Quantum computing stocks are a hot topic these days. If you try using ChatGPT, one of the first prompts you’re likely to encounter is “Explain quantum computing in simple terms.” If you factor in all the news articles and hype surrounding this cutting-edge area of tech, it’s not difficult to see how quantum technology has plenty of individuals curious and wanting to learn more[1].

And with all of this booming interest, a natural question for investors is, “Should I invest in quantum technology?” After all, quantum technology today is sort of like crypto technology back in 2014: Nobody knew where the tech was going, but those lucky enough to get a spot on the ground floor found themselves catapulted to stratospheric heights within a few years.

No one knows where quantum technology is headed, but there is good reason to believe that we can expect the excitement surrounding this space to only increase over the next few years.

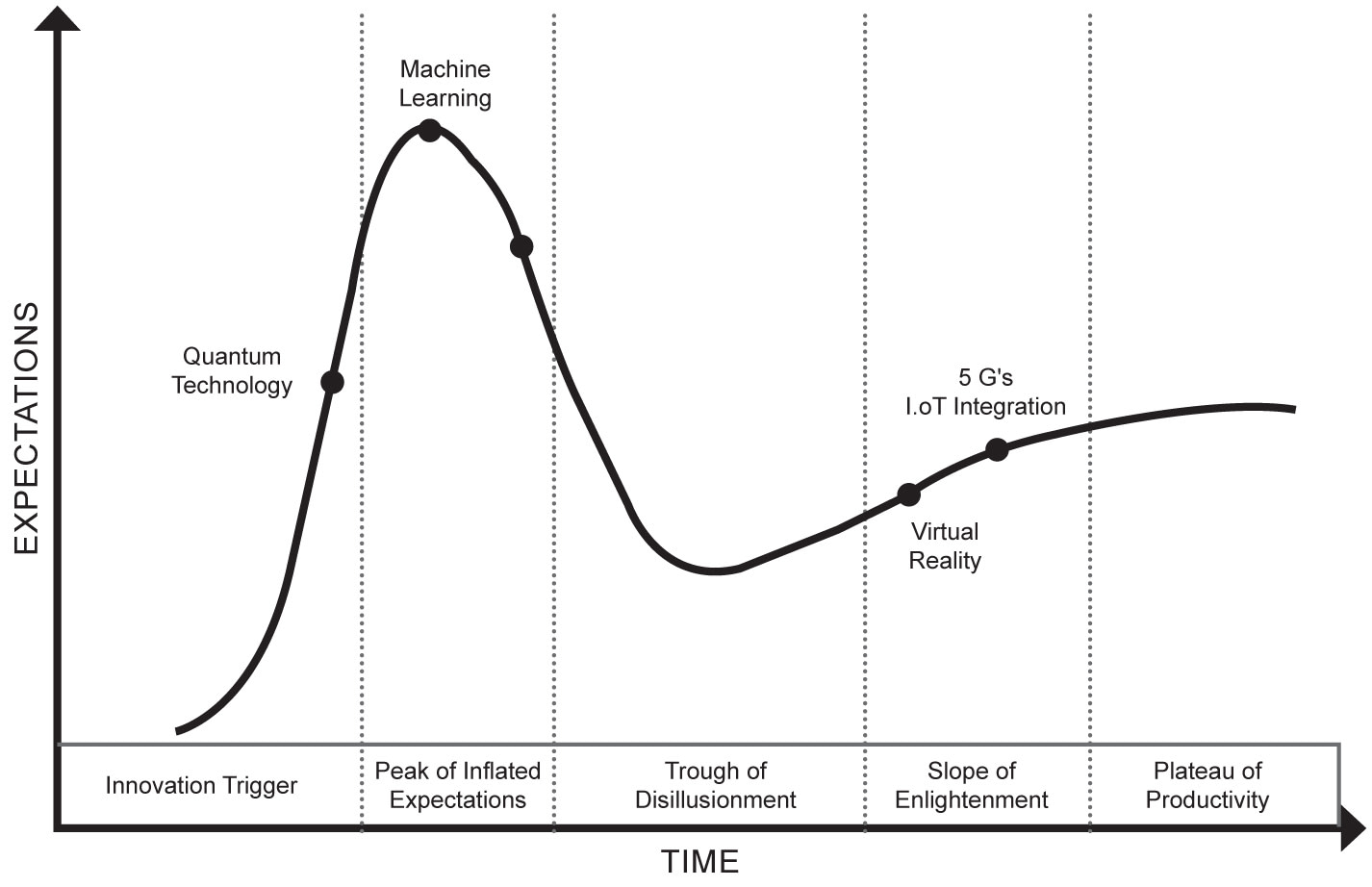

If you look at the technology hype cycle surrounding this space, you see that quantum technology is still in its early phases, with plenty of innovation going on.

Quantum technology is still in its very early stages and has yet to hit the point of inflated expectations. That suggests that the companies that succeed in this space are going to keep appreciating in value in accordance with rising expectations.

Before delving into the different quantum computing stocks that might be worth investing in, let’s look at what exactly quantum technology is, where the industry currently stands, what the different players are doing, and what benchmarks need to be crossed before this industry takes off.

What Exactly Is Quantum Technology?

