho Houses where our community can gather and have fun. It’s an inclusive environment where you feel really connected to your friends, and it’s all centered around watches. Because the intention is to set these up in key capital cities around the world, when you travel, you can go to any of these Lounges and you immediately feel you are at home, that you are connected to people there. At the same time, it strengthens the public’s bond with watches. Imagine if a friend brings you to one of our Lounges. You would say, “What is this community? This is really fascinating that people are all bonding over watches.”

Regarding investing in brands, we will continue to do so but on the condition that we recognize something special in them that we want to bring to our collectors’ community. That is a value add for all participants. We also think we can strive more to build greater media. We believe in building education into everything we do in a fun and enriching way. Finally, we would love to bring our collectors closer to Switzerland to give them the possibility to see where these amazing watches are created. We just want to be a key part in enabling and building this global community with the greatest passion and authenticity. We care and want to support the Swiss watch industry in the sincerest way.

MORE INSIGHTFUL INTERVIEWS

TECH SPECS

| Movement | Self-winding caliber A-500; 60 hours power reserve |

| Functions | Hours, minutes, small seconds, chronograph and date |

| Case | 42.5mm; titanium; water resistant to 30m |

| Dial | Salmon (6N gold plated) with gené or frosted area; Super-LumiNova filled Arabic numerals |

| Strap | Ballistic gray rubber; titanium folding clasp |

The post Building the WatchBox Brand appeared first on Revolution Watch.