- Limited caps absorb had a in point of fact accurate June, outperforming the S&P 500

- One technique to make investments in little caps is through devoted ETFs

- One wrong device is to purchase excessive-flying little caps that we are going to discuss on this article

- InvestingPro Summer season Sale is on: Attempt our giant discounts on subscription plans!

While the expertise-focused Nasdaq and the Jap Nikkei 225 absorb had your entire consideration as a result of their spectacular rallies this year, it be basic to redirect our focal point in opposition to any other category of shares that absorb been performing exceptionally well, critically in contemporary occasions.

Enter the realm of little-cap firms. These firms, with market capitalizations in most cases ranging between $300 million and $2 billion within the US, absorb demonstrated accurate efficiency relative to the broader market.

In Europe, the threshold for outlining a firm as a little cap would possibly perhaps be €3 billion. Beyond these ranges, we salvage mid-cap and well-organized-cap firms.

Within the US, little firms represent over 60% of the market, whereas in Europe, their illustration is reasonably above 50%. This highlights the significance of the little-cap sector, making it an space worth monitoring.

A great deal of little-cap indexes exist to trace the efficiency of those firms. In Europe, little caps will also be tracked by the EURO STOXX Limited Cap, whereas within the US by the S&P 600 Limited Cap and the US Limited Cap 2000.

Investing in little caps will also be executed through specialised funding vehicles equivalent to mutual funds and ETFs. Listed below are about a examples:

- Invesco S&P SmallCap 600 Pure Cost ETF (NYSE:RZV)

- SPDR S&P Rising Markets Limited Cap ETF (NYSE:EWX)

- First Have confidence Developed Markets ex-US Limited Cap AlphaDEX Fund (NASDAQ:FDTS)

- L&G Russell 2000 US Limited Cap UCITS ETF USD Procure (LON:RTWO)

- SPDR® MSCI Europe Limited Cap Cost Weighted UCITS ETF EUR Acc (ETR:ZPRX)

<

p dir="ltr">A compelling illustration of the energy of little caps lies within the S&P 600 Limited Cap ETF (NYSE:SLY) which vastly outperformed the S&P 500 in June. Truly, the massive majority of little-cap shares absorb experienced well-known growth this month.

<

p dir="ltr">Curiously, the IFA U.S. Limited Company index has delivered an spectacular annual return of +11.1% since 1928, outperforming the +9.9% annualized shatter of the S&P 500 over the same interval.

Now, let's survey a various of extremely promising little-cap shares that are experiencing tough growth this June. To behavior our prognosis, we can leverage InvestingPro, which offers us with entire files and precious insights.

1. Caleres

Caleres (NYSE:CAL) is a authorized American sneakers firm headquartered in Clayton, Missouri. With a rich historical previous dating lend a hand to its establishment in 1878 as Bryan, Brown & Company in St. Louis, the firm has gone through several title modifications staunch through its existence. Caleres for the time being owns and operates loads of sneakers brands, positioning itself as a key participant within the industry.

Source: InvestingPro

It may perhaps probably pay an annual dividend of $0.28 per piece ($0.07 every quarter). The yield is +1.16%.

Source: InvestingPro

Caleres is scheduled to tell its monetary results on September 5. Notably, the firm's previous earnings, released on June 1, EPS surpassed expectations.

Source: InvestingPro

InvestingPro objects give it a likely of $33.Forty five.

Source: InvestingPro

The inventory is up +34.77% in June.

2. Quanex Building Merchandise Corporation

Quanex Building Merchandise (NYSE:NX) is a international manufacturing firm serving manufacturers within the cabinetry, solar, refrigeration, and commence air products markets.

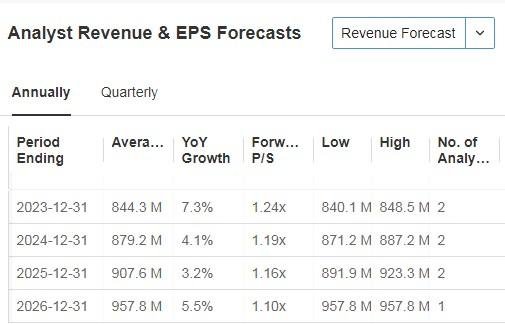

Source: InvestingPro

Quanex Building Merchandise is any other firm that can pay a dividend of $0.32 per year, with a quarterly distribution of $0.08. This finally ends up in a dividend yield of roughly +1.24% in accordance to the sizzling inventory heed.

