‘Our Earth is degenerate in these later days. There are signs that the world is speedily coming to an end. Bribery and corruption are common. Children no longer obey their parents. Every man wants to write a book and the end of the world is evidently approaching…’

—An apocryphal clay tablet from Assyria, dated around 2800 B.C.

I must admit, I hate negative predictions.

Especially those about Doomsday. The Apocalypse. The End of the World.

Why?

Well, because such predictions have a very poor track record of actually coming true. And most of all, they exploit people’s emotions.

The media knows this. This is why they tend to sensationalise apocalyptic stories. They do this because negativity gets a 60% higher response rate.

Joel and Ellie brave a post-apocalyptic America filled with wokeness in The Last of Us.

Source: The Spectator

Is such negativity addictive? Yeah, you bet. It’s addictive in the same way that people enjoy scaring themselves by watching horror stories like The Last of Us.

But watch out. Engaging in too much negativity can warp your thinking.

Focus on the Family, a conservative Christian network, warns people against indulging in pessimistic thoughts:

The Bible clearly instructs us to be vigilant. But it also teaches that no one can say for certain that we are living in the “end times.” This is at best a debatable proposition. Jesus Himself repeatedly said that no one knows or can know the day or hour of His return (Matthew 24:36; Mark 13:32; Acts 1:7). To be sure, we are surrounded by events and developments that could be interpreted as signs of the end. On every hand we see famines, earthquakes, disasters, troubles, persecutions, wars and rumors of wars (Mark 13:7-9). But has there ever been a period in the history of the world when this was not the case?

Can you imagine what it was like to be a believer in Rome under the emperor Caligula, or Nero, or Domitian? To face the arena, the stake, or the lion’s den for your faith? What do you suppose Christians were thinking when the legions captured Jerusalem and destroyed the Temple in A.D. 70? Or when Attila overran Europe in the 5th century, the Vikings in the 9th, Genghis Khan in the 13th, or the Muslim Turks in the 16th? Might anyone have concluded that the end was near when the Black Death decimated Christendom, wiping out entire towns and claiming more than 25 million lives between 1347 and 1352? How did the situation look to believers at the beginning of the last century, when the so-called Great War destroyed the flower of an entire generation (37 million casualties)? Or a few decades later, when the shadow of Hitler and the Third Reich was rising over Germany and Eastern Europe? Clearly, the early 21st century has no monopoly on death, disaster, devastation, and terror. You don’t need to know a great deal about history to realize this.

Let’s try a dose of optimism instead

Personally, I find that negativity in the media is oversold.

Perhaps we should focus more on courage. Resilience. Innovation.

Source: Verywell Mind

Here are a few facts, courtesy of A Wealth of Common Sense:

- Two centuries ago the life expectancy in The Netherlands, the richest country in the world at the time, was just 40, and in no country was it above 45. Today, life expectancy in the poorest country in the world is 54. There are no countries where life expectancy is below 45.

- By the late-1600s, one-third of the children born in the richest parts of the world died before their 5th birthday. Today, this sad fate befalls just 6% of the children in the poorest parts of the world.

- The proportion of people killed annually in wars is less than a quarter of what it was in the 1980s, one-seventh of what it was in the early 1970s, one-eighteenth of what it was in the early 1950s, and a 0.5% of what it was during World War II.

- Just 200 years ago, 85% of the world’s population lived in extreme poverty. 20 years ago it was 29%. Today only 9% live in extreme poverty while the majority of people (75%) around the globe live in middle-income countries.

- In 1905, a Vermont doctor and his chauffeur were the first to successfully drive a car across country from San Francisco to New York. It took them 63 days. Today you can fly cross country in a matter of hours while using wireless Internet.

So, this is why I prefer positive predictions. Because, historically, optimism has a much better track record than pessimism.

For all its faults, for all its frailties, capitalism — as represented by the stock market — seems to be the best problem-solver around. It’s been that way for 400 years, and I believe it will continue for another 400.

So, in October 2022, I actually made a positive prediction of my own. Just in case you missed it, here’s a recap of what I wrote:

- Could there be a 50% chance that the next bull market will happen over the next 8 months?

- Could there be an 80% chance that the next bull market will happen over the next 18 months?

