UOB 3Q24 earnings highlights

UOB Group announced its earnings for the third quarter of 2024. Key highlights include:

- Core net profit reached record S$1.6 billion in Q3 2024, up 11% YoY, driven by strong fee income and trading revenues

- Net fee income hit record high of S$630 million (+7% YoY), while net interest income grew 1% YoY to S$2.5 billion with 5% loan growth

- Credit costs increased to 34bps due to Thailand retail portfolio (post-Citi integration), but NPL ratio remained stable at 1.5%

- Strong capital position with CET1 ratio improving to 15.5% (+2.5% YoY)

UOB’s core net profit reached S$1.6 billion, reflecting an 11% growth year-on-year. This increase is attributed to record levels in net fee income as well as trading and investment income.

Net fee income rose by 7% to hit a record S$630 million, mainly due to an increase in wealth management fees. Wealth management fees grew to S$183 million in 3Q24 from S$173 million in 2Q24 and S$146 million in 3Q24, as assets under management (AUM) reached S$185 billion.

Net Interest Income grew by 1% to S$2.5 billion, driven by a 5% growth in loans. UOB’s net interest margin (NIM) remained steady at 2.05% in 3Q24 and unchanged from 2Q24, after having fallen to 2.02% earlier this year.

Non-Interest income soared by 70% to S$744 million, supported by strong customer-related treasury income.

Credit costs rose to 34 basis points due to changes in the Thailand retail market after integrating Citigroup’s business.

Nonetheless, UOB expects to keep full-year credit costs within their forecasted range. Importantly, the quality of UOB’s assets remains stable, with a non-performing loan ratio of 1.5%.

UOB has successfully completed the integration of Citigroup’s consumer banking business in Malaysia, Thailand, and Indonesia, and sees promising cross-sell synergies from the acquisition.

UOB expects 2025 total income to be higher than in 2024, driven by a high single digit loan growth and double-digit fee income growth. At the same time, costs are likely to be contained with the cost-to-income ratio at 41% to 42%, while credit costs are expected to be benign in the 25-30 basis points (0.25-0.3%) range.

The bank’s Common Equity Tier 1 ratio, a critical measure of financial strength, improved to 15.5%, ensuring ample liquidity and a solid financial foundation. Management of UOB noted that its strong capital position would allow it to take on various capital management initiatives.

Beansprout’s Quick Take on UOB earnings

The strong earnings reported and positive outlook shared are likely to be taken favourably by investors.

In particular, the significant growth in wealth management fee income and stabilisation in net interest margin were a positive surprise, even against the higher expectations following DBS’ stellar earnings report.

While UOB does not pay out a quarterly dividend, management’s comments about taking on various capital management initiatives with its strong capital position may be seen as an indication that there is scope for higher dividend payouts or share buybacks in future.

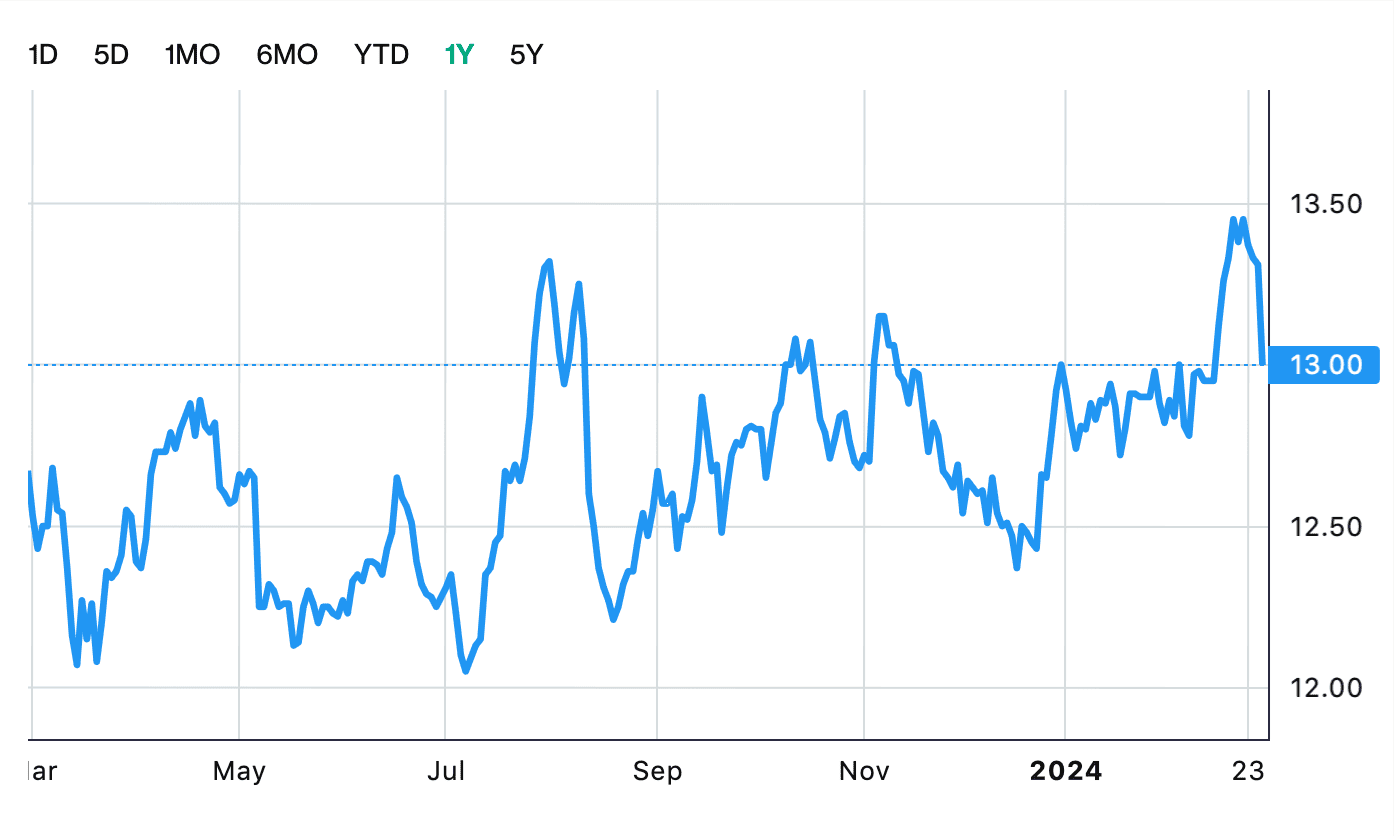

UOB shares reacted positively to the earnings, with its share price rising to as high as S$36.60 on 8 November, close to 10% from its previous day closing price.

UOB’s current dividend yield of 5.3% is above its historical average, and close to the dividend yield of DBS.

Find out how much dividends you would have received as a shareholder of UOB in the past 12 months with the calculator below.

UOB currently trades at a price-to-book valuation of 1.2x, below DBS’ price-to-book valuation of 1.8x.

Related links:

Join the Beansprout Telegram group get the latest insights on Singapore REITs, stocks, bonds, and ETFs.