-

Bitcoin posts fresh 18-month high on Thursday

-

Fed’s neutral stance boosts risk sentiment

-

Are cryptos reestablishing correlation with traditional assets?

Cryptos shine as Fed holds rates unchanged

Unlike what has been happening lately, macroeconomic forces were the main drivers behind moves in the cryptocurrency space this week. Specifically, Bitcoin and most altcoins surged after the Fed struck a less hawkish-than-expected tone on Wednesday, keeping rates steady for a second consecutive meeting.

Fed Chair Jerome Powell’s neutral remarks calmed some nerves in the markets, allowing Treasury yields to ease substantially from their recent multi-year highs, with the US Treasury’s decision to shift to shorter-term funding also providing some aid. Wall street cheered falling yields, dragging cryptocurrencies higher with it despite their recent correlation break.

Lately, Bitcoin’s performance has been impressive considering that it has gained almost 30% in October, in a period of declining stock markets, rising yields and heightened geopolitical tensions. So, after trading in their own world for quite some time, it becomes more striking that they are starting to respect macroeconomic developments when the latter are back on their side.

ETF approval the next volatility event

Undoubtedly, Bitcoin’s Autumn rally is fuelled by speculation that the Securities and Exchange Commission (SEC) is going to eventually greenlight spot-Bitcoin ETF applications, which in turn could trigger a wave of institutional demand. However, the persistent advance in the absence of any new developments is underscoring the case that crypto traders are positioning for a buy-the-rumour sell-the-news type of event.

Given that Bitcoin has more than doubled in the year, it is weird that there is no selling pressure from short-term investors at current levels. This could suggest that speculators are on the sidelines awaiting the official approval and its corresponding demand spike to capitalise on. Therefore, we might see another round of consolidation and low volatility until the final spot-Bitcoin ETF approval comes, unless cryptos start again to care more about the macroeconomic backdrop.

BTCUSD pulls back from 18-month peak

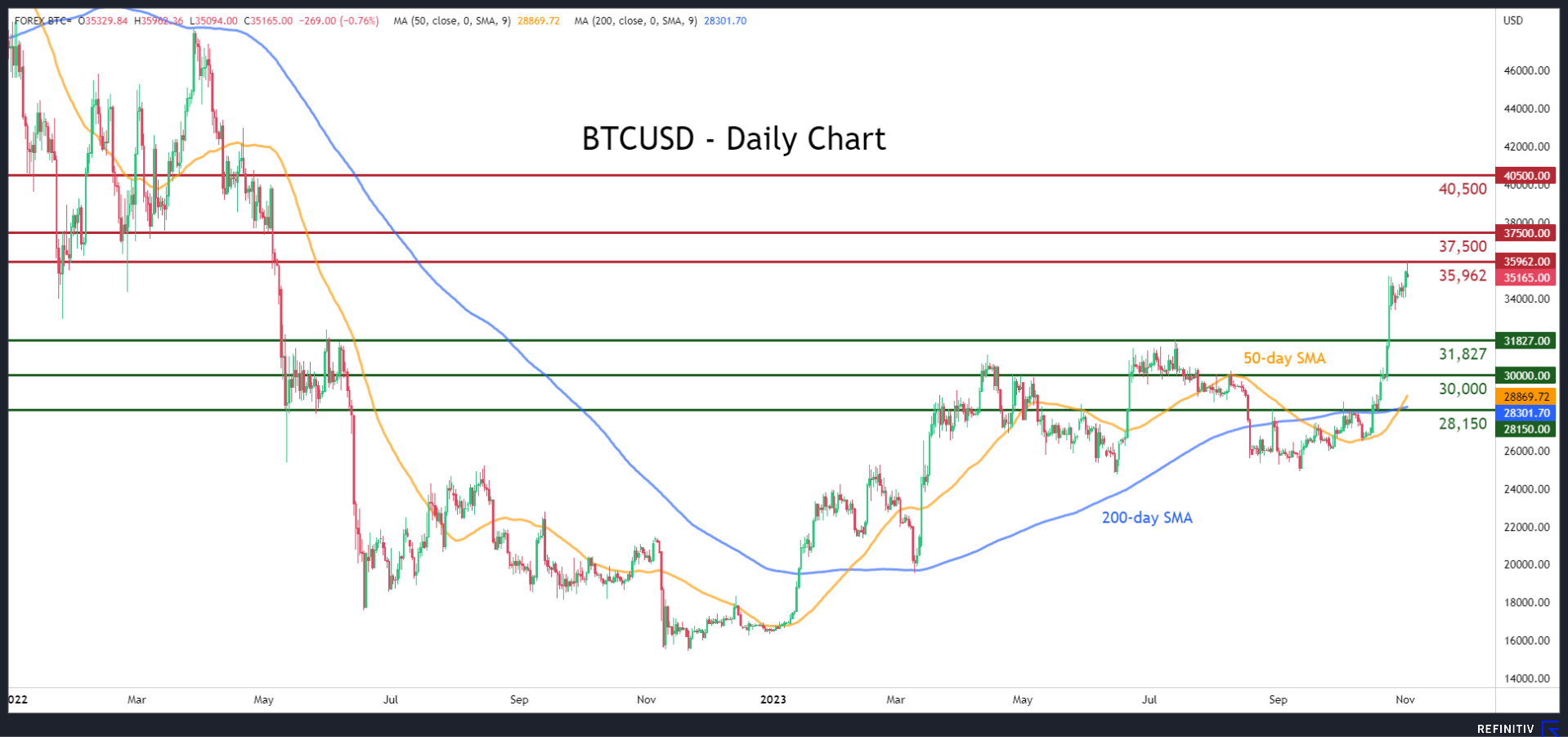

BTCUSD has experienced a massive rally in the short term, which propelled the price to a fresh 18-month high of 35,962 on Thursday. Even though Bitcoin seems to be deep in overbought territories from a technical perspective, the recent completion of a golden cross between 50- and 200-day simple moving averages (SMAs) could apply additional upside pressures.

If the price storms to fresh highs, immediate resistance could be met at the inside swing low of $37,500, registered in May 2022. Further upside attempts could then cease at $40,500, which acted both as resistance and support in the first half of 2022.

If the price storms to fresh highs, immediate resistance could be met at the inside swing low of $37,500, registered in May 2022. Further upside attempts could then cease at $40,500, which acted both as resistance and support in the first half of 2022.

Alternatively, bearish actions could encounter support at the previous resistance level of $31,827 ahead of the $30,000 psychological mark.