There are a few weird things that I cannot stand.

The 50-30-20 rule for savings & spending is one.

But these days, I have weaker views regarding a lot of things, except when I feel that misunderstanding some things has a big material impact on your financial life.

Oh, wait… I think if you manage to frame how you look at income allocation can make a significant difference in your motivation and your distance from your financial goals.

In this video, I shared my perspective to a reader’s question:

Does anyone have a good saving and investment percentage guide to share?

I am in my early 40s, and had YOLO since I graduated and while I know everyone’s situation is different, some guidelines would be helpful.

I called this video Advanced Income Allocation because good optimisation is not just about spending but also how we should think about saving:

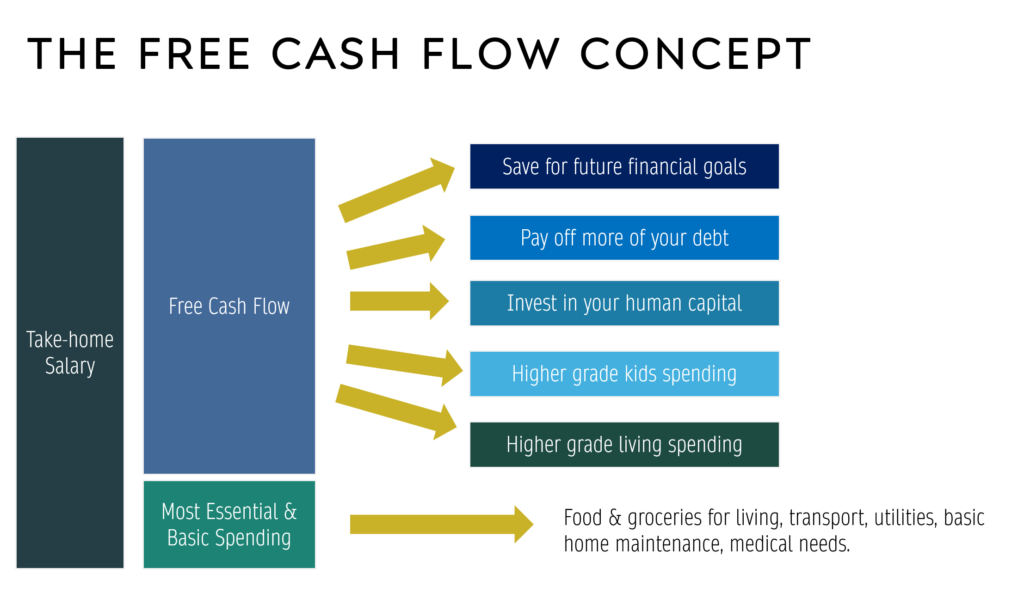

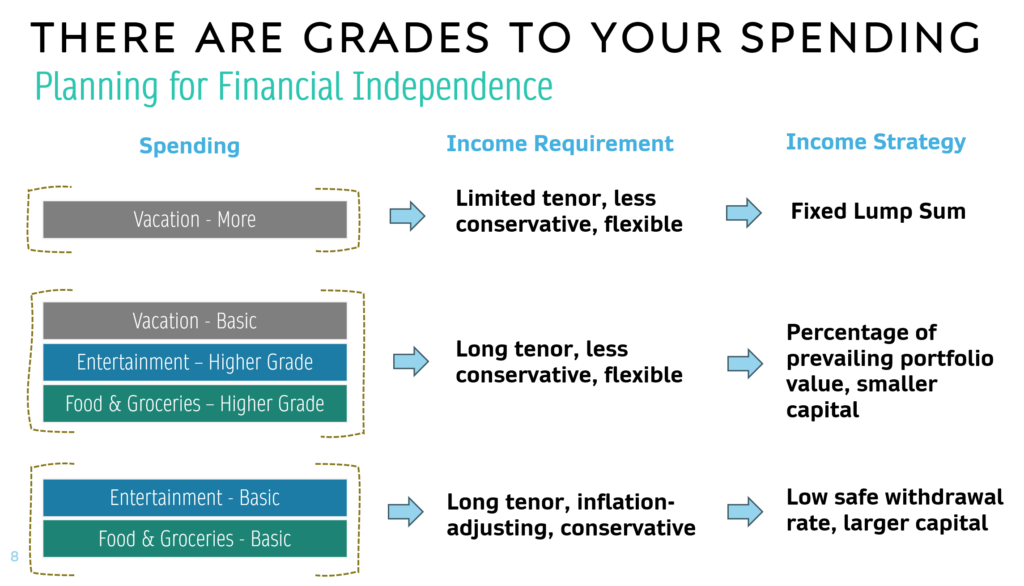

Here are two different framing you can look at your income and spending:

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

The post Advanced Income Allocation for Financial Independence Planning. appeared first on Investment Moats.