Quantum technology is an umbrella term that encapsulates numerous advanced technologies. Some examples include quantum telecommunications, quantum cryptography, quantum sensing, and quantum computing.

Let’s focus on quantum computing technology.

What is Quantum Computing?

The computer you’re reading this article on relies on binary bits, strings of 0’s and 1’s.

Quantum computers use qubits, which stand for quantum bits. Unlike ordinary digital bits, qubits can occupy 1, 0, or both at the same time through a phenomenon called superposition. As a result, a single qubit can carry way more information than a classical bit. A quantum computer can perform many more calculations at a much faster rate.

While there are several online analogies highlighting the difference between quantum and classical computers, the simplest and most straightforward one I found a while back goes as follows:

While there are several online analogies highlighting the difference between quantum and classical computers, the simplest and most straightforward one I found a while back goes as follows:

Imagine you are playing a game where you are standing in front of 100 shut doors. Now, behind one of those doors is a treasure of some sort, but the remaining 99 have nothing behind them. Obviously, you want to open the door that hides the treasure, so how do you go about solving that problem?

For a digital/ classical computer, the answer is simple: Open one door after another until you find the one you’re looking for.

A quantum computer will try to solve this problem by opening all the doors simultaneously, which is a much faster solution.

What Determines The Power of a Quantum Computer?

Although there are numerous factors that dictate the power of a quantum computer, let’s keep the conversation simple by focusing on only one factor: the number of qubits.

A quantum computer’s power almost doubles with the addition of each individual qubit. So, a quantum computer with 32 qubits is twice as powerful as a quantum computer with 31 qubits.

Things aren’t as simple as just simply adding as many qubits as you would like. The addition of each qubit can create errors within the system and makes controlling the entire quantum computer more difficult.

Quantum computer manufacturers are scrambling today to add more and more qubits without sacrificing the performance of their devices. This is a tall order and is easier said than done. In fact, the difficulty of this problem is what is stopping us from achieving quantum advantage.

Quantum advantage is achieved when a quantum computer can do things better than a classical computer. It is the holy grail of the quantum computing industry. Every company is racing towards it, and the first company to cross that finish line will reap significant rewards. We still have not attained that goal, but we are inching toward it every day.

Why Does Any of This Matter to The Average Investor?

If you want to be able to understand how quantum computing is evolving as an investment space, then you need to understand the basics as well as what’s at stake for the companies scrambling to get a foothold. This will make the process of choosing the right quantum computing stock easier for you.

The quantum computing industry is still in the innovation phase. And, as companies push for quantum advantage, many of them are bound to exhibit quantum supremacy, which is a kind of quantum advantage lite. Think of it this way: if quantum advantage is all about quantum computers that outperform classical computers across the board, then quantum supremacy is all about quantum computers that are better than classical computers at very specific tasks.

Once a company can demonstrate quantum supremacy without a shadow of a doubt (I’m looking at you Google), people’s expectations are going to skyrocket. We’ll quickly enter a phase of inflated hopes and dreams, where investors will start pouring so much money into the space that prices will inflate and go beyond what is reasonable. Everybody will start claiming that since we have achieved quantum supremacy, then quantum advantage must be right around the corner.

Even though the quantum computing space contains numerous players, the main ones to focus on are the ones building the actual devices. That this is where most of the competition and innovation is at the moment.

While there are numerous hardware manufacturers building quantum computers, different companies are tackling this problem from different angles. For instance, IonQ uses trapped ion qubits for gate-based quantum computing, but IBM relies on superconducting qubits for their computers. There are even manufacturers building quantum annealers, which are quite different than gate-based quantum computers.

You don’t need to understand all the intricacies involved in the different hardware solutions for quantum computing.

What you need to understand is that there is no consensus about the fundamental constituents of the quantum computers of the future. So, what’s at stake for the manufacturers of today is that those who are able to achieve quantum supremacy first will likely have a much louder voice in dictating how the future of this entire industry will play out.

As a result, investing in a quantum computing stock is tantamount to saying that their hardware solution is the one you’re willing to bet on for the future. It is a very speculative decision, one that should be made with both eyes open.

Best Quantum Computing Stocks to Invest In

Even though there are many ways to break this list down, I figured the best way would be to group the different quantum computing stocks according to their underlying technology seeing as that is what you would be betting on.

The main technologies we will look into are as follows:

- Superconducting qubits

- Quantum annealing

- Trapped-Ion Qubits

Before exploring the stocks within each category, we will briefly talk about the technology itself, how it works, its pros and cons, and how close it is to achieving quantum supremacy.

Superconducting Qubits

Out of all of the technologies, superconducting qubits are receiving the most investment. A big reason they are popular is that they are basically electronic circuits that have a lot in common with both analog and digital circuits. Much of the know-how, as well as the required facilities, are already there.

Some of the benefits of superconducting qubits are as follows:

- They are heavily used in research, and some of the biggest companies in the world, including Google, IBM, and Amazon, are pouring millions of dollars into developing these types of qubits.

- Of the different solutions, superconducting qubits are the most scalable. In other words, when it comes to cramming as many qubits as possible within one device, these types of qubits have proven to be the most effective. As far as the record goes, IBM has been able to put as much as 433 qubits onto its latest quantum product, Osprey.

