Corey Hoffstein of Newfound Research celebrated his company’s 15th birthday with a “What I have learnt in these 15 years” Tweet storm.

You might want to check out my previous notes on how Corey sees his personal portfolio here.

You can read the whole Tweet in a post here: 15 Ideas, Frameworks, and Lessons from 15 Years

I don’t profess to understand everything, but while the post is cheem, it makes me want to re-read it because:

- People have done a lot of hard work, and execution and they distil what works, doesn’t work, or things that are so dangerous in one post.

- Most of these posts come across with very simple instructions. Just diversify. Buy the market. But I find that it is important to go just one or two levels down deeper to understand why because we might be making the same mistakes day-to-day.

As I finished reading the post, I realized something else.

Some of these people really do a lot of things. All we see is just the strategies.

But there is a lot of work done in not putting things into the strategy.

Sometimes clients will ask “What am I paying for?”

Perhaps you are paying for the work that you cannot do, of going through the due diligence of whether these strategies show promise or not. You are also paying for the experience and governance.

And telling “why we don’t do this and why we don’t do that” is also healthy and necessary client communication.

Here are some of the points that really caught my eye.

1. Risk cannot be destroyed, only transformed.

Ultimately, when you build a portfolio of financial assets, or even strategies, you’re expressing a view as to the risks you’re willing to bear.

I’ve come to visualize portfolio risk like a ball of play-doh. As you diversify your portfolio, the play-doh is getting smeared over risk space. For example, if you move from an all equity to an equity/bond portfolio, you might reduce your exposure to economic contractions but increase your exposure to inflation risk.

The play-doh doesn’t disappear – it just gets spread out. And in doing so, you become sensitive to more risks, but less sensitive to any single risk in particular.

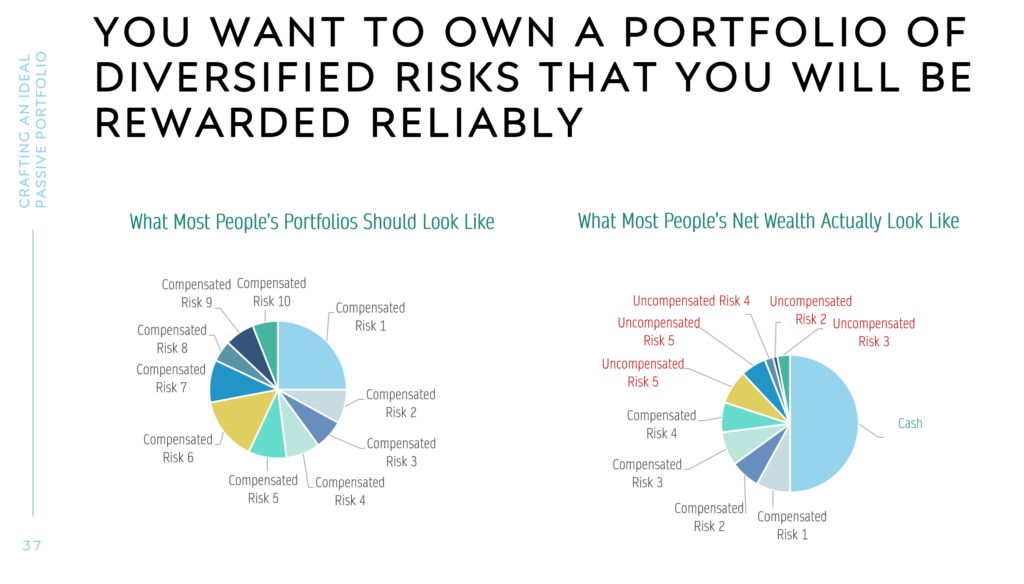

Basically this in a nutshell.

This was taken from my portfolio crafting video.

2. “No pain, no premium”

The philosophy of “no pain, no premium” is just a reminder that over the long run, we get paid to bear risk. And, eventually, risk is likely going to manifest and create losses in our portfolio. After all, if there were no risk of losses, then why would we expect to earn anything above the risk-free rate?

