When you’re three days down the highway

And you’re looking like I feel

And it takes a lot to keep it going

It takes a lot to keep it real

Take some time for yourself

And learn to yield

(From “Yield” by the Indigo Girls, 2002)

Our most recent post on generating yield in the current market environment was back in early July. It’s time to check back in.

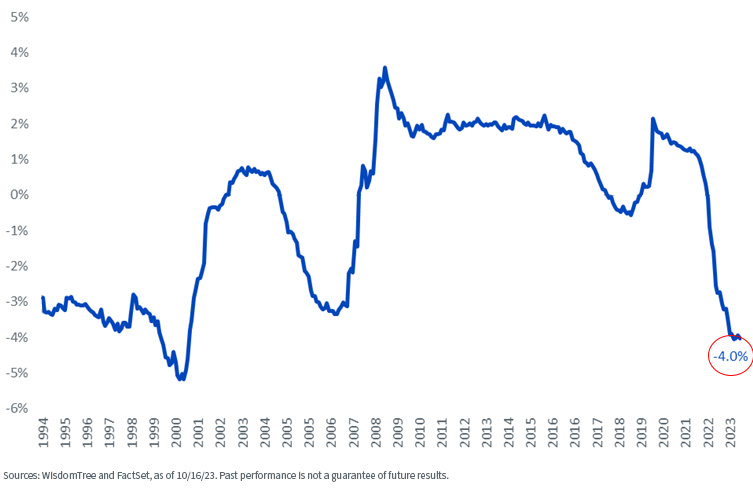

As short-term rates have remained elevated due to the Federal Reserve’s rate regime, the differential between the S&P 500 Index dividend yield and the three-month t-bill yield has become more pronounced.

S&P 500 Dividend Yield: 3-Month U.S Treasury Yield

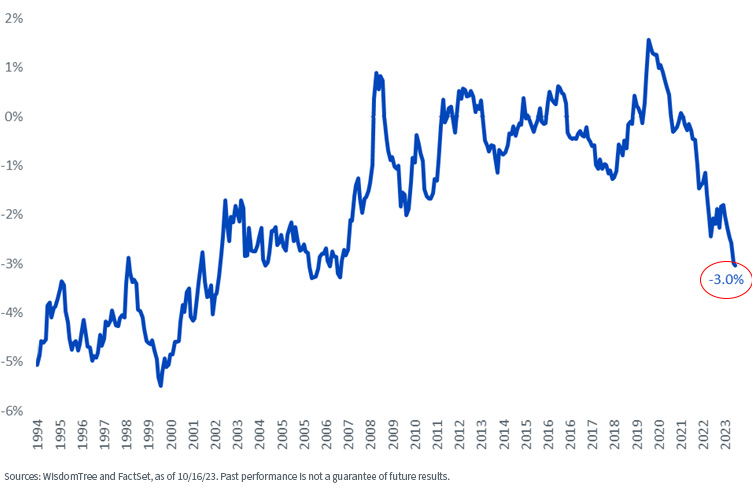

We see a similar story at the long end of the curve.

S&P 500 Dividend Yield: 10-Year U.S Treasury Yield

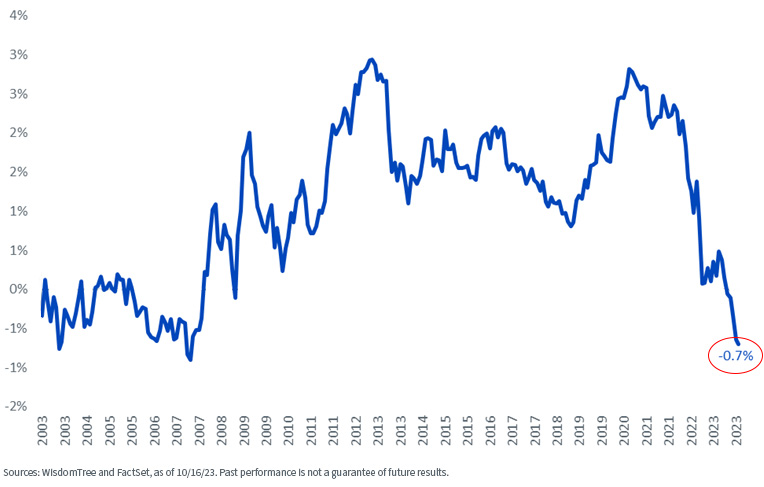

This last comparison uses the nominal Treasury yield. We see slightly less dramatic results if we use the 10-Year real Treasury yield instead, since dividend yields represent a non-inflation-adjusted return on real assets (the underlying stocks).

