1. China’s Current Policy Approach: Small Steps to Prevent Major Setbacks

The Chinese government is taking incremental measures to prevent severe economic downturns. For instance, restrictions on house purchases are expected to be fully lifted within the next year, and mortgage rates for both new and existing purchases are being reduced. The central government is also increasing transfers to local governments to ensure basic services are maintained.

These measures are designed to prevent worst-case scenarios while waiting for private entrepreneurs to invest in various sectors. Currently, investment is primarily seen in sectors like biotech, new energy and electric vehicles. However, as returns on safe assets become minimal, it is expected that private entrepreneurs and Chinese households will venture into riskier private investments in the future.

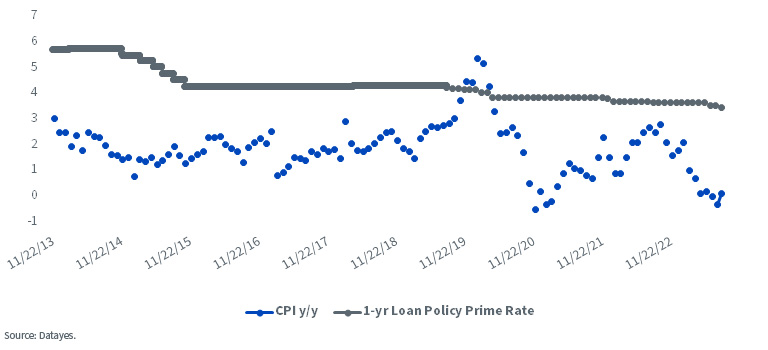

Monetary Policy Room for Maneuver: China Policy 1-year Loan Rate Still Significantly Higher than Year-over-Year Inflation Rate

2. “High Quality Growth”: A Shift Away from Debt-Driven Growth

The Chinese state media has consistently used the term “high-quality growth” since the deterioration of U.S.-China relations post-Covid. This implies a focus on slower growth and heavy investment in climbing the technology value chain. Given the U.S.-lead tech sanctions, this is a top priority for both the government and Chinese companies. Chinese media communication on macroeconomic policies are quite open and public.

3. Local Governments’ Financial Constraints Post-Covid Zero

Many wonder why China didn’t implement major stimulus measures like during the 2008/9 financial crisis. First, even during that crisis, Chinese stimulus was heavily supply-side and investment-driven rather than direct cash transfers to citizens.

Second, with China’s debt-to-GDP ratio now close or slightly higher than that of the U.S., large-scale policies require substantial funds which local governments lack due to decreased land revenue following Covid Zero and the peak of the real estate sector.

4. Upcoming Policies: A Focus on Supply-Side Reforms

China continues to manage growth through supply-side reforms for two main reasons. First, it believes that tech competition with the U.S. requires government funding for research institutions and tech firms. Second, while monetary stimulus is standard practice in the U.S., experiences in Europe and Japan have shown that this approach may not be universally as effective as in the U.S. Chinese leadership does not appear to be convinced the U.S. approach works well in China.

In summary, the Chinese economy is still weathering the impact of the real estate downturn, but it is not in a state of collapse, and there are enough government policy tools to avoid the worst.

]]>