- A lot of the required supporting technologies already exist, such as amplifiers, cryostats, cabling, and so on.

Here are some of the biggest red flags with this technology:

- Even though superconducting qubits are scalable, they tend to be error-prone. This limits what can actually be done with them.

- The number of possible connections between qubits is limited by the hardware architecture.

- Because superconducting qubits can be different from one another, these types of quantum computers need a lot of calibration and complicated microwave frequency maps.

One way to overcome how error-prone superconducting qubits is to use something called error-correcting qubits. The idea, simply, is to collect a group of qubits and have them act as a single qubit. This reduces the error rate and gives us more confidence in the produced result. So, a superconducting quantum computer with 400 qubits might actually operate like one with only 50 qubits, where every 8 qubits are treated as a single one.

Error-correcting qubits are still not an ideal answer because it brings about its own set of problems, including excess overhead, cabling problems, and fidelity stabilization.

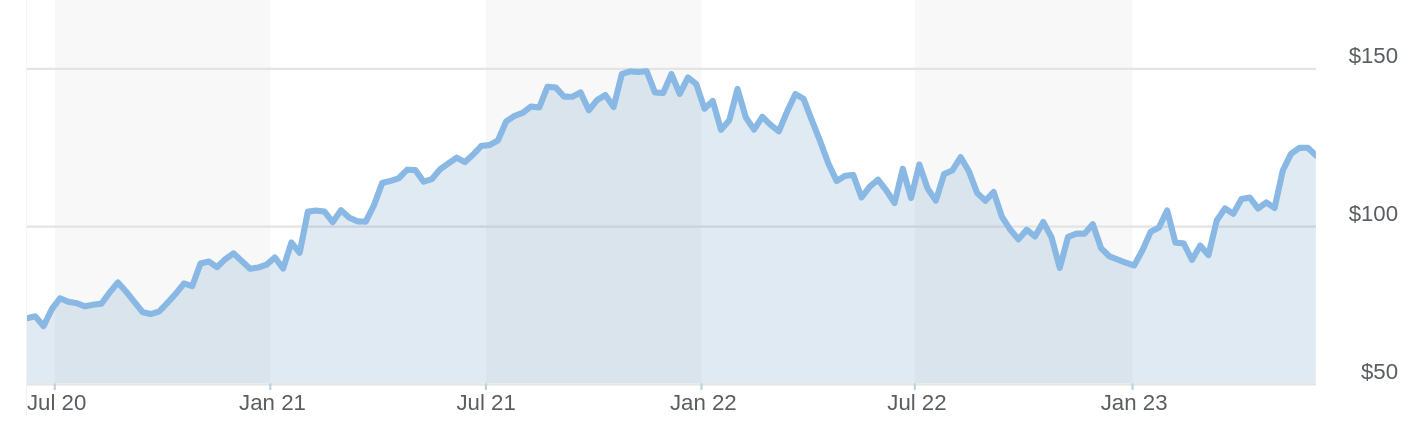

1. IBM (IBM)

| Price as of this writing | $135.41 |

| P/E | 68.92 |

| Dividend Yield | 4.91% |

IBM has its hands in plenty of pies, including AI, cloud computing, and quantum computing.

Of the companies working in superconducting qubits, IBM is probably at the front of the pack:

- In 2019, the tech giant introduced the first circuit-based quantum computer for commercial use. It was called the IBM Quantum System One and supported the 27-qubit processor nicknamed “The Falcon.”

- In 2021, IBM released a new quantum processor dubbed “The Eagle,” and it has 127 qubits.

- In 2022, the company then pushed the envelope even further, releasing Osprey and its 433 qubits.

- For 2023, IBM plans to release Condor, a quantum processor powered by 1121 qubits.

- IBM plans to have a 4000-qubit processor by the year 2025.

IBM is setting its sights on quantum advantage and has no plans of settling for mere quantum supremacy.

Hundreds of organizations are leveraging IBM’s quantum tech for research and development, including automakers, energy producers, and financial services businesses, making it one of the top quantum computing stock options.

2. Alphabet (GOOG)

| Price as of this writing | $122.28 |

| P/E | 27.59 |

| Dividend Yield | 0% |

Alphabet, Google’s parent company, also has skin in the quantum computing game. Google’s exposure to the quantum space is too small to have any real effect on Alphabet’s share price, at least for now. That could change.

Alphabet’s most famous quantum computer is called Sycamore, which has reportedly achieved quantum supremacy. Researchers at Google claimed that they had managed to solve a complex problem in 200 seconds with Sycamore and that the same problem would have taken a classical supercomputer more than 10,000 years.

However, these claims of quantum supremacy were quickly challenged, if not outright debunked. First off, researchers in China were able to demonstrate that a classical supercomputer could beat Sycamore. Researchers at IBM also disputed Google’s claims.

Even if Google hasn’t necessarily achieved quantum supremacy just yet, it has propelled the field forwards and ramped up interest. Google has established a quantum campus in Santa Barbara, California, to build the quantum computers of the future.

Aside from building quantum computers, Google is invested in quantum technologies in several other ways:

- Google is using quantum computing to advance the field of artificial intelligence through its Quantum AI platform.

