Despite the Reserve Bank of Australia (RBA) leaving the door to further hikes open at its latest policy decision, investors are largely convinced that this Bank’s tightening campaign is already over, with the Australian dollar remaining largely a victim of concerns surrounding China. Will Australia’s employment report bring the aussie back to life? The data comes out on Thursday at 01:30 GMT.

Market believes the RBA is done raising rates

At this month’s gathering, RBA policymakers refrained from pushing the hike button, but they remained willing to do so if deemed necessary, to ensure that inflation returns to their target in a reasonable timeframe.

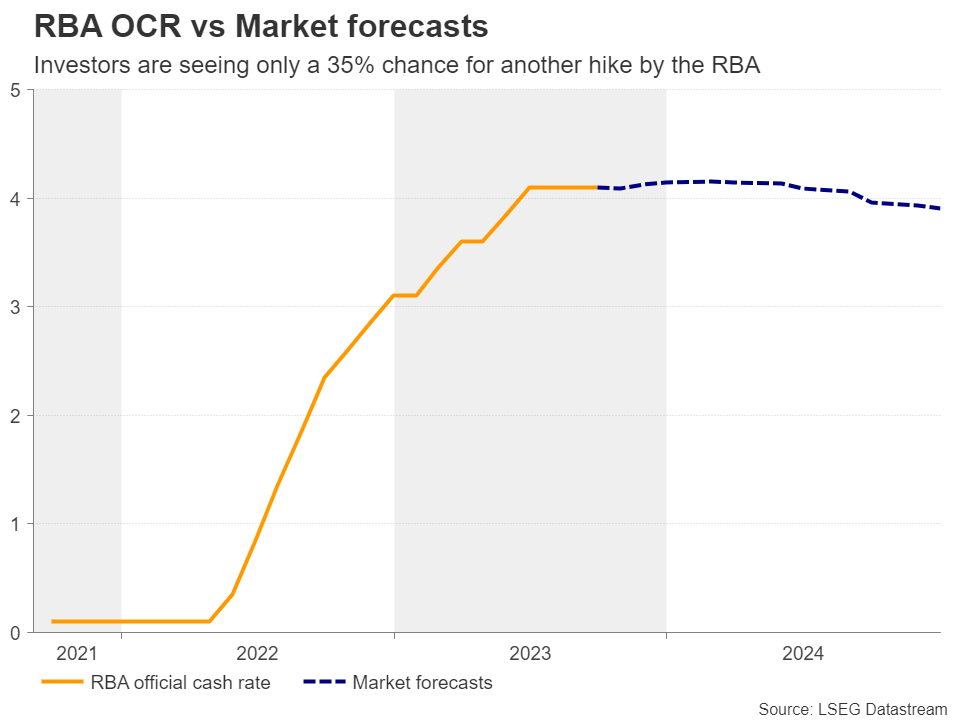

And yet, even after the GDP numbers for Q2 came in better than expected the following day, investors remained convinced that officials will remain sidelined in October, while they are assigning only a 35% probability for one more quarter-point hike by February.

Will the employment report change that?

