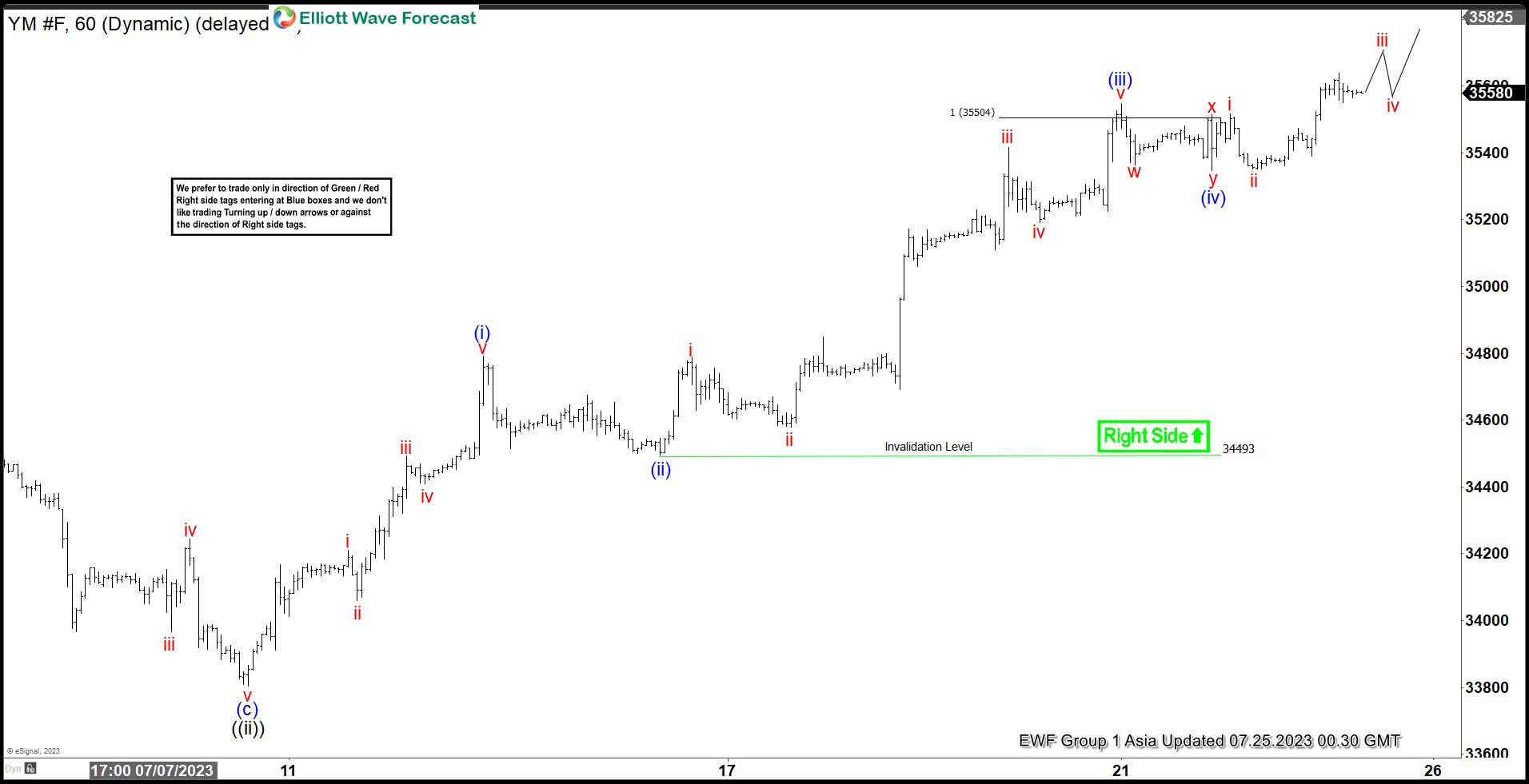

Short Term Elliott Wave view in Dow Futures (YM) suggests cycle from 7.10.2023 low is about to end as 5 waves impulse. From 7.10.2023 low, wave i ended at 34211 and dips in wave ii ended at 34060. The Index rallies again in wave iii towards 34493 and pullback in wave iv ended at 34410. Final leg wave v ended at 34792 which completed wave (i). Index then pullback in wave (ii) which ended at 34493. Index then resumes higher again in wave (iii). Up from wave (ii), wave i ended at 34788 and pullback in wave ii ended at 34581. Index then resumes higher in wave iii to 35417 and pullback in wave iv ended at 35192. Final leg wave v ended at 35549 which completed wave (iii). Pullback in wave (iv) ended at 35348 with internal subdivision as a double three. Down from wave (iii), wave w ended at 35364, wave x ended at 35514, and wave y ended at 35348 which completed wave (iv). The Index resumes higher in wave (v) with internal subdivision as a 5 waves. Near term, as far as pivot at 34493 low stays intact, the Index can extend higher a few more highs before ending wave (v) of ((iii)). This should complete cycle from 7.10.2023 low and Index should then see larger degree pullback to correct that cycle.

Dow Futures (YM) 60 Minutes Elliott Wave Chart

YM_F Elliott Wave Video

The post Dow Futures (YM) Ending Short Term Impulse Soon appeared first on Elliott Wave Forecast : Analysis and Trading Signals.