I read this as:

- If you skirt away from risks, you get rewarded with a risk-free rate.

- Risks usually come with uncertainty. Therefore, investing it is suppose to be uncomfortable.

3. Diversifying, cheap beta is worth just as much as equally diversifying, expensive alpha.

We are obsessed with doing better than the index but instead of doing that, we should be finding a way to just capture market risk premium.

I read this part as… too many just want to pick stocks but didn’t get “invested in the market enough”.

Basically, we have too much cash in our “portfolio” and we should pluck the low hanging fruit of just earning market risk even in bonds, then to just keep trying to pick stocks.

4. Diversification has multiple forms.

Last year, a portfolio manager that is rather experienced in this indexing, factor portfolio formation space spoke to us.

He shared that when you rebalance can cause a difference in short-term performance.

My comment here is short but you should see Corey’s example.

He uses an example of a very popular trend-following risk management strategy of the 10-month moving average that shows us we can have concentration in some of the planning or strategy setups we make.

Shortly thereafter my good friend Adam Butler pointed out to me that the choice of a 10-month moving average was just as arbitrary. Why not 9? Why not 11? Why not 200 days? Why a simple moving average and not an exponential moving average or simple time-series momentum? Just like what I saw with rebalancing schedule, the long-run returns were statistically indistinguishable but the short-run returns had significant dispersion.

The sort of dispersion that put managers out of business.

His conclusion leads him to not just diversify:

- Across assets or securities

- But also across investment decision: value or momentum? and within value, how do you measure value?

- Also the rebalancing schedule

Just as traditional portfolio theory tells us that we should diversify what we invest in because we are not compensated for bearing idiosyncratic risk, I believe the same is true across the how and when axes.

Our aim should be to diversify all uncompensated bets with extreme prejudice.

5. The philosophical limits of diversification: if you diversify away all the risk, you shouldn’t expect any reward.

Our investment analyst likes this one.

If a strategy worked all the time, everyone would do it and it would stop working.

Similarly, if you’re building a portfolio, you need to take some risk. Whether that risk is some economic risk or process risk or path dependency risk, it doesn’t matter – it should be there, lurking in the background.

If you want a portfolio that has absolutely no scenario risk, you’re basically asking for a true arbitrage or an expensive way of replicating the risk-free rate.

In other words, if you diversify away all the risk in your portfolio – again, think of this as smearing the ball of play-doh really, really, really thin across a very large plane of risk scenarios – return should just converge to the risk-free rate.

But arbitrages don’t come around easy. Especially for low-frequency strategies and combinations of low-Sharpe asset classes. There is no magical combination of assets and strategies that will eliminate downside risk in all future states of the world.

But we can also invert the statement and say that for any disciplined investment approach to underperform over the long run, it must experience periods of outperformance in the short run.

For active managers, the frustration is not only does their investment approach have to under-perform from time-to-time, but bad strategies will have to out-perform. The latter may seem confusing, but consider that a purposefully bad strategy could simply be inverted – or traded short – to create a purposefully good one.

There is going to be some uncomfortable situation. If it is so comfortable and there is no real risks… then we will all be earning risk free rates.

6. It’s usually the unintended bets that blow you up.

We make financial decisions often and we wish that they went right.

But it usually isn’t what we intend to do that kills us but it is the things we didn’t intend to do that creep into our portfolio that we weren’t aware of that kills.

This can be found in a few levels but there is this thing called known unknowns. What sophisticated investors know that you don’t know.

People know more than you and you make your decisions without this set of knowledge.

Whenever I craft a financial planning setup, these are the questions I find myself asking more:

- How come not many people use this system more?

- Do I know enough so that we don’t fxxk ourselves (and our clients) up royally?

- When will this setup NOT work?

The unfortunate thing is… we probably need more time to incubate to be more sure about things. But even then… there is still that little bit of uncertainty.