- Google has partnered with several other quantum computing vendors, such as IonQ, and offers access to their devices through the cloud.

- Google has also helped develop Cirq, an open-source software framework to help program and run quantum computers.

When quantum computing starts taking off, Google, and by extension Alphabet, will be poised for the upwards ride.

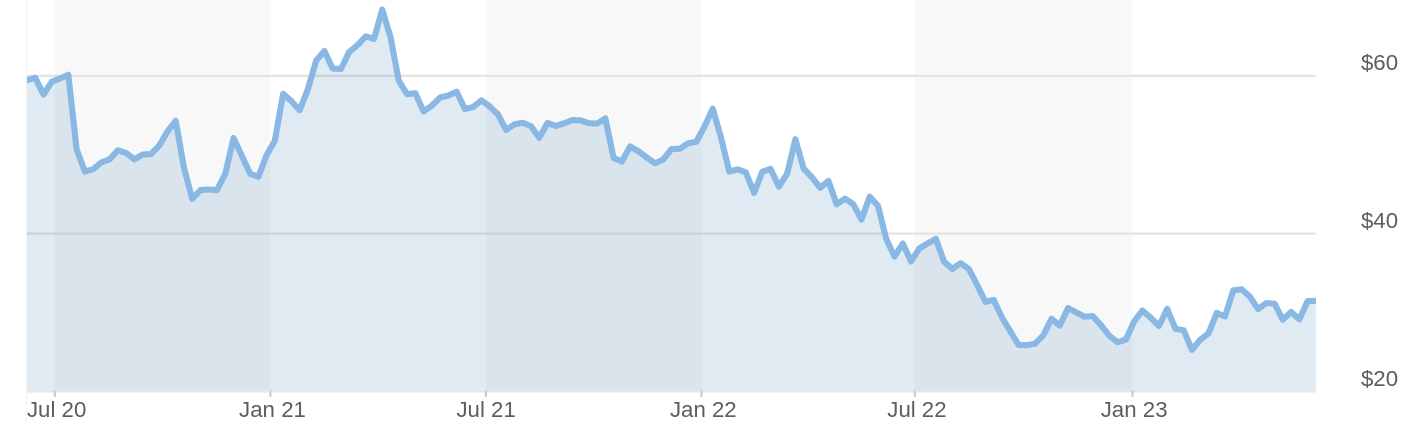

3. Intel (INTC)

| Price as of this writing | $31.35 |

| P/E | 15.9 |

| Dividend Yield | 1.6% |

Intel is known for being a pioneer when it comes to CPUs, where it competes with the likes of Advanced Micro Devices (AMD).

However, Intel has been exploring the quantum computing space as a new frontier. The chipmaker started its journey focusing on superconducting qubits, and here are some of the highlights:

- Intel released a quantum computer chip dubbed “Tangle Lake” back in 2018. The device had a 49-qubit processor.

- In 2020 the semiconductor behemoth announced the release of the Horse Ridge cryogenic control chip, which was cutting-edge at the time. The quantum chip could control up to 128 qubits.

Intel started its quantum computing journey focused on superconducting qubits, but it has recently decided to shift focus and develop silicon spin qubits instead, which is another type of quantum computing technology.

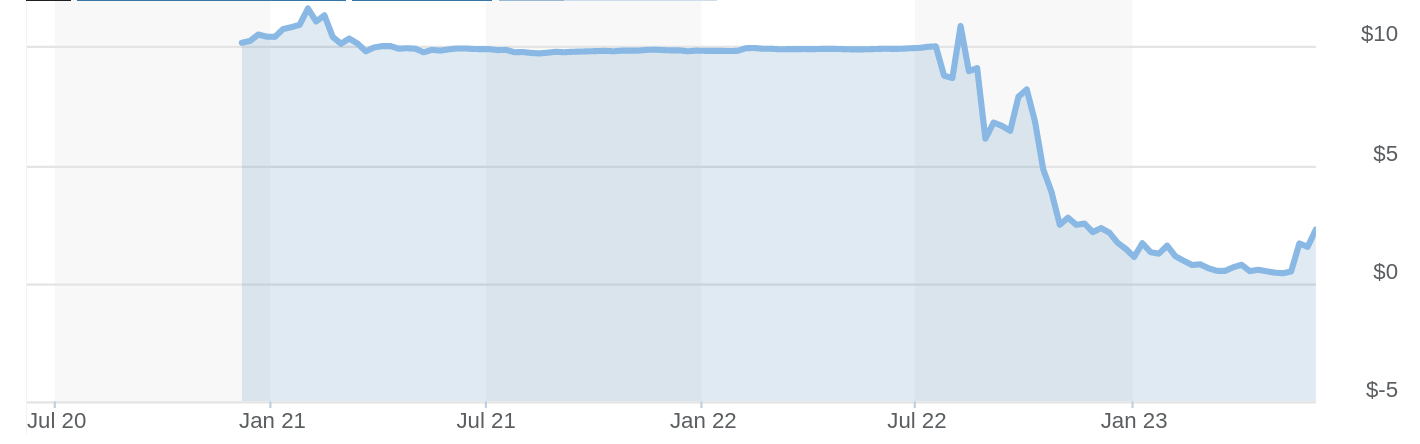

4. Rigetti (RGTI)

| Price as of this writing | $1.33 |

| P/E | -2.08 |

| Dividend Yield | 0% |

Of the companies on our list working on superconducting qubits, Rigetti is the only pure quantum computing play.

