- Australia’s headline inflation rate probably fell in Q3

- But monthly print might be more important after August uptick

- Can the aussie withstand a selloff from Wednesday’s data (0:30 GMT)?

Recent RBA decisions have been a close call

The Reserve Bank of Australia’s last few policy decisions have been a close call, but policymakers have nevertheless opted to keep the cash rate unchanged since June. Not closing the door to further hikes has spurred investors to price in at least one more 25-basis-point increase over the next few months. But ultimately, whether the RBA decides to tighten again will depend on the data.

And this is where it gets difficult for policymakers as the economic picture is no less blurry than it is for other central banks like the Federal Reserve. The Australian economy performed slightly better than expected during the first half of 2023, with quarterly growth averaging 0.4%. It’s likely, though, that Q3 growth will be somewhat lower if the PMI surveys are to be believed.

Is the decline in inflation stalling?

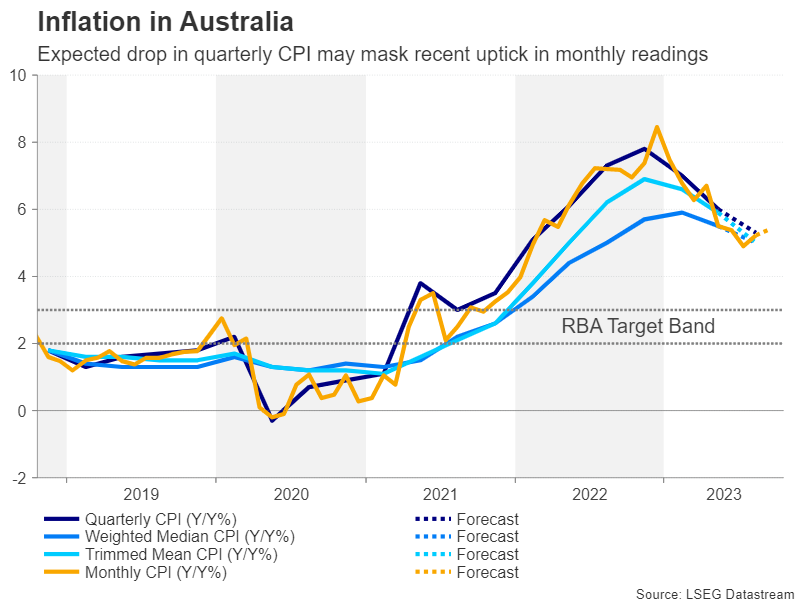

The good news is that inflation has been trending lower all year and it is projected to have fallen further in the third quarter from 6.0% to 5.3% y/y. The RBA’s underlying gauges of inflation – the weighted median CPI and trimmed mean CPI – are also expected to have declined during the quarter.

The problem is that on a monthly basis, inflation is creeping up again. It edged up to 5.2% y/y in August from the prior 4.9% and the forecast is for another acceleration to 5.4% in September. Most likely, this increase is down to higher fuel prices and will be temporary. However, following the recent escalation of violence in the Middle East, there’s an even greater risk that the rally in oil prices will be anything other than short lived.

Upside risks

Domestically, the tight labour market is another upside risk to inflation. The unemployment rate stood at just 3.6% in September and although wage growth has so far remained quite modest, a further drop in joblessness in the coming months is bound to raise concerns at the RBA.

In addition, the situation in China – Australia’s largest trading partner – appears to be stabilizing, possibly even improving. Moreover, with trade tensions between the two countries thawing lately, the China part of the equation could soon become a tailwind instead of a headwind. So where does all this leave the Australian dollar?

