Here is an impressive observation made by a developing trader on the desk that can help your trading, specifically your scalping. The trader observed:

I have sometimes gotten in situations where I have an overall directional bias on the name I’m currently trading, and it ends up bleeding into the actual scalps I’m taking.

Scalping Rules (The secrets to scalp trading success)

How does this manifest to your detriment in your trading? Here are four ways:

- You think a stock will trade higher and then buy a Pull In Trade way too early.

- You misread a signal the stock is about to trade higher because you are so anxious to enter.

- You miss an easy short scalp with an excellent risk/reward.

- You keep scalping the bottom of a stock that is clearly in an intraday downtrend.

What 6 ideas can help you avoid these trading losses?

- Practice daily mindfulness.

- Watch back film of the most important moments in the best scalps.

- Develop specific rules for your shorts. Build a Scalping PlayBook. This is your scalping business.

- Create alerts for your scalps.

- Stick to these scalp trades.

- Measure your scalps, keeping the ones that are most profitable and eliminating the others that are not.

Try these six ideas to avoid harmful bias with your scalping.

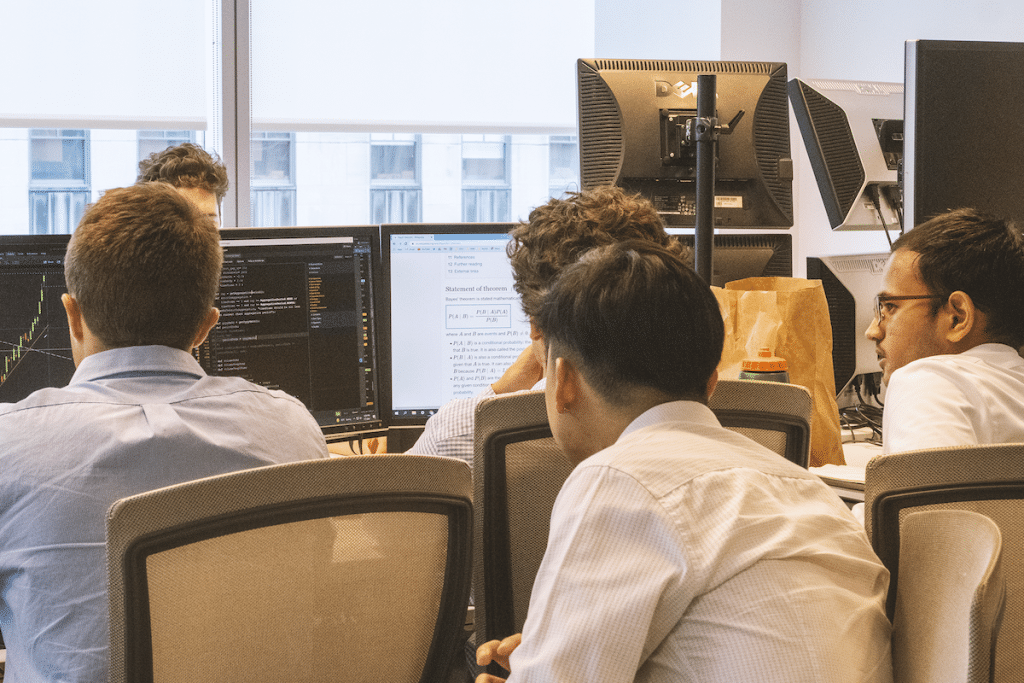

Mike Bellafiore is the Co-Founder of SMB Capital, a proprietary trading desk, and SMB Training, which provides trading education in stocks, options, and futures. Bella, @MikeBellafiore, is the author of One Good Trade and The PlayBook. He welcomes your trading questions at mbellafiore@smbcap.com.

The post 6 Ideas to Avoid Harmful Bias in Your Scalping appeared first on SMB Training Blog.