The global rise in digital payments has brought with it a booming market for virtual cards.

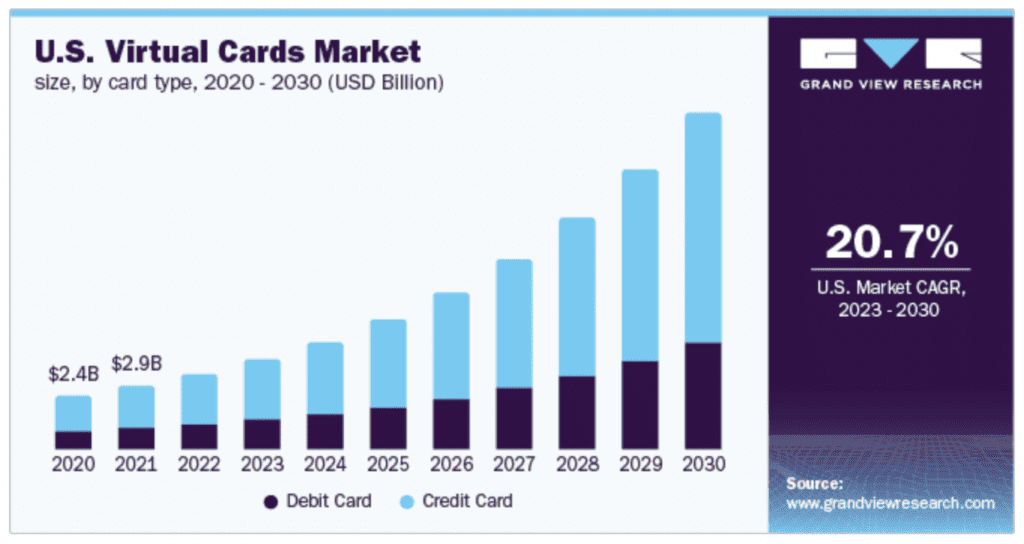

Driven by the ongoing adoption of smartphones, evolving payment technologies, and a desire for increased security, the global virtual card market is expected to reach a value of $9.1 trillion by 2027. If realized, this would represent a 280% growth from 2022, where the market size was found to be $2.4 trillion

According to a Mastercard Payment Index report, in May 2021, 93% of surveyed consumers used and preferred emerging payment methods involving the use of biometrics, digital currencies, and QR codes, in addition to contactless payment. As a result, payment providers are developing alternative solutions.

Virtual cards have provided consumers with an easily accessible, easy-to-manage alternative to the physical card. Digitally centric, it allows the user to simplify the payment process, as well as manage features such as spending limits seamlessly.

Juniper Research has found that B2B payments are likely to be the next driver of growth for virtual cards. The sector, already accounting for a large portion of virtual cards’ global transaction volume, is predicted to make up 71% of the value by 2026.

However, businesses, and their accounts receivable (AR) teams, have been met with an issue with the increased digitization of payments. While 90% of suppliers have said that they prefer digital payments, the speed has become overwhelming for many in a landscape of majoritively manual processes.

Accounts Receivables in virtual card future

According to a study conducted by Billtrust, almost half of the surveyed organizations send between 10,000-25,000 per month. AR teams spend the most time on cash application and reconciliation, credit, collections, payments, and invoicing.

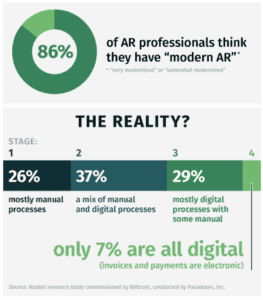

Despite the majority of AR teams stating that their processes are “modernized,” many continue to operate within a primarily manual environment. The study found that over 60% do not have a majority of their payments or invoices as digital, with nearly 30% of payments still being cash and paper checks.

As digital payment and virtual card adoption continue their growth, with B2B as its flag bearer, this could pose a significant issue, weighing teams down with an increased need for faster processing that could be greatly assisted by automation.

In response, Mastercard, in partnership with Billtrust, launched, on Monday, 25 July, their Receivables Manager, directly targeting a need for improved processing.

The new product bypasses the need to manually capture and enter virtual card details to reconcile the vast number of digital payments received.

Card payments from all issuers are consolidated, and the remittance data can automatically be matched to open invoices. It can also be formatted for their Enterprise Resource Planning (ERP) systems, potentially increasing the efficiency and accuracy of invoice reconciliation.

“We’re bridging the gap between buyers’ virtual card preferences and suppliers’ acceptance challenges by automating manual processes and transforming the way accounts receivable teams operate,” said Chad Wallace, global head of Commercial Solutions at Mastercard.

RELATED: Embedded finance/B2B convergence an important trend: Galileo report