Aussie is swimming against the risk tide

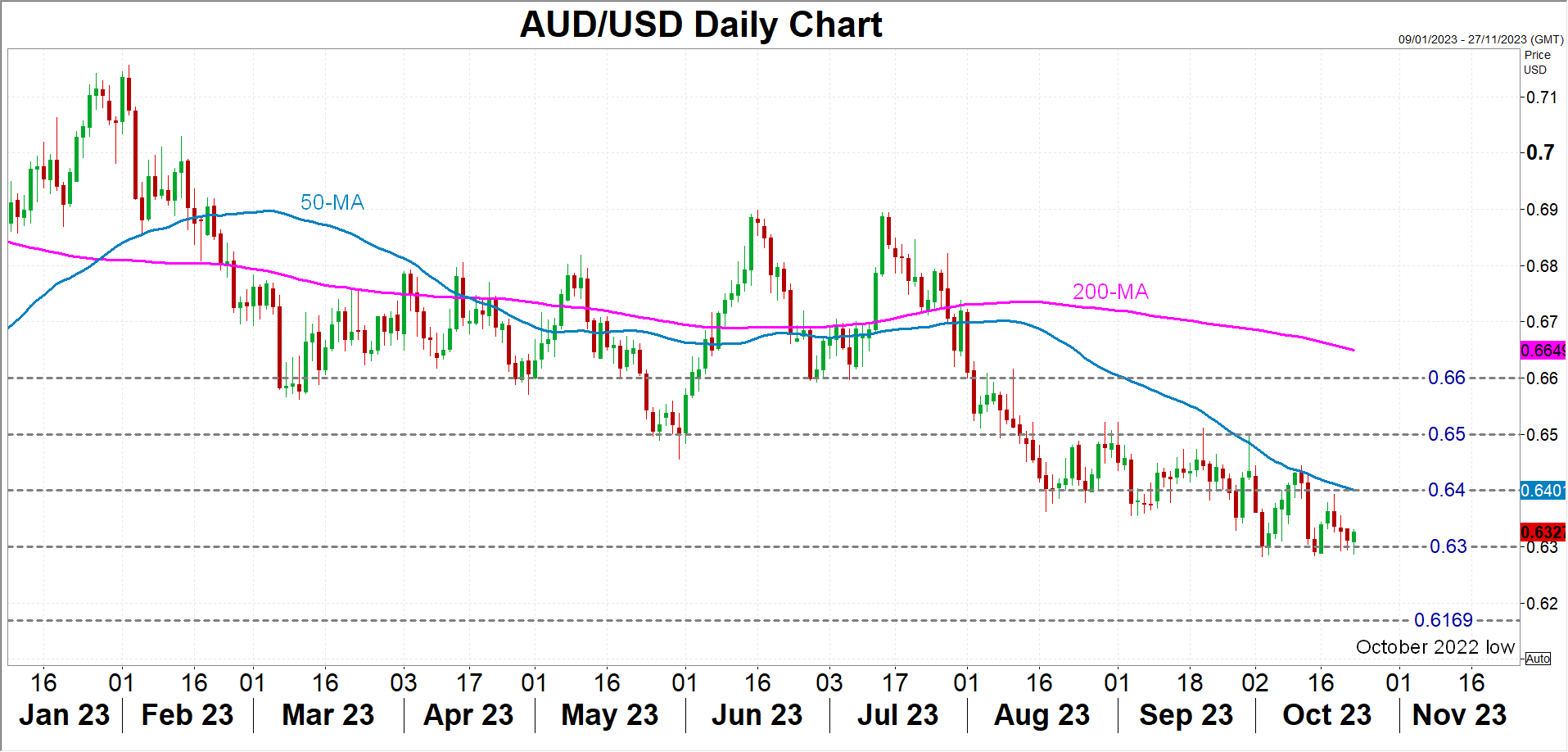

The aussie has slumped towards the $0.6300 area during October, the weakest in almost a year. Hotter-than-expected CPI numbers could lift the battered currency towards its 50-day moving average, which has just landed on the $0.6400 level, as this would boost the odds of the RBA hiking rates again before the year-end.

However, unless risk appetite improves or yield differentials with the US narrow in the aussie’s favour, it will be hard for the pair to stage a more meaningful rebound.

On the other hand, if inflation moderates more than anticipated, the aussie could come under renewed selling pressure to potentially revisit the October 2022 trough of $0.6169, which was a two-and-a-half-year low.