- What will happen when interest rates hit their peak? What will happen when central banks decide that the inflation ceiling has been reached? What if interest rates need to drop again? How will the market react?

- Given that the baby boomers are the richest generation ever, what will happen when the greatest wealth transfer in human history gets underway? What will happen when $68 trillion worth of assets start to move?

So…how did my prediction play out?

Well, as it turns out, pretty well.

As the moment, the S&P 500 is up over 20% from its most recent low. Meanwhile, the Nasdaq is up over 30% from its most recent low.

So we have entered a new bull market.

Now, let me be clear. I’m not claiming that I’m a psychic. I’m not even claiming that I’m particularly smart. All I’m doing, really, is studying history and drawing some rational conclusions.

So, let’s go back to my article in October 2022. Here’s a little bit more of what I said:

Property. Crypto. Stocks. Bonds.

All sliding into the red.

This bear feels like a ferocious beast — the mainstream media on both the Left and Right never fails to remind us — but so far, its roar has actually been worse than its bite.

Already, I see people misreading the tea leaves. Giving into irrational fear. Making anxious statements: ‘This time it’s different.’

Well, Sir John Templeton, one of the greatest value investors of the 20th century, has warned us that these are the most dangerous words to utter: ‘This time it’s different.’

So, are your emotions paralysing you? Are they deceiving you?

Here are some critical facts for you to know:

- The longest bear market in history happened in the early 2000s. It was driven by the dot-com crash. It lasted a total of 929 days — or two and a half years.

- The second-longest bear market happened in 1973-1974. It was triggered by the oil shock. It lasted a total of 630 days — or just under two years.

- The shortest bear market happened in 2022. It happened because of the Covid pandemic. It lasted only 33 days.

So, what happens when you take all these unpleasant events and average them out?

Well, you will see that the average bear market lasts anywhere between 289 to 388 days.

So… roughly a year.

Uh-huh. There you go.

Historically speaking, the bear doesn’t stick very long. Sooner or later, something has to give.

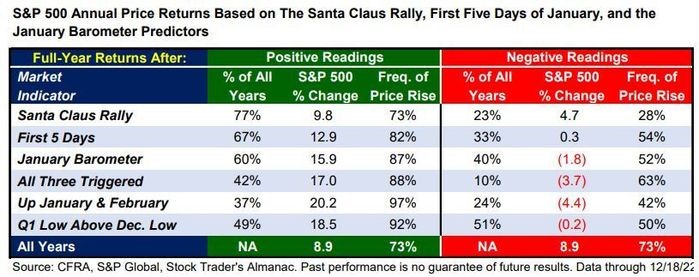

In early 2023, we saw the turning point happen. The American stock market hit a very important milestone, known as the January Indicator Trifecta. These involved three powerful buttons being activated at the same time. Here’s why it matters:

- The Santa Claus Rally, the First Five Days Early Warning System, and the January Barometer were all triggered. They were showing green.

- The sequence goes like this — we experienced a stock market rally for the final five trading days of 2022, as well as the first two trading days of 2023. We also experienced a gain over the first five trading days of 2023. And, finally, we had a rally for the entire month of January 2023.

- These seasonal indicators suggested there was an 88% chance that the market’s direction would be positive for the rest of the year.