Back in 2013, the company was founded by Chad Rigetti, who is also the current CEO. Before starting Rigetti, Chad received his Ph.D. from Yale and built up some experience working with IBM’s quantum computing group. Accordingly, he is not only familiar with the space but has grand ambitions for it. He asserted that “In the next decade, one Rigetti computer could be more powerful than today’s entire global cloud.”

Rigetti – both the company and the man – is working hard to meet that ambitious vision. In addition to building superconducting quantum computers, the company is also leveraging its own cloud services platform as well as other cloud platform providers to grant access to its quantum devices. Rigetti also enables programmers by developing the requisite software solutions for them, helping them build algorithms.

Rigetti went public in 2022 through a SPAC merger with Supernova Partners Acquisition Co. II. Once public, it was initially valued at $1.5B, and its gross cash proceeds from the offering were around $458M.

Quantum Annealing

While superconducting qubits and trapped-ion qubits rely on a computing paradigm called gate-based computing, quantum annealing is a different quantum computing paradigm altogether. Even the underlying physics is different.

Quantum annealing operates somewhere between your gate-based quantum computer and a classical supercomputer.

A quantum annealer can do anything a gate-based computer can do, but there are differences in efficiency and speed.

Quantum annealers have several advantages to them:

- Quantum annealing is one of the oldest and most well-researched forms of quantum computing, so it is more technologically mature in comparison to its relatively younger siblings.

- Given its maturity, quantum annealing enjoys a healthy software ecosystem, with several startups working on these types of quantum computers.

- Quantum annealing has seen the largest number of successful case studies across numerous industries.

On the other hand, the technology does have a few drawbacks, including the following:

- The number of companies working in quantum annealing is limited, with D-Wave being the main name.

- Quantum annealing can have a high error rate.

- While there are several case studies, most of these applications are still at the proof of concept stage.

Quantum annealing will probably not produce a general-purpose quantum computer. It will excel at some things, such as optimization problems, but fall short on others.

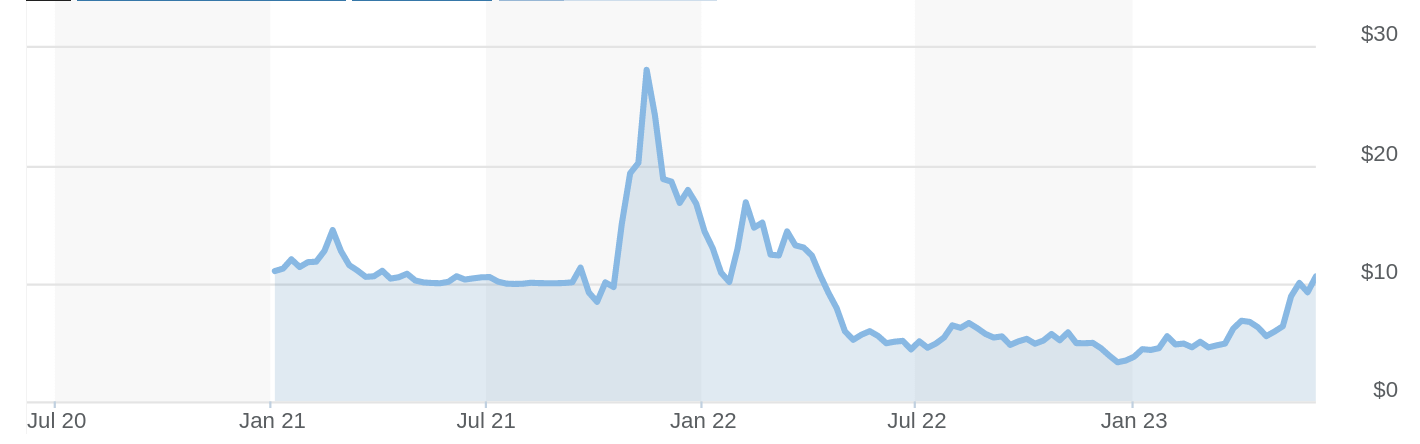

5. D-Wave (QBTS)

| Price as of this writing | $2.26 |

| P/E | -4.1 |

| Dividend Yield | 0.00% |

Another great quantum computing stock option is D-Wave. Like Rigetti, D-Wave is pure quantum computing play that provides end-to-end services. It builds quantum systems, delivers them to the public through the cloud, and helps programmers develop applications and algorithms to tackle different use cases.

D-Wave is not only one of the oldest quantum computing companies on our list, having been founded back in 1999, but it is also the only one specialized in quantum annealing. It has also demonstrated through numerous case studies how its tech cuts across various fields.

Interestingly, even though D-Wave’s accrued experience centers around quantum annealing, the company has decided to diversify, shifting part of its focus onto gate-based quantum computing.

D-Wave went public in 2022 through a SPAC merger.

Trapped-Ion Qubits

As the name might suggest, trapped-ion technology traps positively ionized atoms with the help of electrodes or magnetic fields. These ions are then placed next to each other in a confined space.