The following dividend from Quanex Building Merchandise is scheduled to be disbursed on June 30.

Source: InvestingPro

Quanex Building Merchandise is predicament to reveal its monetary results on September 7. Within the previous liberate on June 1, the firm reported definite results that exceeded market expectations.

Source: InvestingPro

The inventory is up +21.41% in June.

Source: InvestingPro

Source: InvestingPro

InvestingPro objects give it a likely of $32.58.

3. CIRCOR Global

CIRCOR Global, Inc. (NYSE:CIR) is a renowned international dealer of products and companies catering to industrial, aerospace, and protection markets. It boasts a diverse portfolio of products from high brands, which it distributes through varied partners to over 14,000 possibilities all the very best device through 100 nations. With a international presence, its headquarters will be found in Burlington, Massachusetts.

The firm is predicted to liberate its monetary results on August 10. The market has raised income expectations for the quarter, indicating anticipated accurate efficiency. Moreover, the firm forecasts a extra than +13% assemble bigger in earnings for the year, projecting earnings per piece of $2.07. Over the next five fiscal years, fetch earnings growth is predicted to common around +37%.

Source: InvestingPro

The previous earnings file used to be on Might perhaps perhaps well also merely 11, and so that they a ways exceeded market forecasts.

Source: InvestingPro

BlackRock is the discontinue equity holder, and Forefront is the third.

Source: InvestingPro

CIRCOR Global's inventory has demonstrated mighty growth in contemporary occasions. Within the month of June by myself, its shares absorb surged by +77%, and over the previous twelve months, they've soared by an spectacular +239.87%.

4. Clothier Brands

Clothier Brands (NYSE:DBI) is a firm that specializes in designing, producing, and retailing sneakers and equipment brands. With over 1,000 distribution points, it offers a giant various of branded and clothier sneakers and equipment for both costume and informal sports actions occasions. The firm's first retailer opened in 1991 in Dublin, Ohio, and it has since expanded to operate extra than 500 stores all the very best device through 44 states.

Source: InvestingPro

Source: InvestingPro

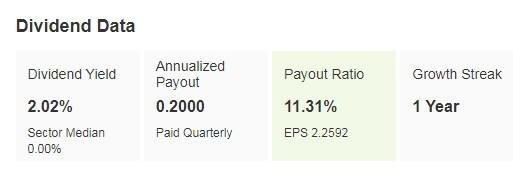

Distributes an annual dividend of $0.20 per piece ($0.05 every quarter) with a yield of +2.02%.

Source: InvestingPro

Clothier Brands has pursued an aggressive piece repurchase procedure, ensuing in repurchase yields of +19.6% over the previous twelve months.

It reports results on August 29.

Source: InvestingPro

Its shares are up +52.64% in June.

Are you pondering contemporary inventory additions to your portfolio or divesting from underperforming shares? While you study about access to the finest market insights to optimize your investments, we counsel making an try the InvestingPro knowledgeable tool without cost for seven days.

Bag entry to first-hand market files, components affecting shares, and entire prognosis. Money in on of this chance by visiting the hyperlink and unlocking the capacity of InvestingPro to toughen your funding choices.

And now, you doubtlessly need to have faith the subscription at a little bit of the humble heed. So, glean ready to spice up your funding procedure with our queer summer discounts!

As of 06/20/2023, InvestingPro is on sale!

Experience amazing discounts on our subscription plans:

- Monthly: Place 20% and glean the pliability of a month-to-month subscription.

- Annual: Place an wonderful 50% and accurate your monetary future with a pudgy year of InvestingPro at an unbeatable heed.

- Bi-Annual (Web Special): Place an wonderful 52% and maximize your earnings with our queer web provide.

Don't streak over this restricted-time various to access cutting-edge instruments, proper-time market prognosis, and knowledgeable opinions.

Be a half of InvestingPro nowadays and unleash your funding likely. Dart, the Summer season Sale would possibly perhaps furthermore no longer closing eternally!

Disclaimer: This article used to be written for informational applications finest; it would now not represent a solicitation, provide, advice, counsel, or suggestion to make investments, nor is it supposed to lend a hand the have faith of resources by any means.

The post 4 Limited-Cap Powerhouses That Skyrocketed in June appeared first on FOREX IN WORLD.