S&P 500 Dividend Yield: 10-Year U.S TIPS Yield

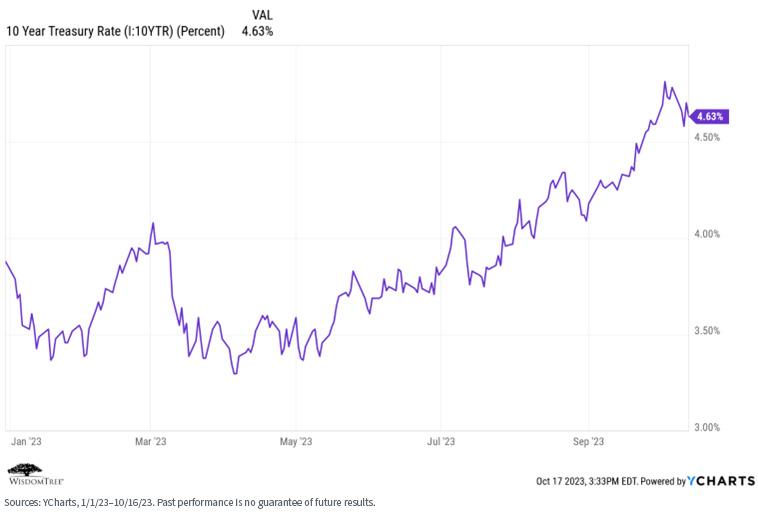

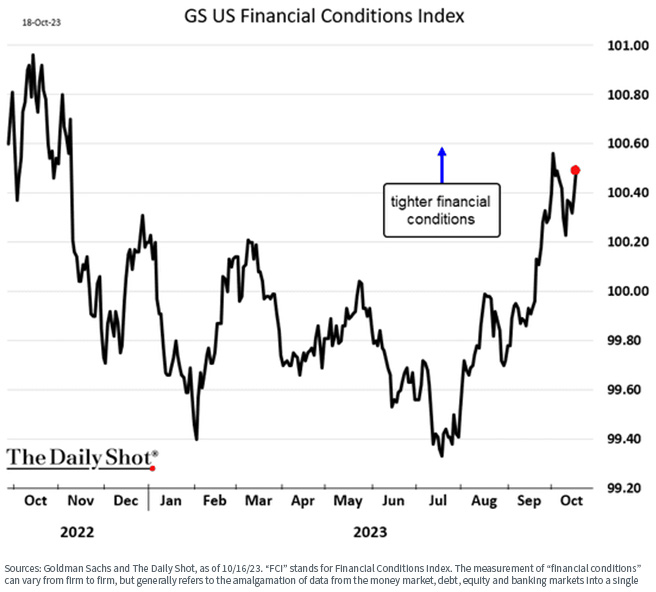

Let’s survey the current market environment. As we’ve noted in several earlier posts, the Fed seemingly wants to remain hawkish, but the bond market is, in many respects, doing their job for them. There has been a dramatic run up in the 10-Year over the past several months, with a corresponding tightening of general financial conditions (two charts).

