A frequent Investment Moats reader, Limster read what I wrote, tried to digest it, and tried to think how that affected his F.I. model.

He titled his post Safely Ignoring the Withdrawal Rate.

I like to reflect and give my thoughts about another person’s situation because it may allow some of you to understand some concepts better than my usual explanation.

Why He Feels that the Dividend Model is a More Simple Model for Himself than the SWR

Limster prefers a dividend income model.

One of the thing he likes about the dividend income model is that it is a simpler to understand, or perhaps execute model than the frequent income model I talked about: the Safe Withdrawal Rate (SWR) way.

I think the more we talk through the approach, the more what he wrote proves that the dividend model is not simple if we look at it as a preferred income model.

As I’ve mentioned before, as long as passive income > current standard of living, that’s FI to me. To be safe, I can add a 20% buffer in case there is a 20% drop of income like during COVID (but since I didn’t travel, my expenditure was much lower as well).

……

So for my type of FIRE, all I need to do each year is to make sure I don’t spend more than my passive income that year (if I spend less, it means there is some money saved to be spent during a bad year).Limster

If I felt that the dividend income model is safer and my current lifestyle spending is $5,000 monthly, if I have a passive income of $5,001 monthly, then I am financially independent.

The model is simpler than the SWR if the above work.

This means that tomorrow Limster loses his job and he decides to live off this income needs and this plan provides the income the way he needs it.

If due to inflation, his spending comes up to $5,500, and the dividend income model provides that $5,500 for that month, but the next month the spending drops to $4,500 and the dividend income model provides for that income, then he has the income stream he is looking for.

If he feels that this stream of income is long enough to last the duration that he needs it (30 years? 50 years? perpetual?) then this plan is sound enough.

Remember: as long as the passive income now covers the current standard of living.

The dividend income model is a model without any buffers.

He Admits that there are Variability In Life

My struggle with that very simple line to explain why one will attain financial independence is that a novice into this F.I. realm would have a different interpretation about it.

A novice who has a very inflexible spending need (say his food cost) of $300 monthly would be able to find a bunch of high dividend yielders that yield 8% on average currently and declare that he has secure an income source for his needs (This amounts to $45,000)

The challenge for this dividend income plan is:

- The survival of that portfolio of high-yielders selected.

- The dividend income is likely to be variable, not just up but also down.

- The income variability is to different degree. Most underestimate the degree of income variability.

- At the same time, his spending is inflexible and inflation of the spending is unknown. Inflexible means he needs to spend to maintain his purchasing power

Limster understands that spending and income will be variable and in the next part, you can see he embedded this deeper understanding into his plan.

But if you put out a simple line as the dividend income is less than the current income, and treat this as the full income strategy, I don’t think that is an ideal strategy because that does not factor in the full consideration.

How He Makes His Dividend Income Model Safer

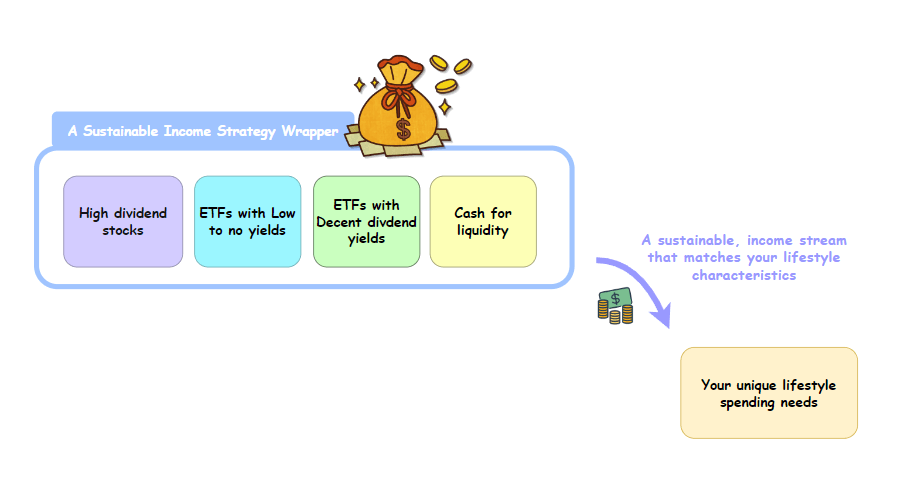

Limster provided the following illustration for the income model that he is working towards:

I will try my best to explain his approach in my way:

- He understands that his income needs is made up of three groups:

- The most important for daily living. Does a great job by talking about non-immediate and immediate needs. Too often people forgets about the non-immediate.

- The stuff that is nice-to-have that is part of his current lifestyle

- Additional spending that is a result of more free time.

- His passive income cannot fall below 50% of a certain model spending needs (not his current spending but a spending lifestyle he wish to get to.). If it falls below a little bit still okay but if he starts planning with $5,000 monthly and the income falls to $2,300 monthly then he needs to go back to work.

- If the income is variable as is his spending but it is less than 50% of his income, it is still a manageable situation.