Some of the positives of trapped-ion technology include the following:

- Since the ions used are always identical, trapped-ion quantum computers tend to require little to no calibration, which isn’t the case with something such as superconducting qubits.

- Of the different types of qubits, ions tend to have the best stability, and the error rate per qubit tends to be low.

- The required physical conditions to run the quantum computer, such as cryogeny, are somewhat less onerous in comparison to other options.

- The number of potential connections between different qubits is much larger than other hardware solutions. This means that ion-trapped computers can theoretically solve more problems with fewer qubits in comparison to something as superconducting qubits.

On the other hand, ion-trapped qubits also have their own problems:

- The more qubits used in a single ion trap, the harder it is to get these qubits to communicate with each other.

- There is a scalability issue. Building a device with more than 50 qubits seems untenable with current technology.

- While trapped ion qubits can stay connected to one another for a relatively long time, it takes longer than usual for any mathematical operation to be carried out on them.

So, what will it take to achieve quantum supremacy with ion-trapped qubits?

While there are many ideas being thrown around, one of the most promising comes from companies like IonQ. They want to explore using a multicore architecture to overcome the scalability problem. The idea is that if you can’t build a single core with more than 50 qubits, then you might be able to scale by connecting multiple cores, each containing several qubits, and having these different cores communicate and operate as one large processor.

The jury is still out on whether this solution is viable or not, and only time will tell.

So, with that out of the way, let’s explore some of the top companies building ion-trapped quantum computers.

6. IonQ (IONQ)

| Price as of this writing | $10.61 |

| P/E | -29.47 |

| Dividend Yield | 0.0% |

IonQ is probably the biggest name in the game in trapped-ion technology. It is another pure quantum computing play.

Back in 2015, two researchers, Chris Monroe and Jungsang Kim, decided to license core technology from both Duke University and the University of Maryland to found IonQ. They started their journey with $2M from New Enterprise Associates, and their vision was simple yet grand: “Take trapped ion quantum computing out of the lab and into the market.”

Over the next few years, the young startup went through more funding rounds, gathering $20M in 2018 and $55M in 2019. Then, in 2021, IonQ went public through a SPAC merger.

IonQ started by focusing on quantum computing hardware:

- Their first quantum computer, called Harmony, had 11 qubits.

- Afterward, IonQ released Aria, which had a better ion trap and a superior laser arrangement.

- IonQ recently unleashed a new quantum computer dubbed Forte, with architecture that is fully configurable through software.

Thanks to their advanced quantum computers, IonQ has worked with numerous companies in the research and development phase. For instance, the quantum computing startup has partnered with Hyundai, helping them with image recognition in vehicles as well as with modeling molecules for battery research. IonQ worked with Fidelity Center to explore how quantum computers and AI can further the field of finance.

IonQ has grand plans for the future. The company intends to transition from a hardware manufacturer to a full-stack quantum company. This means that IonQ will be more involved with the software and algorithm development process. More specifically, the tech company wants to hone in on specific quantum applications: quantum machine learning and quantum molecular simulations.

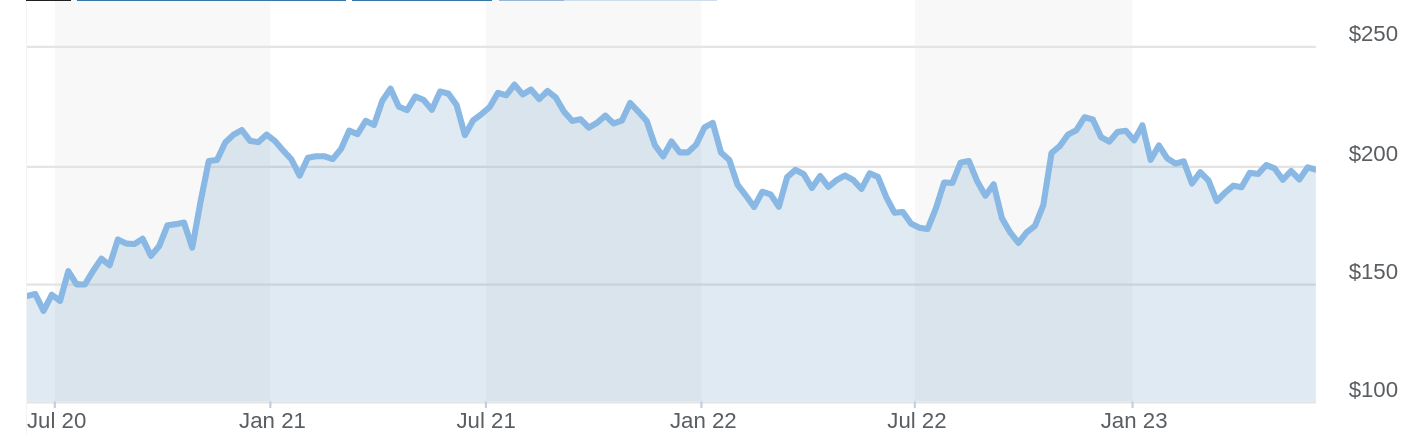

7. Honeywell (HON)

| Price as of this writing | $198 |

| P/E | 25.69 |

| Dividend Yield | 2.08% |

Honeywell is a large industrial manufacturing company that serves numerous industries, including aerospace, safety solutions, performance materials, and construction.