Source: MarketWatch

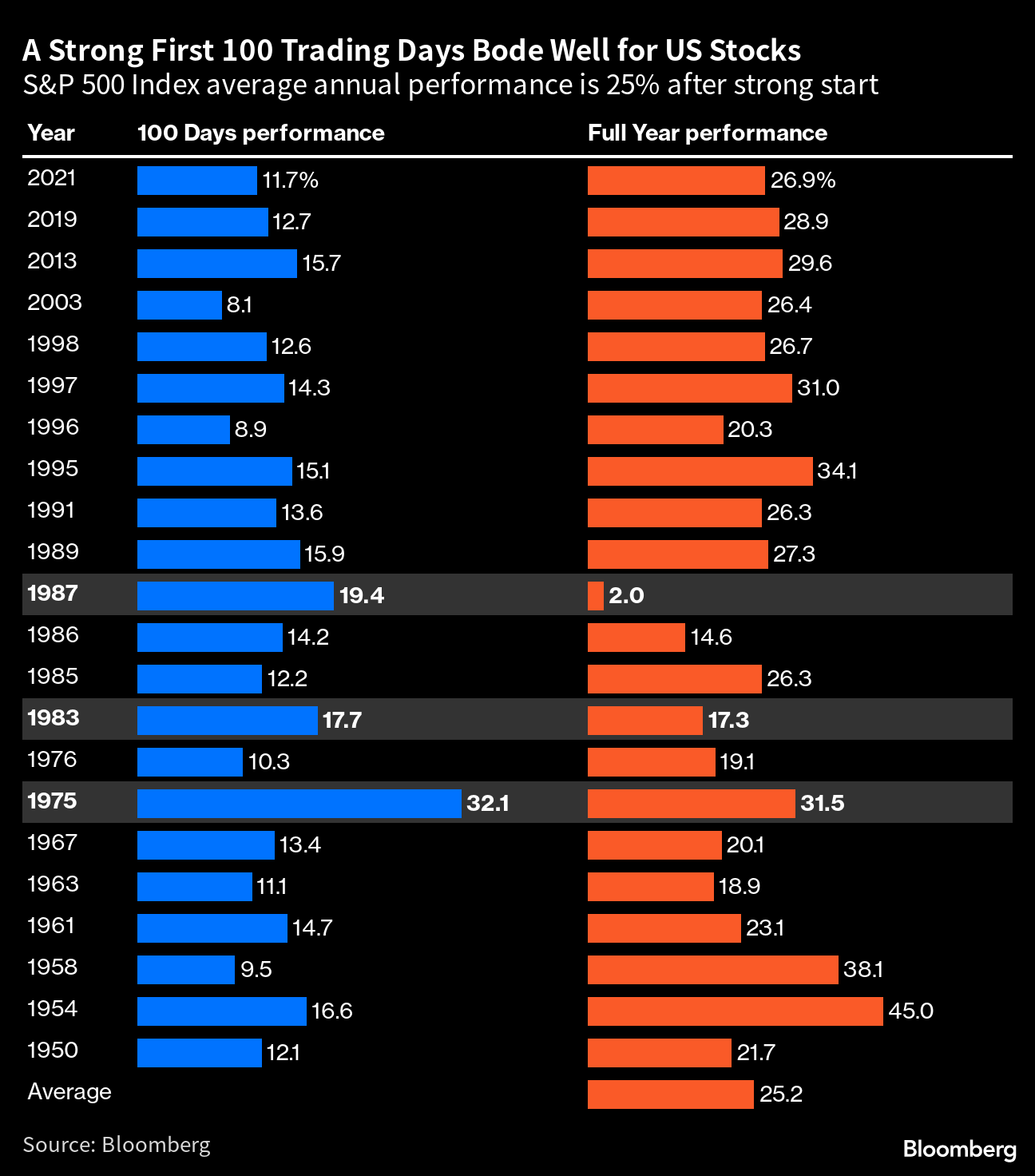

Later in 2023, we saw even more credible evidence emerge:

- The stock market rallied during the first 100 days. It looked strong.

- Based on historical data going all the way back to 1950, this suggests an 86% chance that the market will be positive for the rest of the year.

Source: Bloomberg

So, what’s driving all this buoyancy? Well, it’s quite simple. We’re making good progress in the fight against inflation, and the global economy remains resilient:

- In the United States, the Federal Reserve has raised its base interest rate from almost 0% to over 5%. This has unfolded over the course of 14 months — representing the steepest rate hike in decades.

- Yes, this policy of monetary-tightening has shocked the market — but this bitter medicine was necessary. Inflation needed to be tamed.

- In this regard, the Fed has been remarkably successful in its mission. Back in June 2022, year-on-year inflation in America clocked in at 9.1%. However, in May 2023, that figure has dropped to 4%.

- Meanwhile, despite all the predictions of a deep recession, the economists have been proven wrong so far. The job market remains extraordinarily strong. For example, in May 2023, analysts predicted that 190,000 jobs would be added in America. The actual figure turned out to be much higher — 339,000.

- Some data appears to suggest that America’s unemployment rate is at its lowest point since 1969. Truly mind-blowing.