Now before I go on, I think Limster’s plan is conservative and how you build a spending strategy around the dividend investing approach.

But what made his plan work was:

- A clear understanding of a model lifestyle. Not today’s lifestyle but the spending line-items based on the life he wishes his family to live.

- An open admittance that his income lifestyle needs is flexible.

- Not just flexible but HOW MUCH he could be flexible about. Too many people say they can be flexible but I wonder do they really know in the worse case how flexible they could be. Perhaps their flexibility is that if they plan for $5,000 and they can be flexible to $4,800. Or is it to $2,500?

- He reflected and is okay to cut away ALL his flexible spending in the worse case situation.

Most May Have Underestimate the Degree of Lifestyle and Income Variability

I think people may not have a good handle over the degree of lifestyle and income variability.

Being flexible is being thrown around too much but how bad could things be?

Within a sub-discipline of the SWR study, there is a way to study how variable your income can be, and the plan would work for different time frame of retirement.

This allows you to see some how bad things are.

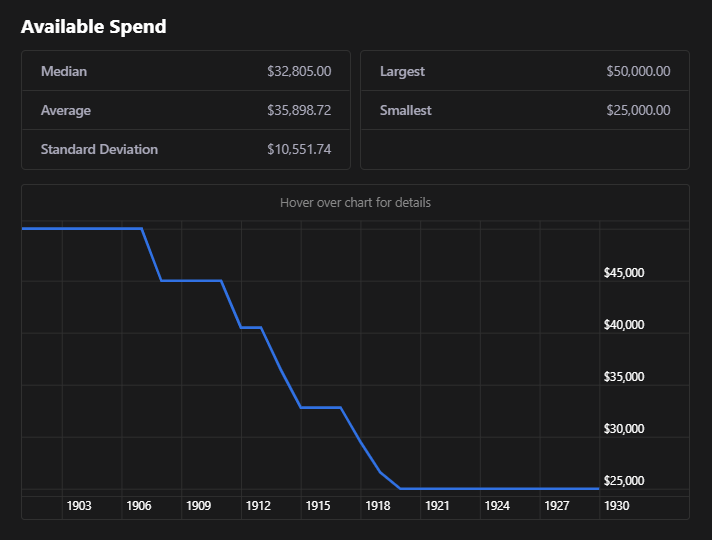

I put this example from Fi.calc

as an example to show how low these income adjustment could get:

In a retirement sequence from 1901 to 1931 for a 30-year retirement, you can be flexible and your plan would still work.

But your income of $50,000 a year initially dropped to $25,000 and never climbed back up.

This is the kind of insight the Safe Withdrawal Framework can give you.

Now you have some breadth to plan around.

If Limster’s plan is to start with $50,000 today and his most important spending is $25,000, and he wants this $25,000 to be inflation adjusting and don’t care about his two less important groups, his dividend income model would still work!

Figuring out this breadth is also what Limster appreciates and he put this in his planning:

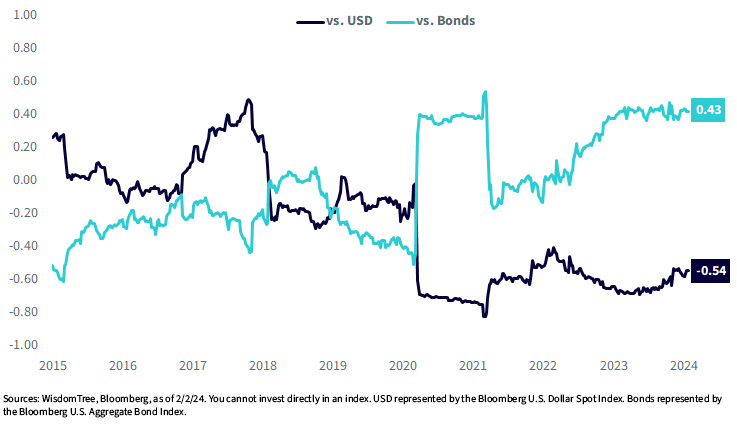

Investmentmoats linked to a chart showing the dividend volatility of the S&P500. What is interesting is that the drawdowns were “short and sharp” like COVID in 2020 when my passive income dropped by 20% and promptly recovered the following year.

The dividend drop in GFC was not as bad as it seemed because there was price deflation. During GFC, COE prices dropped (unlike COVID19) and you could get a parallel imported Mercedes C180 for $135k and property prices were soft because of lack of liquidity (I bought my current condo just after the GFC). Whereas now COE alone will set you back $100k+++

Limster

We Tried Too Hard to Make an Investment Strategy as an Income Strategy

I feel this is the same problem.

People want to say the ETF strategy is the most suitable income strategy, or dividend investing to be the more suitable.

What about a unit trust strategy or a private equity strategy?