Honeywell also set up Honeywell Quantum Solutions (HQS), which later combined with Cambridge Quantum to form Quantinuum, a manufacturer and vendor of trapped-ion quantum computers.

Today, Honeywell is the major shareholder of Quantinuum, owning around 54% of the quantum technology company. Honeywell makes sure to supply the spin-off with everything it needs, from funding to equipment, including both hardware and software.

Quantinuum was supposed to go public back in 2022, but the unfavorable market made the young company delay that decision. The best way to invest in Quantinuum today would be to buy Honeywell stock.

Other Quantum Computing Stocks to Look Into

While most of the companies on this list so far are hardware manufacturers first and quantum application developers second, the next two companies are more focused on delivering quantum technology to the masses, be it through providing the necessary infrastructure or researching how to advance the field as a whole.

8. Amazon (AMZN)

| Price as of this writing | $123.04 |

| P/E | 299.44 |

| Dividend Yield | 0.00% |

Amazon does not have its own quantum computer. Nevertheless, the e-commerce giant is invested heavily in quantum technology.

Amazon offers the Amazon Braket platform, which enables the public to try using quantum computers from different vendors, including IonQ, OQC, Rigetti, and QuEra. This is a niche called Quantum Computing as a Service, or QCaaS, and it is growing in size every year.

Amazon also offers the AWS Center for Quantum Computing, which is a research center dedicated to finding new ways of advancing the hardware and software of quantum computing. The AWS Center for Quantum Computing is located right next to Caltech.

Tip: If you’re into stock trading, you might find this post on ‘Best Stock Charting Software‘ useful. It’s quite insightful.

Tip: If you’re into stock trading, you might find this post on ‘Best Stock Charting Software‘ useful. It’s quite insightful.

Over and above, Amazon has invested in developing the Amazon Quantum Solutions Lab. The Solutions Lab is a program that bridges AWS customers and quantum computing experts from Amazon.

9. Baidu (BIDU)

| Price as of this writing | $135.05 |

| P/E | 22.94 |

| Dividend Yield | 0.00% |

Baidu is heavily invested in quantum computing research, exploring different ways the new technology can be incorporated into its day-to-day operations. Baidu is exploring three main facets of quantum computing:

- Quantum AI

- Quantum Algorithms

- Quantum Architecture

What’s interesting to note is that almost every company on this list is investing in quantum technology in order to sell it later on to the public. Baidu is the only company here that is solely interested in how quantum computing can improve its own core business. And this is a very reasonable plan as a lot of Baidu’s services stand to gain from a quantum boost, including Baidu’s search function and their advertising business.

And while Baidu might not have its own quantum hardware, it is building interfaces to other quantum computers so as to increase accessibility.

Quantum Computing ETFs to Invest in

The quantum computing space is quite fragmented. There is no consensus on the hardware that will be used, let alone if quantum computers can ever realistically achieve quantum advantage.

Any investment you make in this space is speculative in the sense that you are not just betting on the future of the industry but that you are also betting on the company’s choice of hardware.

If you want to put money into quantum technology but would like to mitigate the risk that a quantum computer stock might carry, then investing in a diversified ETF might be the optimal solution for you. That way, you are only exposed to the risks of the industry as a whole rather than tying your fate to a particular company and its choice of technology.

There aren’t that many ETFs to choose from, given how young this entire industry is, but there are still some options.