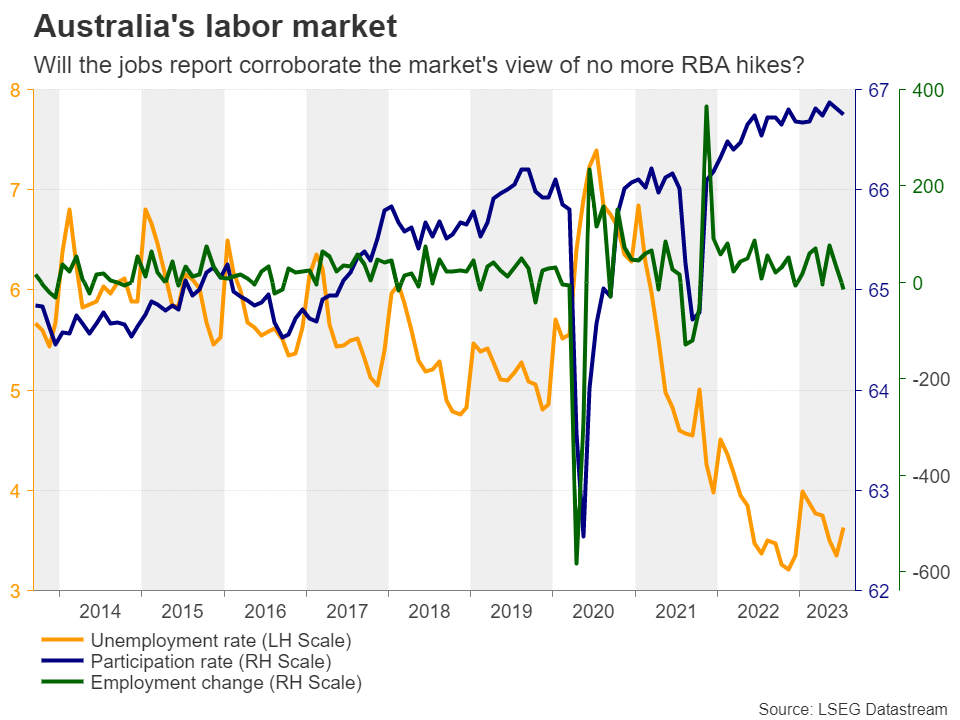

Next week, on Thursday, aussie traders may pay special attention to Australia’s employment report for August as they try to figure out whether their view is correct or not. The July numbers pointed to some softening in the labor market, with the economy losing jobs instead of gaining as the forecast suggested, and the unemployment rate rising to 3.7% from 3.5%. Therefore, another round of weak numbers could enhance the idea that the end credits of this Bank’s tightening series have already rolled, thereby pushing the aussie lower. The opposite may be true in the case of a better-than-expected employment report.

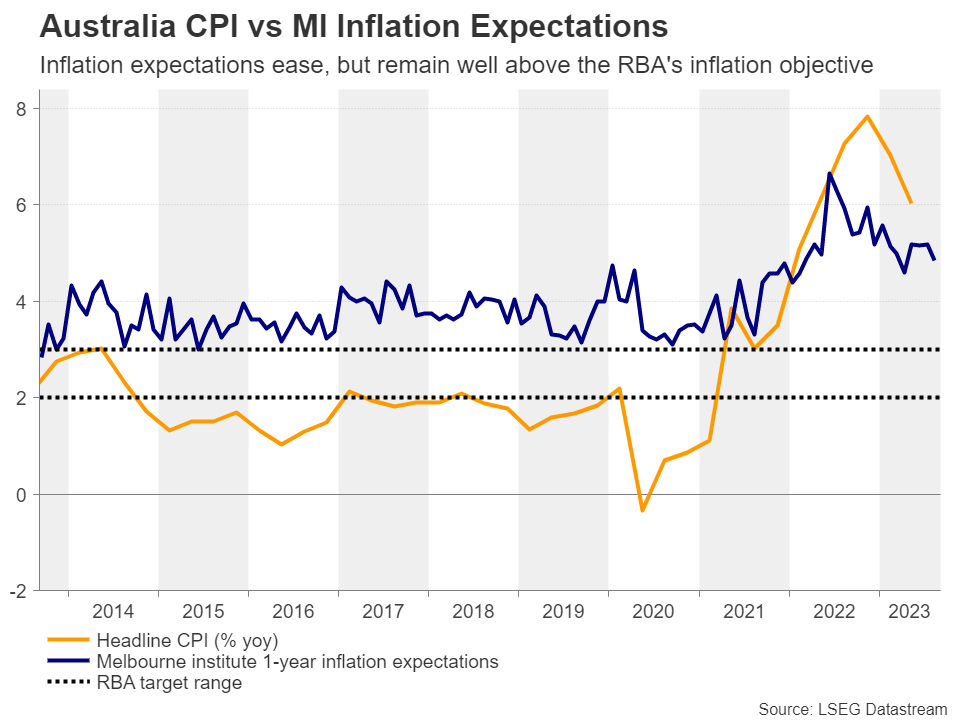

Although not aussie movers, the National Australia Bank (NAB) business survey on Tuesday and the Melburne Institute (MI) 1-year inflation expectations on Thursday could assist in better evaluating whether the door to further hikes is closed or not. The last NAB survey for July showed that price and cost growth accelerated, while the MI inflation expectations for the month slowed to 4.9% from 5.2%, which means that inflation is still expected to be well above the upper bound of the RBA’s target range of 2-3% a year from now. Therefore, if the NAB survey points to further acceleration in wages and prices, and inflation expectations continue to indicate sticky inflation, calling for the end of this hiking cycle may be an unwise choice.