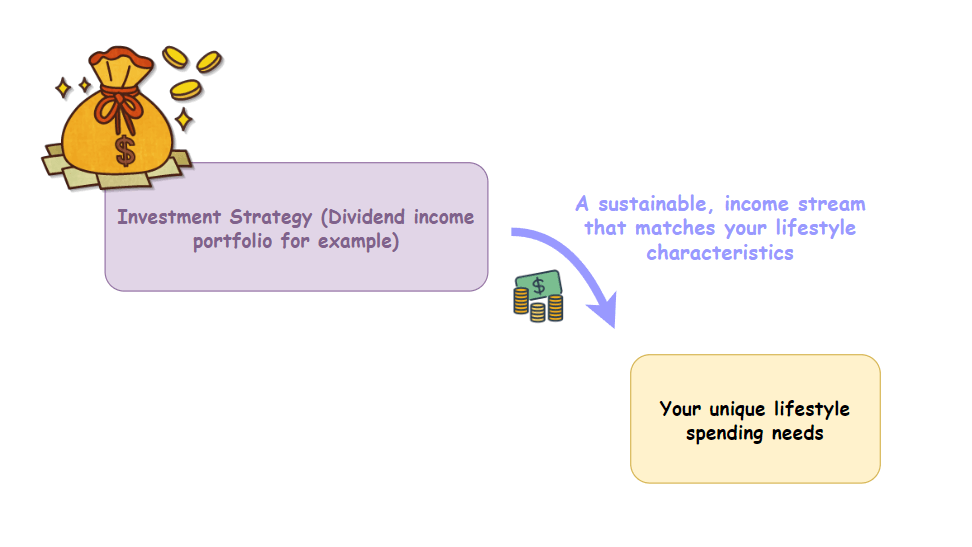

The problem I feel is the framing. This is how most people look at it.

They search for an investment strategy that gives them an income that matches the income characteristics they require. Most feel their spending is flexible and that matches the income model.

But even sensible people like Limster knows the picture is not like that.

What is ACTUALLY in their minds is this:

Limster is trying to be conservative and think about his personal wrapper (wrapper is a software development metaphor) to create an income stream that is sustainable for his lifestyle.

I am sure most people think this way.

But people don’t talk about this wrapper!

Instead we spend time arguing about which investment method is the best.

If you understand this, you will understand that a single line of dividend strategy is not “simple”.

Sustainability is not the only thing we consider when we plan our income.

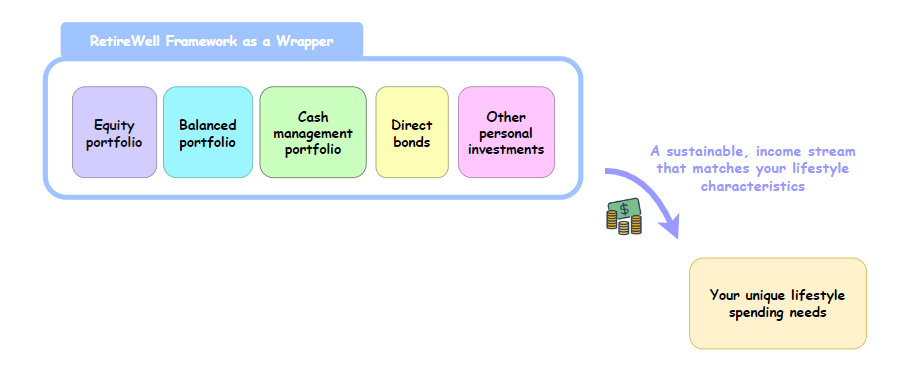

I know I spoken about the safe withdrawal rate so much that people think that this is what we at Providend use to do income planning for those people who has financial independence aspirations.

We don’t.

We use a RetireWell framework for that. (If you would like to find out more, you can read an ebook that you can download here in this article)

But the idea is still the same:

- You have a unique spending lifestyle that you are planning for.

- We use a flexible framework to design an income stream for you.

The balance between spending today and enough conservatism takes place on the wrapper level.

We also don’t apply the SWR Framework directly but it remain a very good framework for us to understand and think about the balance between giving the income you need and enough conservatism in the plan.

And I think that is my main problem.

If you are a learned person, you embed all that you learn into simple one-liners, two-liners, or one short paragraph.

But it is usually not so simple.

You masked a lot of critical details from a novice trying to learn this.

To be fair the Safe Withdrawal Rate is even more simple.

It is just one percentage! 2%, 3%, 4%.

But SWR too embeds a lot of critical things inside it:

- It studies 50 years, 100 years or 150 years of history of depressions, high inflation, bull markets, recessions to figure out the highest income that you can spend.

- You can vary the tenor of your income needs.

- It is based around the idea that 100% of all your income is inflexible in nature but if your income needs is flexible in a rules-based way, we can test to see how will it perform.

The SWR also suffers from these problems but I do contend that we are not trying to mask things.

At least I will opening admit the percentage and how to determine it is so simple but there are a lot of stuff embed in it.

And this is why I choose to talk about it more. So that you guys can view it differently.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

The post A Dividends-based Income Strategy Works Better If You Have a Sustainable Income Wrapper Around the Investments appeared first on Investment Moats.