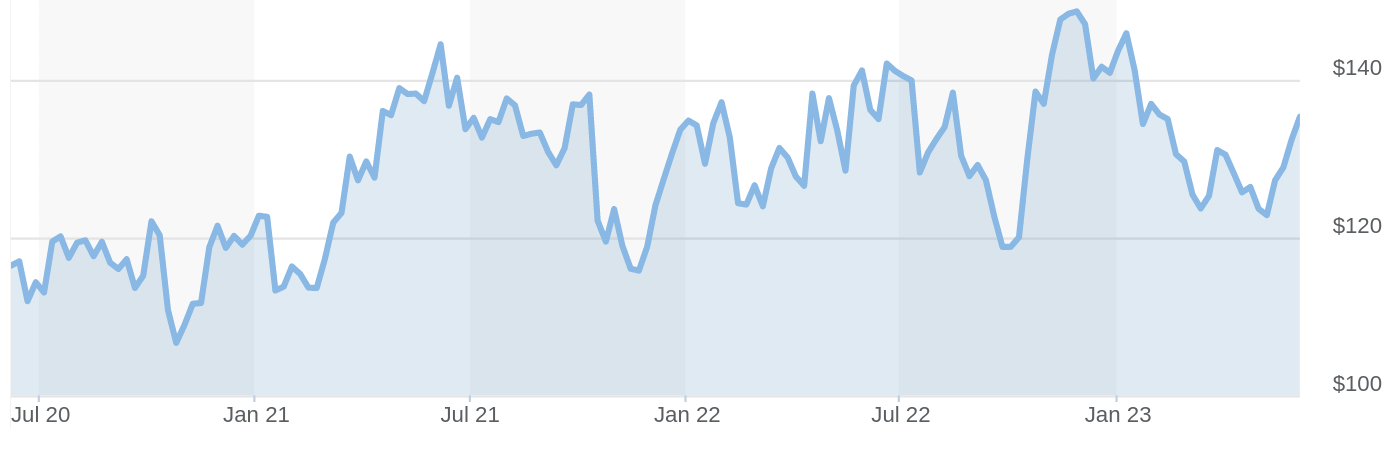

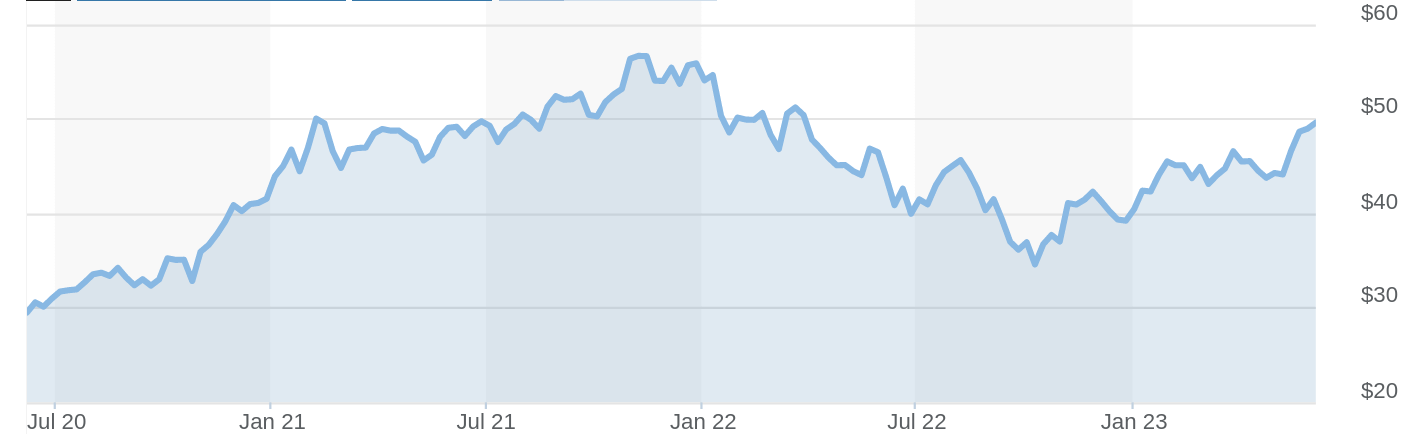

1. Defiance’s Quantum ETF (QTUM)

| Price as of this writing | $51.99 |

| P/E | 22 |

| Dividend Yield | 1.17% |

| Expense Ratio | 0.40% |

Started in 2018, QTUM tracks The BlueStar Quantum Computing and Machine Learning Index, which is composed of more than 70 public companies, all of which produce more than 50% of their revenue from quantum computing or machine learning. The index is rules-based, meaning that companies are included or excluded from the index depending on a set of pre-determined rules and that no individual interferes with the composition of the index.

The index focuses on companies that research, develop, or sell quantum computing, which includes software and semiconductor companies. Here are some of the biggest names in the index, along with their weight within the fund:

- Analog Devices (ADI) representing 2.8%

- Synaptics (SYNA) representing 2.5%

- Advanced Micro Devices (AMD) representing 2.4%

- Nvidia (NVDA) represents 2.3%

QTUM is a small fund with a market capitalization equal to around $140M, but there are several benefits:

- You’d get exposed to a large basket of quantum computing stocks, lowering your risk yet preserving your potential upside for that moment when the industry takes off.

- The fund is also stable because a lot of the stocks in the portfolio are established software and semiconductor companies, so they aren’t solely reliant on the evolution of the quantum computing industry.

Investors who put money in QTUM early on have watched their investment almost double over the past 5 years.

Putting it All Together…

It’s important to repeat that no one knows for certain where the quantum computing industry is headed. There are very real barriers impeding this technology from going mainstream. Here are a few of the main ones:

- Error correction is a big problem that every quantum computer manufacturer needs to grapple with.

- Several quantum computing algorithms rely on quantum RAM to operate efficiently. No company has developed quantum RAM, even though there are several interesting ideas on what the technology might look like.

- We can’t run quantum computers on their own. Instead, we need classical computers to help us control and manage our quantum computers. Therefore, a common term you will hear time and again is hybrid quantum computing. Simply, we will never reach that point where quantum computers completely replace our classic devices. Instead, the two will supplement each other, with each one dedicated to the kinds of problems it is best suited to solve.

How can investors benefit from this quantum revolution?

Start by figuring out your risk tolerance. Not only will this help you decide how concentrated or diversified your portfolio should be, but it can help you decide between risky pure quantum computing plays like IonQ and more established and stable tech giants dipping their toes in the quantum pool, like Alphabet and IBM.

Afterward, you need to do your own research, including understanding the underlying tech and figuring out which horse you would like to back. The problem is that because this is a very new industry, you won’t find much historical data to work with.

If you decide to invest in quantum computing stocks, be sure that you understand what’s at stake and are aware of the risks involved.

The post 10 Top Quantum Computing Stocks and ETFs to Invest In appeared first on FinMasters.