Aussie remains more sensitive to China

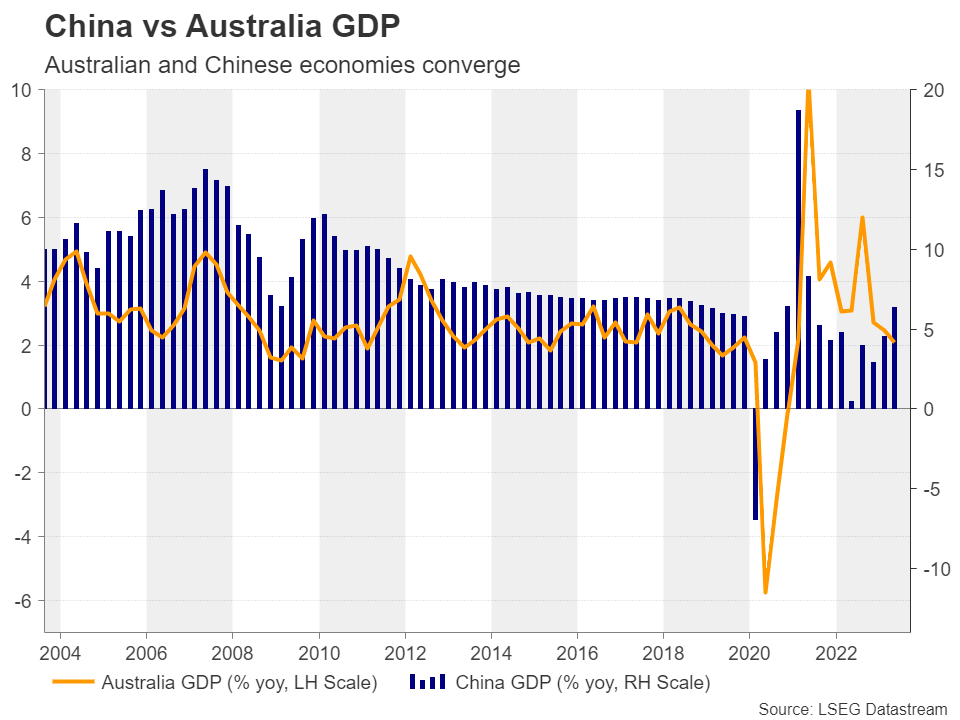

Having said all that though, what seems to be driving the aussie more than monetary policy expectations is developments and concerns surrounding China, the world’s second largest economy and Australia’s main trading partner. The latest piece of worrisome information was China’s trade data, which pointed to another month of falling exports and imports, with exports contracting for the fourth month in a row.

With investors not convinced that the support measures adopted by authorities could bear fruit soon, even if next week’s releases boost the RBA hike probability and help the aussie rebound, the broader outlook of the currency is likely to remain negative. With the US dollar’s engine tanks fueled by data pointing to economic resilience in the US and safe-haven flows resulting from China worries, the aussie/dollar pair may be the best proxy for exploiting further aussie weakness.

Technical picture points to a downtrend

From a technical standpoint, aussie/dollar has been in a steep decline since mid-July and at the beginning of August it fell below the lower bound of a sideways range that was containing most of the price action since February 24. This has turned the outlook overly bearish, and although the pair is now holding near the 0.6360 zone, it may be a matter of time before it breaks lower and heads towards the low of November 3 at 0.6270.

For the pair to escape bearish conditions, the bulls may need to prove strong enough to drive the battle above the 0.6570 zone, back within the aforementioned sideways range.