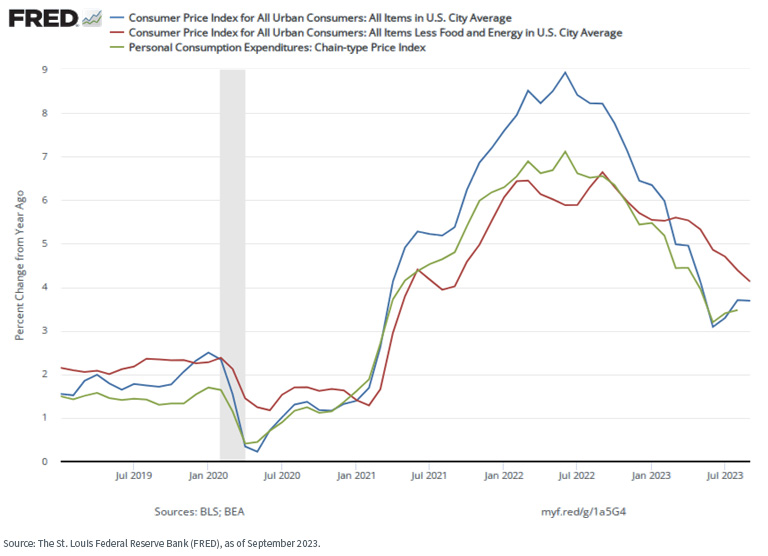

At the same time, and despite the Fed’s ongoing anxiety, inflation has peaked and is moving downward, though it remains above the Fed’s 2% target rate (and probably will for a while). As we write this, the markets anticipate perhaps one more round of rate tightening in 2023—probably in December, if it happens at all.

Rate cut expectations have now been pushed back to June 2024, at the earliest. At this point, the ongoing strength of the labor market seems to be the primary driver of what is keeping the Fed awake at night.

Finally, credit spreads (particularly high-yield spreads) have widened recently but remain near their 25-year historical levels.

So, What Is a Yield-Seeking Investor to Do?

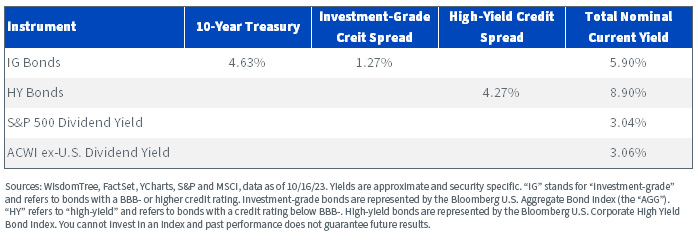

One of our primary investment themes for 2023 and into 2024 is “there is income back in fixed income.” Let’s compare current fixed income nominal yields to equity market nominal yields.

Certainly, in comparison to the equity markets, there is income back in fixed income.

Product/Strategy Ideas

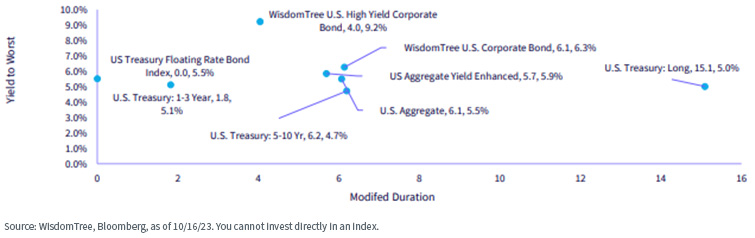

Unless you believe that the long end of the yield curve is nearing peak rate levels and will begin to come back down significantly (which is not our view), then the inverted Treasury yield curve does not offer much of an incentive to move out in duration.

While investors may wish to consider a barbell approach given the current yield backdrop, we continue to see value in tilting the allocation toward U.S. Treasury (UST) floating rate notes (FRNs).

Index Yield to Worst/Modified Duration

As of this writing, UST FRNs are essentially the highest-yielding Treasury security and, with only one week duration, they offer income without the volatility that potentially comes with fixed coupon issues. The WisdomTree Floating Rate Treasury Fund (USFR) is a way for investors to tap into this investment theme.