- Neil Irwin from Axios says: ‘This economy has been a freight train. It’s just been chugging along at a steady pace.’

- The story is much the same in other countries around the world. The fight against inflation is gaining positive traction — without necessarily pushing the world into hardship. This is good news.

- Then, on Wednesday night, we got another positive indicator. The Fed has paused interest-rate hikes for now, while leaving the door open for just two more hikes later this year. Most notably, the Fed believes that the American economy will remain resilient. Any recession, if it happens, will be mild. This may very well mean that the next leg of the investment cycle can begin in earnest.

Source: Zipmex

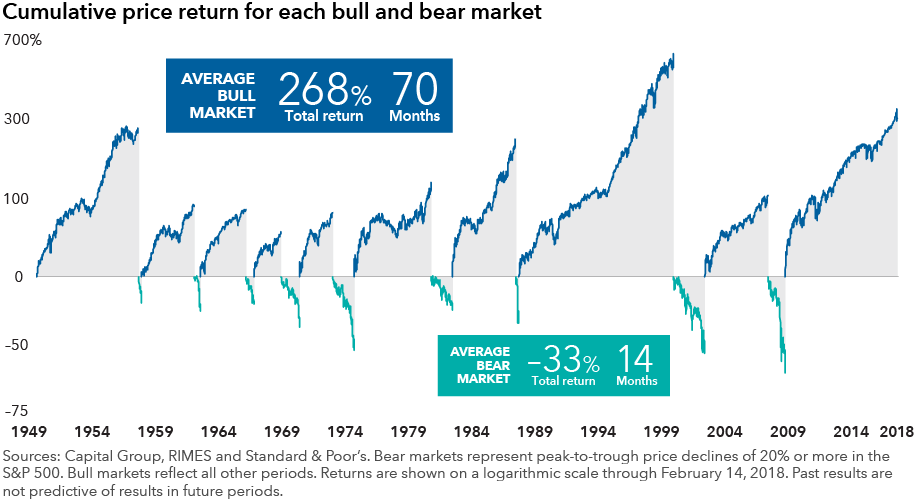

So, is it really happening? Are the bears retreating while the bulls are starting to charge forward? Well, let’s get some clarity here:

- The American Association of Individual Investors has released its latest sentiment survey. It revealed that 44.5% of respondents were bullish, expecting stocks to be higher six months from now. Only 24.3% remained bearish.

- Interestingly, this is the first time since November 2021 that the bulls have exceeded bears by more than 20%.

- I’ll translate this into plain English: the bulls seem to have the momentum now.

What happens next?

If you’ve been paying attention to the financial news, then you already know about the artificial intelligence craze that’s driving tech stocks higher. They’re clearly the flavour of the moment.

But that’s not the only seismic shift that’s happening. What you’re seeing is just the tip of the iceberg. There is actually another secret opportunity unfolding right now in the stock market. It’s happening specifically in global real estate.

We are currently targeting companies that may offer the perfect combination of value, income, and growth.

At the moment, because of irrational negativity, they are available at lower-than-usual prices. They are selling for as much as a 30% discount below their book value.

A bargain? Yeah, absolutely.

In the words of Warren Buffett: ‘I don’t look to jump over seven-foot bars; I look around for one-foot bars that I can step over.’

But watch out. These one-foot bars won’t last forever. When the inflation cycle turns, you can bet those bars will probably jump back up to being seven-foot tall. And it can happen faster than you think.

What happens when fear turns to greed?

Source: Capital Group

Right now, our Wealth Morning Managed Accounts are designed for Eligible and Wholesale Investors who need a Quantum Income Strategy to protect and grow their wealth.

For our target client, we are focused on securing strong dividend income of $60,000 or more per year (depending on capital and market conditions).

Ask yourself: is this something you urgently need to act on?

Come talk to us.

We are opening for limited consultations on our Managed Accounts Service. (Available until Tuesday, 20 June).

Apply for your consultation now.

Apply for your consultation now.

Regards,

John Ling

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. Managed Account Services are for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013. Please request a free consultation if you would like to discuss your eligibility.)

The post Investor Alert: Is a Bull Market Building? appeared first on Global Opportunities Beyond the Radar.