A lot of times, the better set up is one where it is:

- More simple

- More diversified

- Rely on flexibility of humans (if we determine we can really be flexible)

8. The more diversified a portfolio is, the higher the hurdle rate for market timing.

Corey explains that it is so hard to make a case for market timing when compared to diversification.

He cites a regime-based factor-timing strategy he came across and proceeds to test it himself. The returns from the result was astoundingly good but so is the result of a naive, equally-weighted portfolio of factors.

He finds it hard to beat naive diversification:

- The question we should ask is “how accurate would I have to be to beat a well-diversified portfolio?”. If we did the work, we will realize we have to be very accurate to beat a well-diversified portfolio.

- To quote Michele Aghassi from AQR, “you’re comparing now versus usual.” And being wrong compounds forever.

- It is a lot easier to find something that can diversify your returns than it is to increase your accuracy in forecasting returns.

- The more predictable a thing is, the less you should be able to profit from it.

10. Under strong uncertainty, “halvsies” can be an optimal decision.

Corey gave us the example of a debate into which way to construct a factor portfolio is the best: whether to construct each factor in isolation and held them in its own sleeve or to rank the stocks in all factors simultaneously, and take the stocks with the best aggregate scores.

Both were strongly supported and Corey did deep work into it.

Eventually, he just did 50% of one and 50% of the other.

He diversified.

He hedged against uncertainty.

If we did enough work, such that both strategies look “Equal” but we know they might not be “Equal”, perhaps the easier way is to just be diversified.

It hedges the “what if I missed out something in my own analysis” situation.

11. Always ask: “What’s the trade?”

There are some situations where it looks absurd if you are financially sophisticated enough.

Corey shares that maybe it makes sense to us ourselves that title question.

Working through how actually to profit from the absurdity often shines a light on why our analysis is wrong.

13. Behavioral Time is decades longer than Statistical Time

Managing money is tough.

Your clients are humans.

In the real world, however, a multi-year drawdown feels like a multi-decade drawdown. Saying, “this performance is within standard confidence bands for a strategy given our expected Sharpe ratio and we cannot find any evidence that our process is broken,” is little comfort to those who have allocated to you. Clients will ask you for attribution. Clients will ask you whether you’ve considered X explanation or Y. Sales will come screeching to a halt. Clients will redeem.

For anyone considering a career in managing money, it is important to get comfortable living in behavioral time.

Being in this business, I know this all too well.

There is a thing called “Tracking Error” risk.

In my words, it is how far your actual performance is from the index.

Even if your proposed fund works and help the client during a downturn with a better result, they don’t see it. Especially so if you did worse than the index in the run-up.

This is why so many are in a market-cap weighted S&P 500.

15. A backtest is just a single draw of a stochastic process.

Backtests can be done with a lot of “confirmation bias” in its own ways.

We could curve fit, over fit, over optimize in our desperation surge of the holy grail strategy.

Historical prices and data are, after all, just a record of what happened but not a full picture of what could have happened.

I will try to remember this since I look at so much historical returns.

Even with 150 years of US return data, that might not be long enough in the grand scheme of things.

The 20-25 year US market returns show that the lowest compounded return is 4-6% a year. That sounds real good until you pit the historical return against the mathematical model. Then the historical return will look too high. It may mean that going forward, we might have something worse than the Great Depression on the horizon.

If you like this stuff and wanna tap into my money brain, do join my Telegram channel.

I share what I come across in:

- individual stock investing

- wealth-building strategies

- portfolio management

- personal finance, financial independence.

I would also share some of the thoughts of wealth advisory, financial planning and the industry that I don’t wanna put out on the blog.

Would probably share some life planning case studies based on the things I hear or came across as well.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I currently work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

The post 15 years, 15 lessons on Risk & Returns, Diversification, Factors, and Being Wrong – Corey Hoffstein appeared first on Investment Moats.