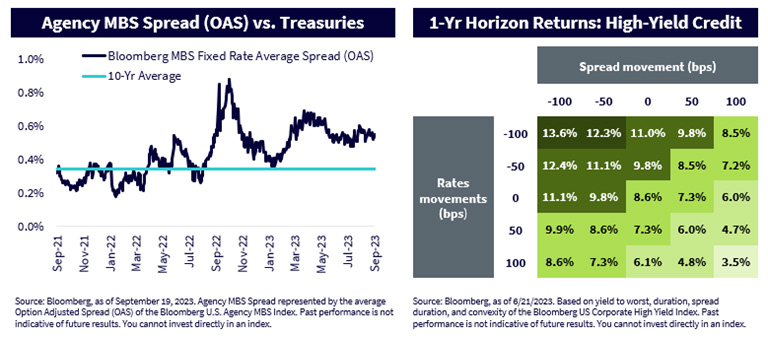

We also remain constructive on high-yield corporates. At current rate and spread levels, the segment continues to offer elevated yields level to investors, while maintaining a comfortable buffer against both a further rise in rates and/or a rise in spreads (right-hand chart below).

We suggest an approach that is selective and takes default prospects into consideration. The WisdomTree U.S. High Yield Corporate Bond Fund (WFHY) offers investors a way of screening for quality (we exclude negative cash flow companies in our Index construction) while tilting for income in the high-yield space.

At the same time, on a relative value basis, agency backed mortgages, which are investable via the WisdomTree Mortgage Plus Bond Fund (MTGP) are exhibiting attractive spreads to Treasuries in comparison to their historical average (left-hand chart below).

Within our own Model Portfolios, we recently reduced (but did not eliminate) our over-weight allocation in high yield and reallocated the proceeds to mortgage-backed securities.

Model Portfolio Ideas

In addition to our product line-up, WisdomTree also manages three Model Portfolios we think fit nicely into today’s yield environment, depending on investor objectives: an all-equity Global Dividend Model, Multi-Asset Income Models of different risk bands and the Siegel-WisdomTree Longevity Model, which we manage in collaboration with our Senior Economist, Professor Jeremy Siegel.

All these Models focus on generating a significant portion of the current yield from their equity allocations while using the fixed income allocation to generate additional, risk-controlled yield.

Conclusions

When we first began writing this series of posts about generating yield in the current market environment, back in March 2021, we were in an historically anomalous environment where investors could generate higher yields out of their equity allocations than they could from their fixed income allocation. But, as we wrote most recently, the script has flipped.

Fixed income has regained its historical role within portfolios—generating risk-controlled yield and acting as a hedge to equity beta risk. It has been a long time coming, but here we are.

For investors and advisors looking to “learn to yield,” we believe we have several ways to achieve this goal without taking excessive risk, including quality-screened high-yield (WFHY) and dividend-focused equities within the portfolio.

For investors wishing to not take on duration risk while benefitting from the current Fed rate regime, our floating rate U.S. Treasury product (USFR) may fit the bill.

Fixed income investors looking for relative value opportunities may find our mortgage-backed security product (MTGP) fits the bill.

Additionally, our yield-focused Model Portfolios are all delivering on their mandates of generating equity-driven enhanced yield in a risk-controlled manner.

We encourage you to take a look.

For definitions of indices & terms in the charts above, please visit the glossary.

Important Risks Related to this Article

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the account; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from the information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Jeremy Siegel serves as Senior Economist to WisdomTree, Inc., and its subsidiary, WisdomTree Asset Management, Inc. (“WTAM” or “WisdomTree”). He serves on the Model Portfolio Investment Committee for the Siegel-WisdomTree Model Portfolios of WisdomTree, which develops and rebalances WisdomTree’s Model Portfolios. In serving as an advisor to WisdomTree in such roles, Mr. Siegel is not attempting to meet the objectives of any person, does not express opinions as to the investment merits of any particular securities and is not undertaking to provide and does not provide any individualized or personalized advice attuned or tailored to the concerns of any person.

The Siegel-WisdomTree Longevity Model Portfolio seeks to address increasing longevity by shifting the focus to potential long-term growth through a higher stock allocation versus more traditional “60/40” portfolios.

WFHY/MTGP: There are risks associated with investing, including the possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. High-yield or “junk” bonds have lower credit ratings and involve a greater risk to principal. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. While the Fund attempts to limit credit and counterparty exposure, the value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

USFR: There are risks associated with investing, including the possible loss of principal. Securities with floating rates can be less sensitive to interest rate changes than securities with fixed interest rates but may decline in value. Fixed income securities will normally decline in value as interest rates rise. The value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

]]>